Flat Rate To Effective Rate

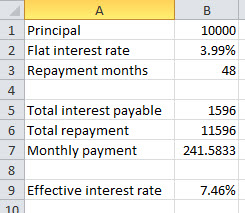

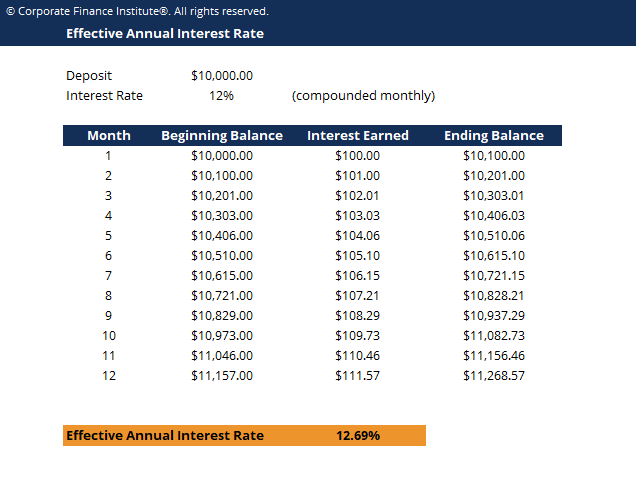

A flat interest rate is always a fixed percentage.

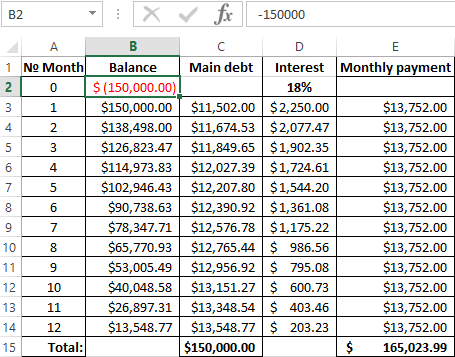

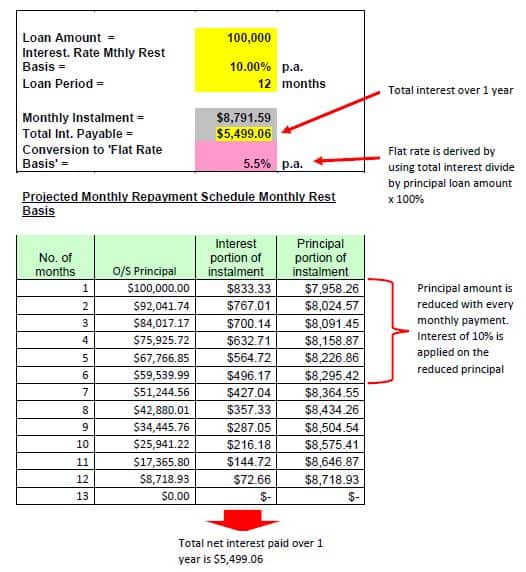

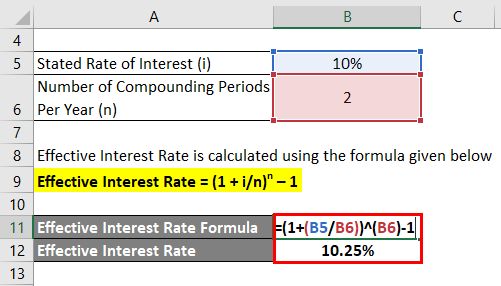

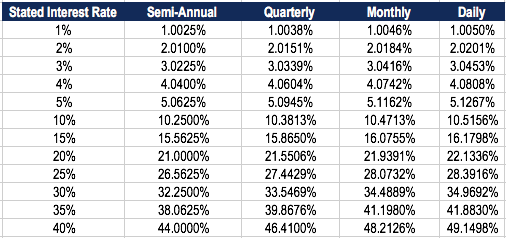

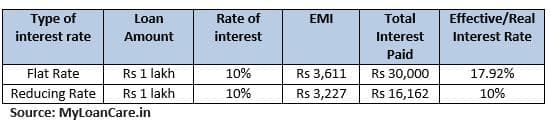

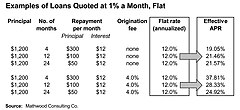

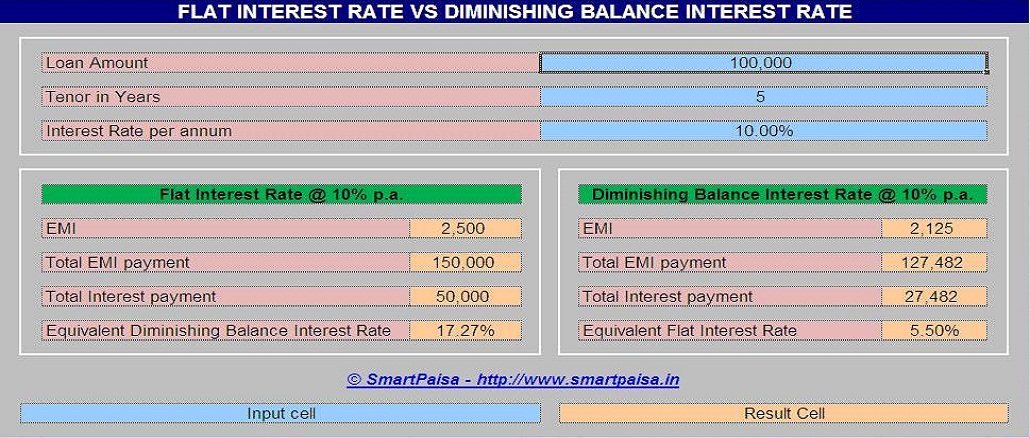

Flat rate to effective rate. Imagine you applied for a personal loan of rm100 000 at a flat interest rate of 5 p a. Flat interest rate vs effective interest rate. From the above illustration example we can see that flat interest rate is about 1 92 times more than an effective interest rate term. A flat rate is commonly used for car loans and personal term loans.

In this case you will be paying 5 interest every year on the rm100 000 loan that you ve taken. The flat interest rate is mostly used for personal and car loans. Depending on the loan tenure as a general rule of thumb flat interest rate terms are almost always about 2 times of effective interest rates. With a tenure of 10 years.

The monthly interest stays the same throughout even though your outstanding loan reduces over time. When evaluating a personal loan in singapore it s extremely important to consider both annual flat rate and effective interest rate. For a loan amount of 1 00 000 with a flat rate of 12 00 or reducing balance interest rate of 21 20 total interest payment during 3 years is 36 000. For a loan tenure of 3 years flat interest rate of 12 00 is approximately equals to 21 20 of reducing balance interest rate.