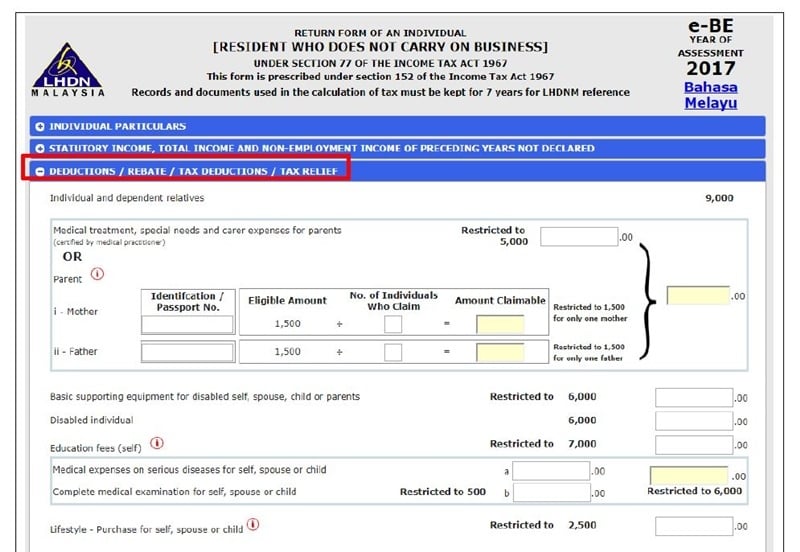

Entitled To Claim Incentive Under Section 127

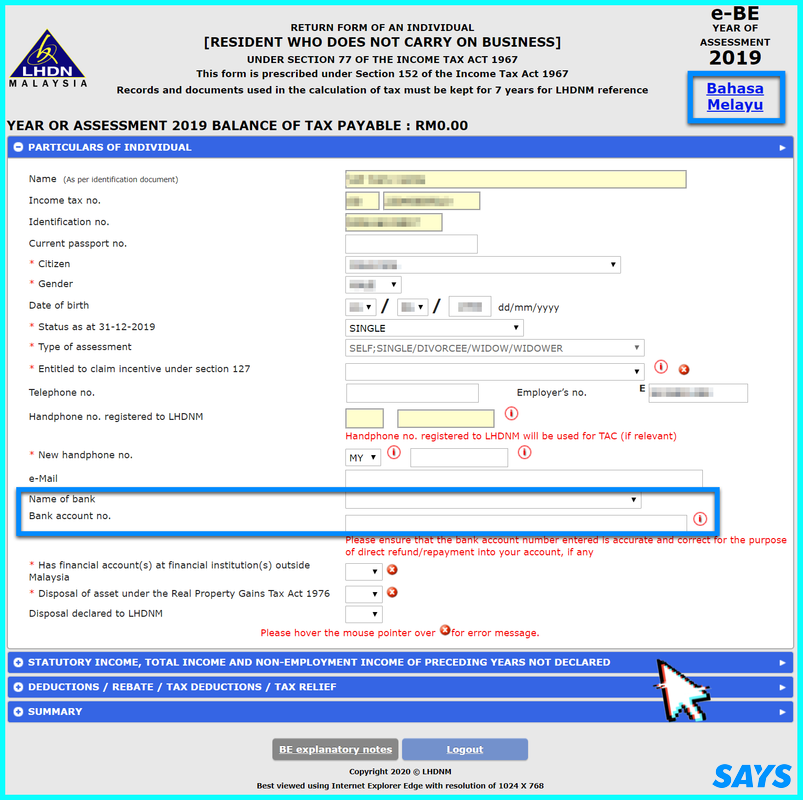

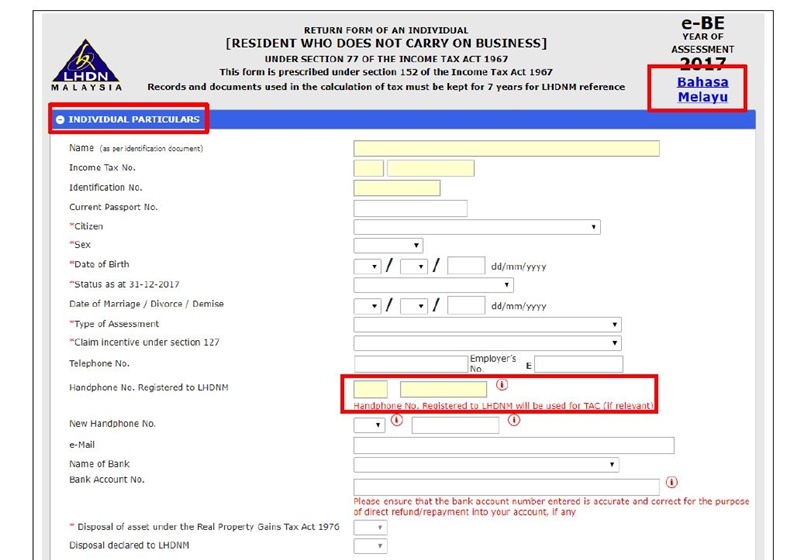

A tac which is needed to sign and submit your e form will be sent to your handphone number registered to lhdn so ensure it is correct.

Entitled to claim incentive under section 127. I enter x in the box for the type s of incentive. I enter x in the box for the type s of incentive entitled to be claimed for which a claim is made for the current. Explanatory notes additions amendments item subject page a7 entitled to claim incentive under section 127 2 b5 approved donations gifts contributions 7 gift of money to an approved fund gift of money for any sports activity approved by the minister of finance new relief. This is incentives such as exemptions under the provision of paragraph 127 3 b or subsection 127 3a of ita 1976 which is claimable as per government gazette or with a minister s approval letter.

Scope of exemption granted under section 127. In the same page there is an item called entitled to claim incentive under section 127 which refers to claiming incentives under section 127 of the income tax act ita 1976. A7 refers to incentives for example exemptions under the provision entitled to claim incentive under section 127 of paragraph 127 3 b or subsection 127 3a of ita 1967 entitled to be claimed as per the government gazette or minister s approval letter.

There will also be a layak menuntut insentif dibawah seksyen 127 which refers to claiming incentives under section 127 of the income tax act ita 1976. Where section 127 of the income tax act 1967 ita is included in the mutual exclusion list of a gazette order the taxpayer therefore cannot make a claim for the incentive offered in the said gazette order. A7 entitled to claim incentive under section 127 refers to incentives for example exemptions under the provision of paragraph 127 3 b or subsection 127 3a of ita 1967 entitled to be claimed as per the government gazette or minister s approval letter. It is only applicable to those who have incentives claimable as per government gazette or with a minister s approval letter.

Incentive under section 127 refers to the income tax act 1976. Business income income arising from services rendered by an ohq company to its offices or related companies.