Fixed Deposit Interest Tax Exemption Malaysia

If interest is paid for a deposit which has not reached its maturity date the accrued interest is for the period for which the interest is paid.

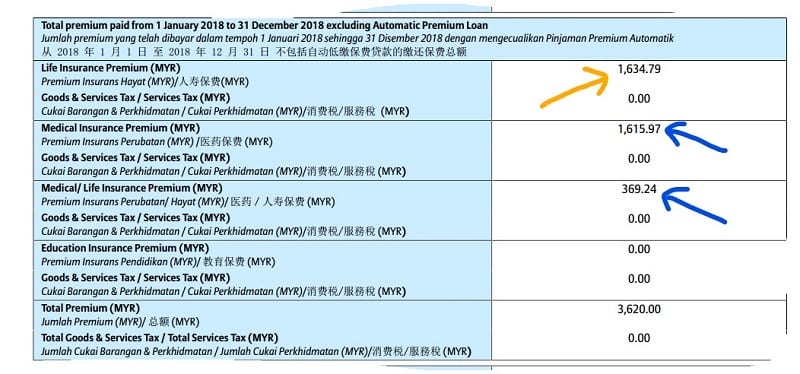

Fixed deposit interest tax exemption malaysia. By applying these exemptions and reliefs ben s chargeable income will actually be like below. Income tax exemption equivalent to 100 of qce incurred that can be offset against 100 statutory income for five years in respect of specified qualifying activities. Interest that accrues in respect of any savings deposited with bank simpanan nasional bsn. This deduction can be claimed under new section 80ttb.

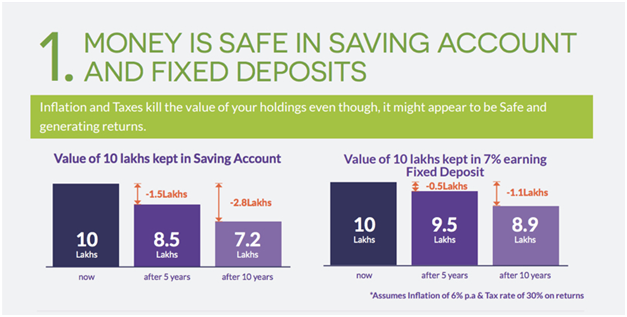

Total annual income tax exemptions tax reliefs. Deferred payment credit 19 11. Although there are a few exemptions tax is deducted on the interest earned on a term deposit. The determination of the source of interest income is significant as only interest derived from malaysia is taxable in malaysia.

Other than interest income from savings or fixed deposits and profits from syariah based. Depending on the terms and conditions of the fixed deposit contract. Firstly pensions paid to people after reaching the age of retirement are exempt from tax under schedule 6 paragraph 30 of the income tax act 1967. Yes interest accumulated on fixed deposits are seen to be financial income and is therefore taxed.

It ll also apply when the pension is paid due to retirement from ill health or if the pension is paid under any other approved fund even if you have not reached the legal age of retirement. A bank or a finance company licensed or deemed to be licensed under the banking and financial institutions act 1989. Thus the date of interest accrued for the purpose of income tax is the last day of the period set out in each case. For senior citizens the interest income earned on fixed deposits recurring deposits will be exempted till rs 50 000.

However no deductions under existing 80tta can be claimed if 80ttb tax benefit has been claimed the limit for fy 2017 18 fy 2018 19 u s 80tta is rs 10 000. An individual resident in malaysia is exempt from tax in respect of the interest received from the following savings or investments i. Tax treatment of interest expense 1 3 6. For your information the interest earned from local bank is tax exempt with effect from august 30 2008.

Non application of subsection 33 2 interest restriction 7 8 8. Malaysia has a wide variety of incentives covering the major industry. Income in respect of interest received by individuals resident in malaysia from money deposited with the following institutions is tax exempt with effect from august 30 2008. Foreign sourced interest income is specifically tax exempt.

Interest expense incurred on investments 8 17 9. Additionally where interest is paid to a non resident the interest derived or deemed derived from malaysia is subject to withholding provisions.