Freelance Income Tax Malaysia

If you re a writer a graphic designer or an web developer you re a good candidate to start a freelance business in malaysia.

Freelance income tax malaysia. Yes you must file your income tax. As of 2018 it is stated that you must pay taxes if your annual income exceeds rm34 000 per year. Of course as an entrepreneur you get to decide your business structure. The good news is that you only pay taxes on your chargeable income which is your total annual income minus all the tax reliefs and exemptions that malaysians residents are entitled to.

So yes if you are a freelancer you are subject to income tax and therefore must file your income tax. On the first 20 000 next 15 000. On the first 5 000. This is in addition to the regular income tax you would owe.

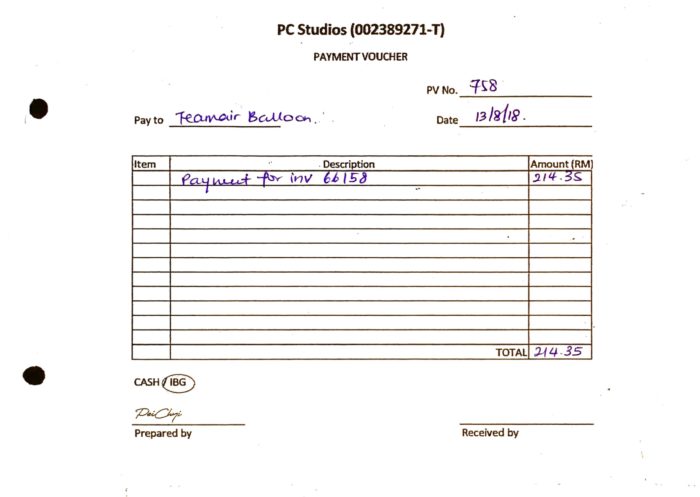

Your other income apart from employment income will fall under c6 as extra income. Calculations rm rate tax rm 0 5 000. If you already have a tax file registered from previous employment do submit your return form even if your annual or monthly income falls below the chargeable level rm34 000 after epf deduction. Based on this amount the income tax to pay the government is rm1 640 at a rate of 8.

On the first 5 000 next 15 000. Most malaysians are familiar with tax reliefs which you can file as income that won t get taxed because you spent them on certain types of expenses. You can file it in individual income if u register for sole proprietorship still will be filing the same total income but different form. Here are the income tax rates for personal income tax in malaysia for ya 2019.

And you must pay taxes if your annual income exceed rm34 000 a year as per 2018 guidelines. Honest services with fast solutions. Freelance accounting income tax secretarial tax audit bookkeeping services in kl malaysia. But you might not have known that there are also tax exemptions in the law which are basically types of income that you pay 0 tax on.

For example let s say your annual taxable income is rm48 000. We provide professional company secretary services payroll set up of limited liability partnership services in affordable fee. Inland revenue board of malaysia shall not be liable for any loss or damage caused by the usage of any information obtained from. If you already have a tax file registered from previous employment do submit your return form even if your annual or monthly income falls below the chargeable level rm34 000 after epf deduction.

Before you ask yes you do need to file your taxes even if you freelance.