Form B Income Tax Malaysia

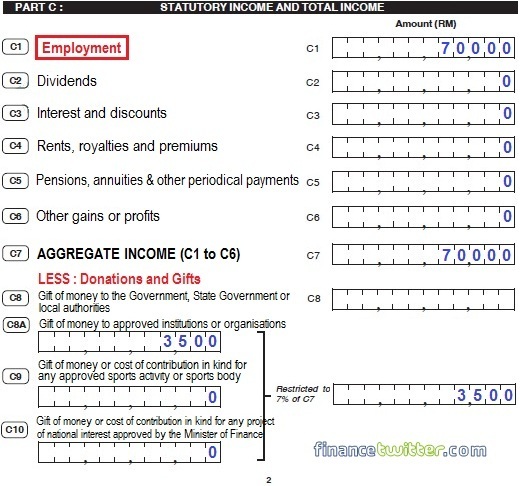

Untuk makluman stokc adalah pengesahan yang dikeluarkan oleh lhdnm ke atas status seseorang yang dikenakan cukai di malaysia.

Form b income tax malaysia. 2019 b lembaga hasil dalam negeri malaysia return form of an individual resident who carries on business under section 77 of the income tax act 1967 this form is prescribed under section 152 of the income tax act 1967 complete the following items name. If you required assistance to e file visit need help to e file paper file. Can i declare my business income if i receive a form be. One for the husband and one for the wife.

Business income should be declared in the form b. Year of assessmentform amend. Choose the right income tax form. B 2018 year of assessment form cp4a pin.

E file via mytax portal recommended you can e file via mytax portal with your singpass iras unique account. Once you ve logged in you will be shown a list of features available on e filing. Taxpayer is responsible to submit income tax return form itrf and make income tax payment yearly prior to due date. Income other than business.

1 an individual who carries on a business is required to fill out the form b. Ibu pejabat lembaga hasil dalam negeri malaysia menara hasil persiaran rimba permai cyber 8 63000 cyberjaya selangor. Form b guidebook self assessment system 3 reminder before filling out the form please take note of the following. Identification passport no.

Every individual in malaysia including resident or non resident who is liable to tax is required to declare his income to inland revenue board of malaysia irbm or lembaga hasil dalam negeri malaysia ldhn. There are two ways to file form b. 2 married individuals who elect for separate assessment are required to fill out separate tax forms b be ie. Form b income assessed under section 4 a 4 f of the ita 1967 and be completed by individual residents who have business income sole proprietorship or partnership.

Here is a list of income tax forms and the income tax deadline 2019. Meanwhile for the b form resident individuals who carry on business the deadline is 15 july for e filing and 30 june for manual filing. To begin filing your tax click on e borang under e filing. 150 tarikh kemaskini.

Pada amnya stokc digunakan bagi tujuan tuntutan bayaran balik cukai jualan dan perkhidmatan cukai nilai tambah atau cukai barangan dan perkhidmatan sst vat dan gst yang dibayar di luar negara oleh individu syarikat atau badan orang di malaysia. If you are required to file iras will send your form b from feb to mar. Identification passport no.