Form C Guidebook 2017 Malaysia

Of the pricewaterhousecoopers organisation in malaysia each of which is a separate and independent legal entity.

Form c guidebook 2017 malaysia. Country code shareholding 2. Permission to study form student personal data form dp11 employment pass form dp11a dependant pass form additional information document permission to study employment pass please ensure the cover letter is stating the company has no objection for the expatriate to study during his employment in malaysia. Single filing deadline from 2021. Name of company 2.

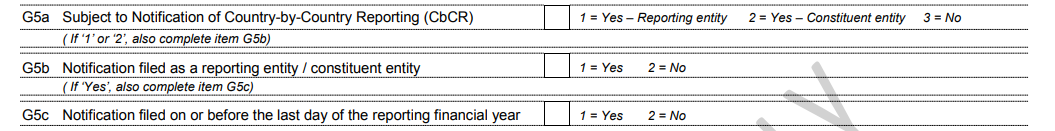

Some items in bold for the above table deserve special mention. The sample form c and guidebook for ya 2017 can be downloaded from the irb s website. From the year of assessment ya 2020 e filing of form c s c is compulsory for all companies the filing deadline is 15 dec 2020. Notification of the demise of taxpayer.

Form mne pin 1 2017 part a. Country code shareholding 3. In addition to mutualexclusions with other. Standard operating procedure sop for census fieldwork.

List of affilliates companies in malaysia including branches and pe income tax no. Guidebookfor the ya 2017 form c. No guide to income tax will be complete without a list of tax reliefs. Guidelines for control of cosmetic products in malaysia national pharmaceutical regulatory agency ministry of health malaysia 1st revision february 2017 please visit the npra website for the latest updates.

Country code as provided in guidebook for form c 1. 2016 2017 malaysian tax booklet a quick reference guide outlining malaysian tax information the information provided in this booklet is based on taxation laws and other legislation as well as current practices including legislative proposals and measures contained in the 2017 malaysian budget announced on 21 october 2016. Effective on 1st august 2017 applications for post licensing and post incentive are required to be submitted to mida through the application form below. Technical or management service fees are only liable to tax if the services are rendered in malaysia while the 28 tax rate for non residents is a 3 increase from the previous year s 25.

Lembaga hasil dalam negeri malaysia bahagian pengurusan rekod dan maklumat percukaian jabatan operasi cukai menara hasil bangi. Company information for year ending 1. Highlight of mycensus 2020. The extended filing deadline of 15 dec which was initially introduced in 2012 to encourage companies to e file their corporate income tax returns will no longer be available from 2021.