Epf Rate Of Contribution

The epf receives and manages retirement savings for all its members encompassing mandatory contributions by employees of the private and non pensionable public sectors as well as voluntary contributions by those in the informal sector.

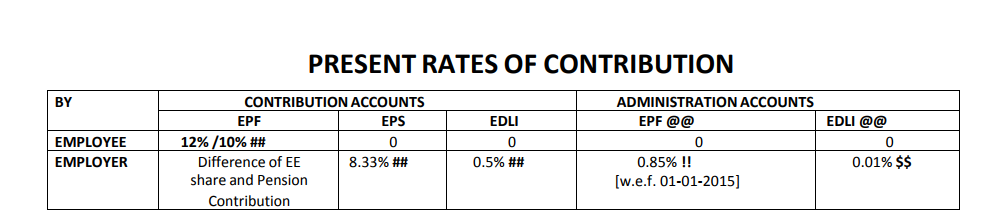

Epf rate of contribution. Edli employee deposited linked insurance is a kind of insurance policy for the employees of the employer. If you do not wish to reduce your contribution members are required to opt out by submitting a form to their respective employers. Ref contribution rate section a applicable for ii and iii only employees share. Effective from january 2018 the employees monthly statutory contribution rates will be reverted from the current 8 to the original 11 for employees below the age of 60.

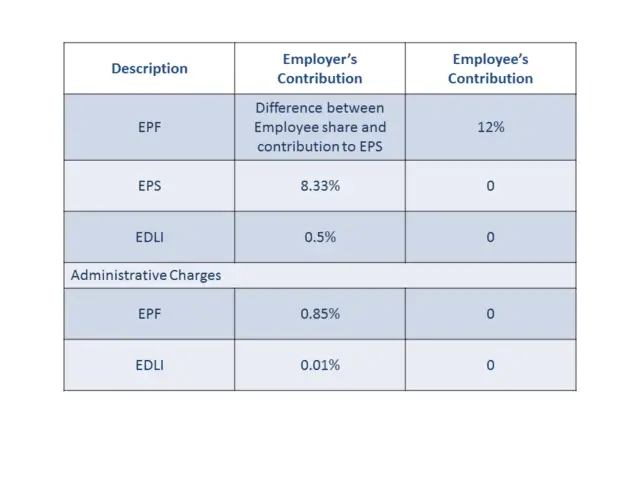

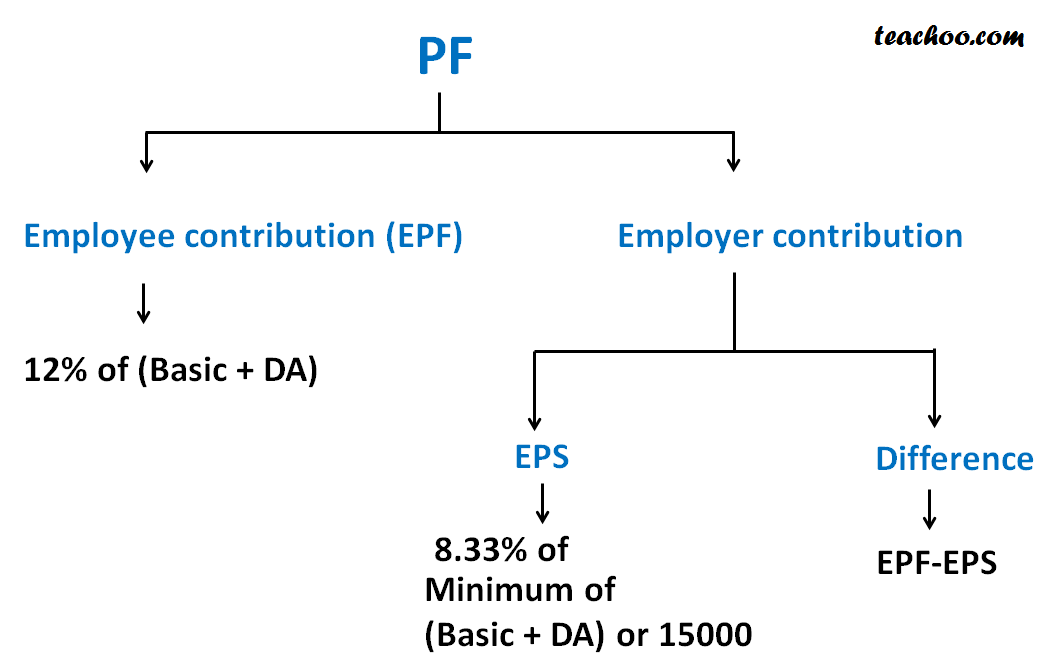

6 ref contribution rate section c non malaysians registered as member from 1 august 1998 no limit. May 2020 june 2020 july 2020. Employee contribution epf 12 20000 2400 employer contribution eps 8 33 15000 1250 difference 2400 1250 1150 total employer pf 1250 1150 2400 note even if pf is calculated at higher amount for eps we will take 15000 limit only remaining amount wil go to difference. Minimum employers share of epf statutory contribution rate for employees above age 60 who are liable to contribute will be reduced to 4 per month while the employees share of contribution rate will be 0.

What are the minimum contribution rates. Epf employee contribution rate has been revised from 11 to 7 from 1 april 2020 until 31 december 2020. Earlier this contribution was 0 85 than reduced to 0 65 and now from 01 06 2018 the edli charges are 0 5. The total percentage of the amount goes to this account is 0 5 and this 0 5 of the contribution is being paid by the employer.

Rm5 00 ref contribution rate section b employees share. Let s understand with charts. As announced during the budget 2021 the employees provident fund epf employee contribution rate will be reduced from 11 to 9 for the period between january to december 2021.