Epf Withdrawal For Housing Loan

Partial withdrawal is subject to limits depending on the reason.

Epf withdrawal for housing loan. Epf withdrawal for repay housing loan modifying existing house purchasing. Section 68bb of the employees provident funds and miscellaneous provisions act 1952 allows pf withdrawal for repayment. Repayment of home loan an employee can prepay the home loan by withdrawing the pf amount. Minimum of 10 years in epf.

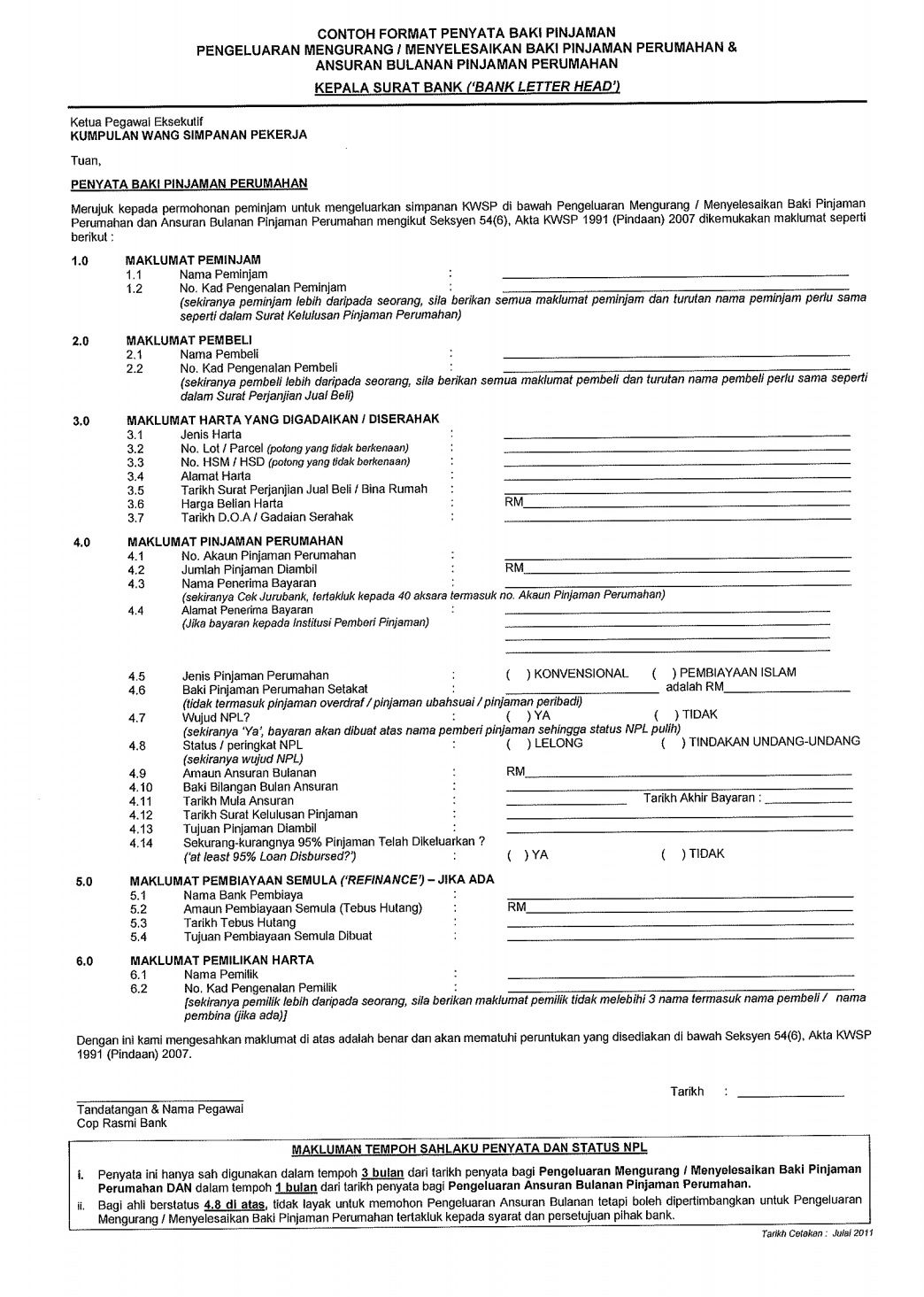

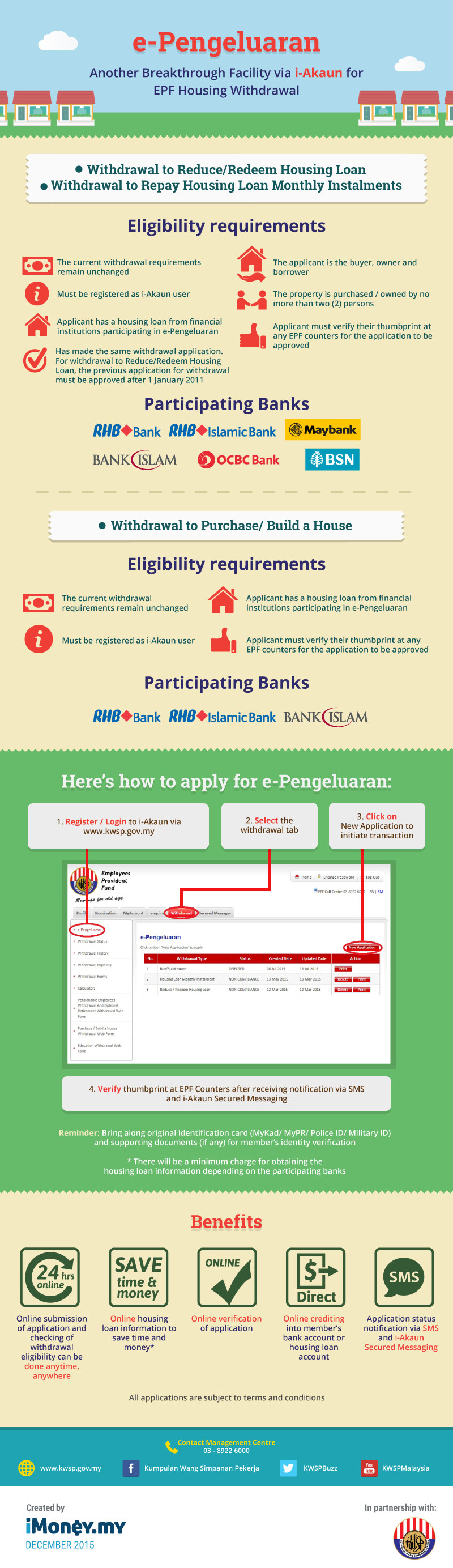

However there certain procedures and criteria that one is required to carefully follow. Follow these simple steps to utilize your epf for repaying your home loan as per the updated epf withdrawal rules a pf member can apply for the loan through the housing society to the epf commissioner in the format prescribed in annexure 1. Obtain the at least the letter of approval for the housing loan. The money can be withdrawn only after retirement.

Your spouse s loan with the epf panel bank is not in the non performing loan npl status. Members can withdraw the existing amount to be used in repaying an already prevailing house loan. Money from epf