Financial Literacy In Malaysia

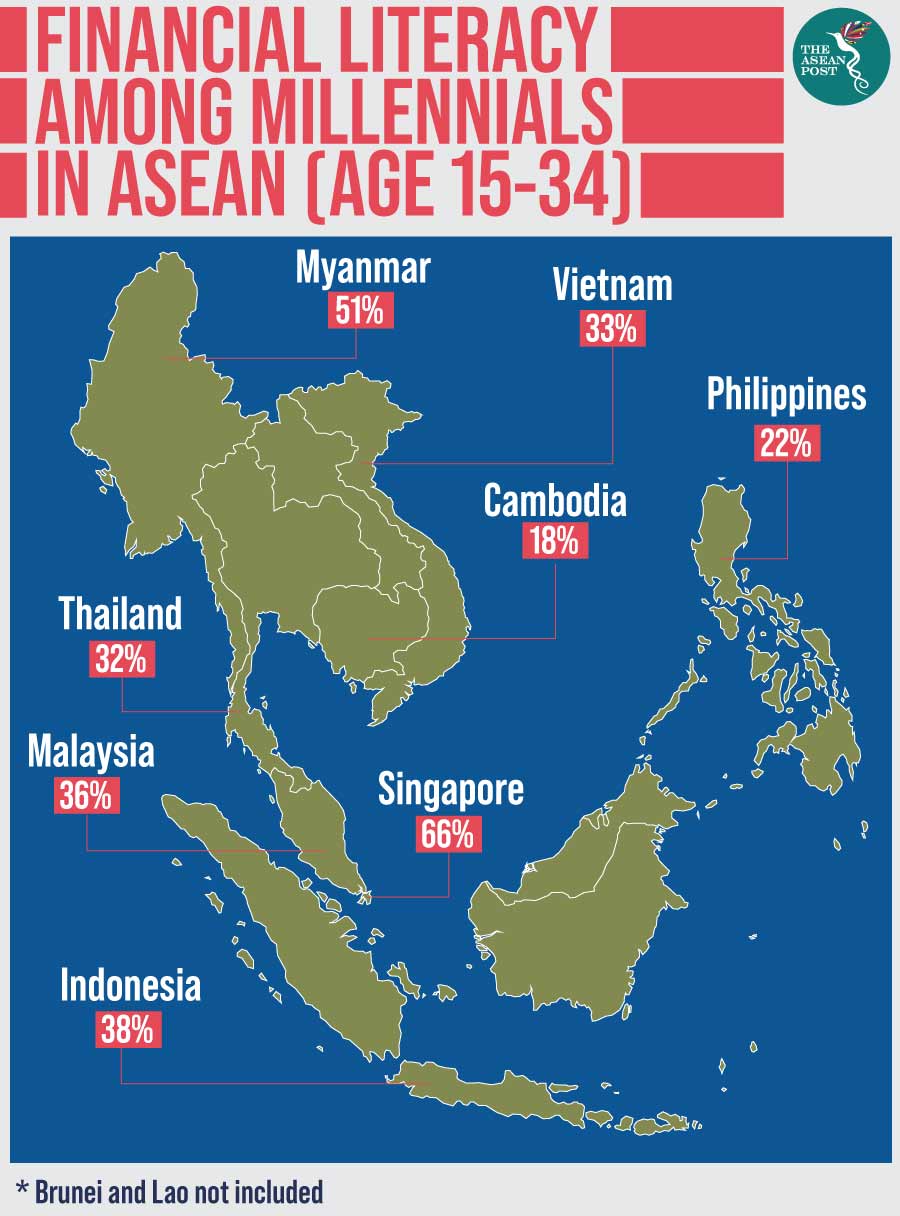

A study by s p global literacy financial in 2014 reported that financial literacy rate in malaysia is only at 36 compared with 59 in developed countries.

Financial literacy in malaysia. One out of three malaysians are not comfortable with their financial knowledge while half of the population 52 say they face difficulties raising even rm1 000 for emergencies. It was formulated by the financial education network fenetwork an inter agency group led by bank negara malaysia and the securities commission malaysia. Learning and acquiring the necessary skills to do so is invaluable. This national financial literacy strategy is essential for developing a sustainable society make wise financial decisions to avoid the pressure of.

