Epf Employer Contribution Rate

12 ref contribution rate section a.

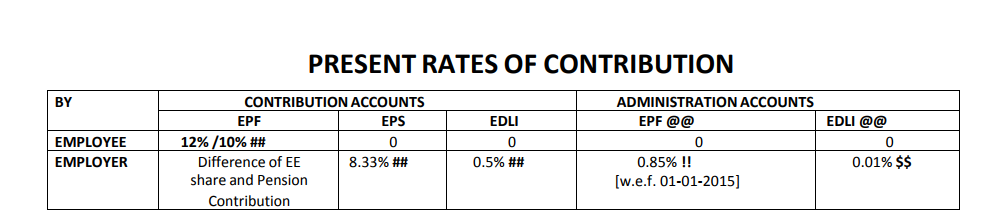

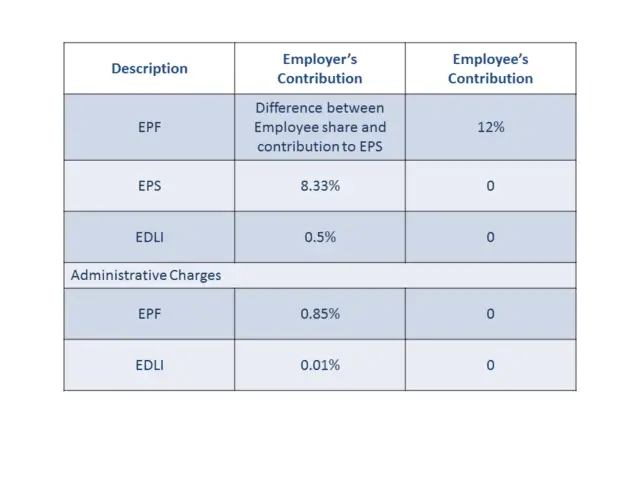

Epf employer contribution rate. If you do not wish to reduce your contribution members are required to opt out by submitting a form to their respective employers. The eps contribution 8 33 of wages subject to ceiling of 15 000 is diverted from employer s share of epf contributions. Employer s contribution to epf is 10 or 12. Epf inspection charges payable by the employers of exempted establishments period rate reckoned on 01 11 1952 to 31 12 1962 0 75 on total employees and employer s contributions payable 6 25.

Employee provident fund epf is a scheme in which you as an employee at a government or private organisation can create wealth through your working years. 13 ref contribution rate section a applicable for ii and iii only employees share. The employee s share of the statutory contribution rate to the employees provident fund epf will be reduced to 9 from 11 next year. Is it still eligible for reduced rate of contribution.

The minimum employee contribution rate for the employees provident fund epf will be set at 9 starting from january 2021 for a period of 12 months. In a statement today epf said the new. 6 5 ref contribution rate section c more than rm5 000. May 2020 june 2020 july 2020.

The announcement was made by finance minister tengku zafrul aziz today during the tabling of budget 2021. Employee contribution epf 12 15000 1800 employer contribution eps 8 33 15000 1250 difference 1800 1250 550 total employer 1800. Union finance minister nirmala sitharaman on 13 05 2020 announced the statutory provident fund or pf contribution of both employer and employee will be reduced to 10 each from existing 12 each for all establishments covered by epfo for the next three months i e. As announced during the budget 2021 the employees provident fund epf employee contribution rate will be reduced from 11 to 9 for the period between january to december 2021.

My establishments will not be able to remit dues timely during the scheme period.