account 2 can be used to pay the price difference between the spa house price and the housing loan amount up to an additional 10 on the price of the house. Generally if the mortgage interest rate far exceed 5 epf dividend return then it is advisable to apply for epf withdrawal.

The commissioner issues a certificate specifying the monthly contribution of the last 3 months. You spouse has a housing loan account with a panel bank appointed by the epf. Next question is how much is far exceeding in this case to justify for the epf withdrawal. For the withdrawal the employee should have reached at least 10 years of service.

One can withdraw up to 90 per cent of the pf corpus for repaying the loan. Epf is a long term retirement savings scheme. The withdrawal is done through the from 31 form for epf partial withdrawal. I have been doing some simulation.

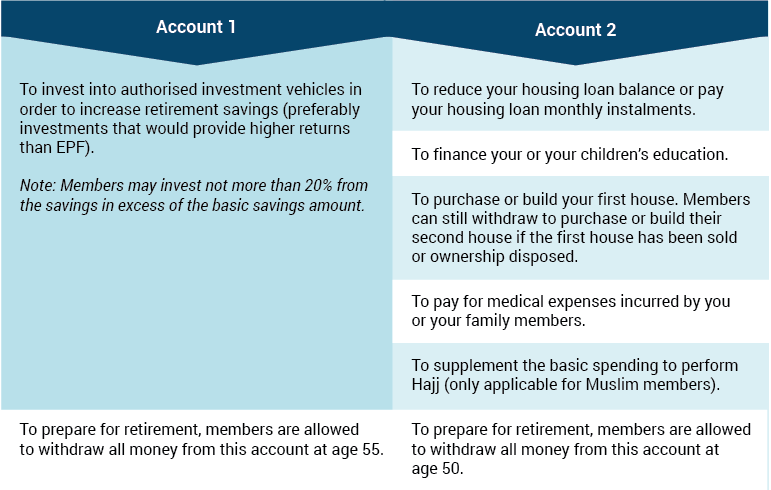

So if a full housing loan 100 is obtained the maximum that can be withdrawn is up to 10 of the price of the house. All withdrawal payments will be credited directly into yours or your spouse s housing loan account when you meet the following criteria. Referring to the table here.