Employment Insurance Scheme Eis Malaysia Rate

Depart of statistics chief statistician mohd uzir mahidin recently shared that malaysia s unemployment rate rose to 3 9 610 000 jobless people the highest since june 2010 when the rate was 3 6.

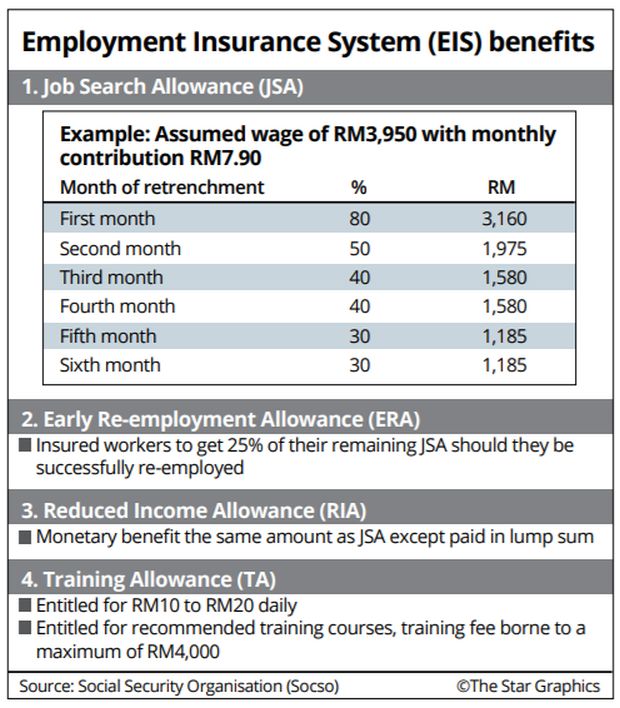

Employment insurance scheme eis malaysia rate. For months 1 3 under the jsa you will get paid 80 50 and 40 of your monthly assumed wage respectively and for months 4 6 you will get paid 40 30 and 30. The country is at a needful time for such help as many have had their rice bowls affected one way or another. First category employment injury scheme and invalidity scheme second category employment injury scheme employer s. Self employment social security act 2017 act 789 self employment social security scheme.

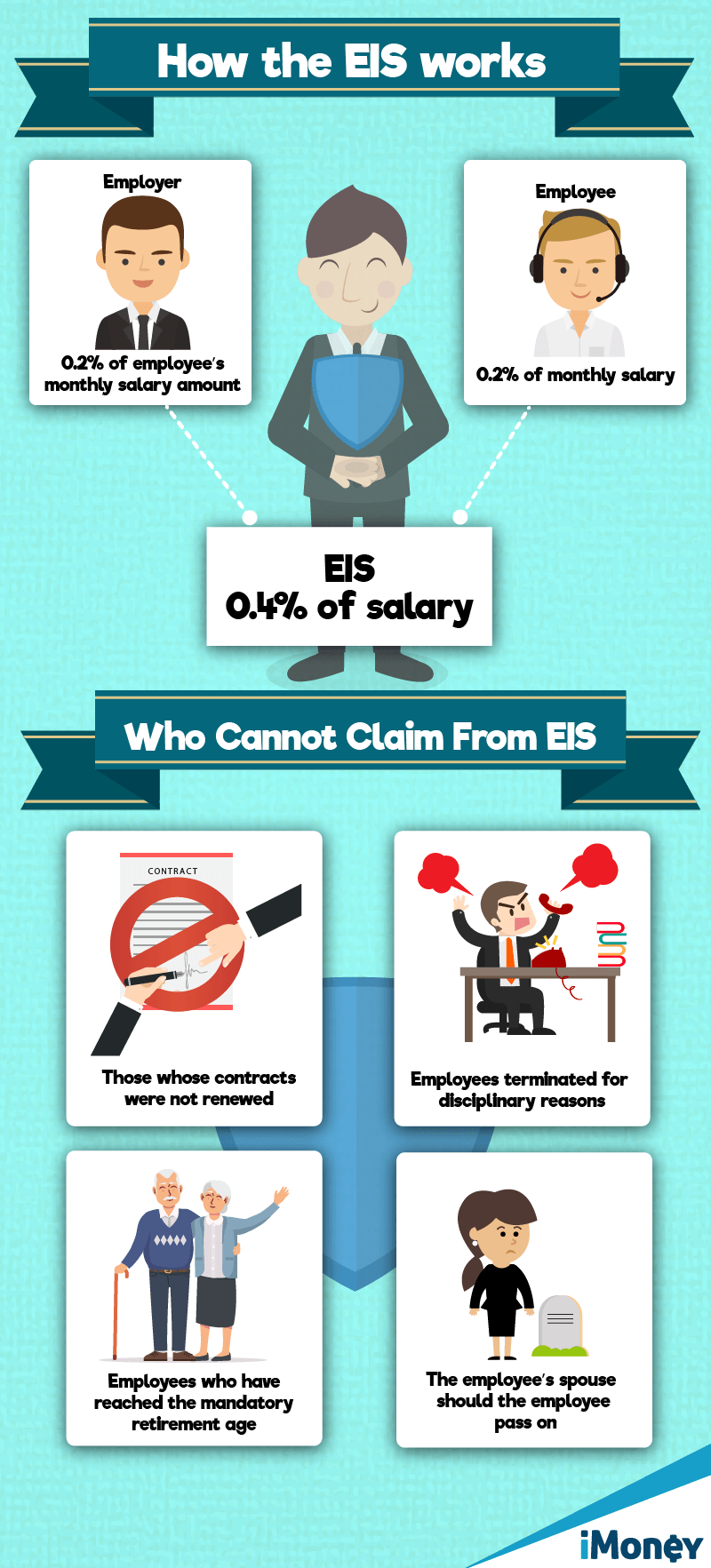

Proposed by prime minister datuk seri najib razak the employment insurance scheme eis is expected to be tabled in parliament in the july august 2017 sitting. Firsly the unemployment rate has always been low in malaysia from 2 9 in 2014 rising marginally to 3 2 in 2015 and 3 5 last year. How much allowance you get each month will also depend on pre determined rates and your assumed monthly wages. The actual contribution amount follows section 18 second schedule of the employment insurance act 2017 not the exact 0 2 percent calculation.

Return to work program. Therefore the amount reflected on your payslip will not be exactly 0 2 percent of your salary wages gaji. This means that employers of foreign workers must make the same 1 25 contribution to the eis that they do for their domestic workers during monthly payroll. Looking at the table above why is my eis contribution not exactly 0 2 of my wages salary gaji.

Malaysia on the other hand is catching up to provide retrenchment benefits to unemployed malaysians. Inclusion of foreign employees in the eis. Contribution by employer only. Employers must contribute 0 2 while employees will contribute the remaining 0 2 under this new law.

Should you lose your job then you will be able to claim a number of benefits from the insurance scheme. On 1 january 2019 the eis was expanded to cover foreign employees in malaysia including valid expatriate workers. The contributions will be on a fixed rate based on the employees salary. When wages exceed rm50 but not rm70.

Under eis employees who are retrenched will be given a portion of the insured salary from the 0 4 monthly contribution. So even if you re earning more than rm4 000 a month the contribution from you and your employer is fixed at 0 4 of rm4 000 leading to the maximum amount of contribution capped at rm15 80 per month. When wages exceed rm30 but not rm50. Employment injury scheme for foreign worker.

Employment insurance system act 800 eis centre.