In malaysia financial literacy is still very low and the national strategy for financial literacy was launched in july 2019 to address just that. In our previous article on the national strategy for financial literacy 2019 2023 we briefly touched on the five strategies that were the main focus of the entire plan. Financial literacy for youths fly is an initiative started by students. Read more improving the standard of financial literacy.

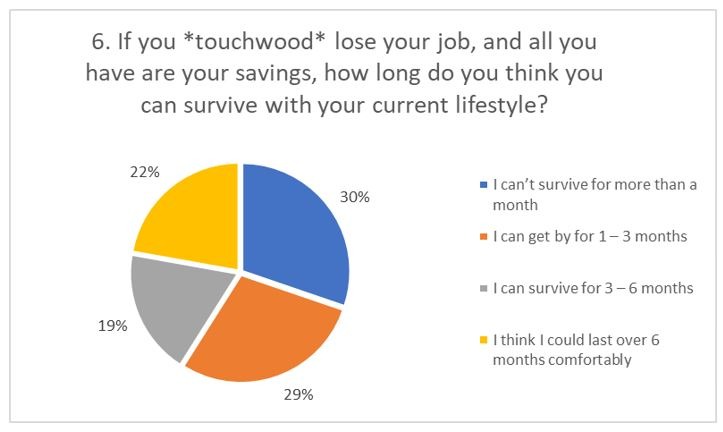

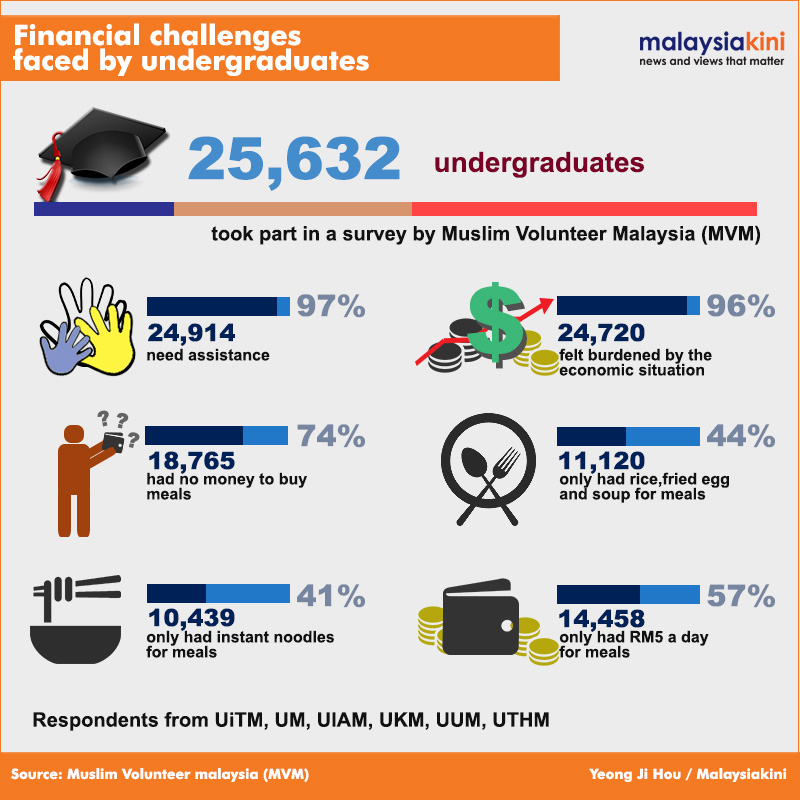

Unfortunately the level of financial capability and financial literacy of malaysians is alarmingly low. In this article we dive deeper into what they actually contain. Governments around the world are recognizing the benefits to individuals and national economies of having a financially literate population that has access to appropriate financial products with relevant consumer protection in place. Currently with a team of over 30 people in malaysia we are focused on giving the best financial talks alongside weekly publications.

For financial literacy 2019 2023 national strategy which aspires to elevate the levels of financial literacy promote responsible financial behaviour and healthy attitudes towards financial management. Almost 70 of malaysians are in need of financial literacy support according to a recent survey by newly launched financial literacy platform multiply multiply was established by private equity firm creador through its not for profit arm creador foundation to address these gaps in financial literacy in a statement today creador foundation said the survey attracted. Kuala lumpur oct 20. Planning and managing finances for personal and professional purposes is a lifelong process.

Malaysian financial planning council malaysia.