Eis Contribution Rate Malaysia

In total he would have rm15 80 contributed to socso per month.

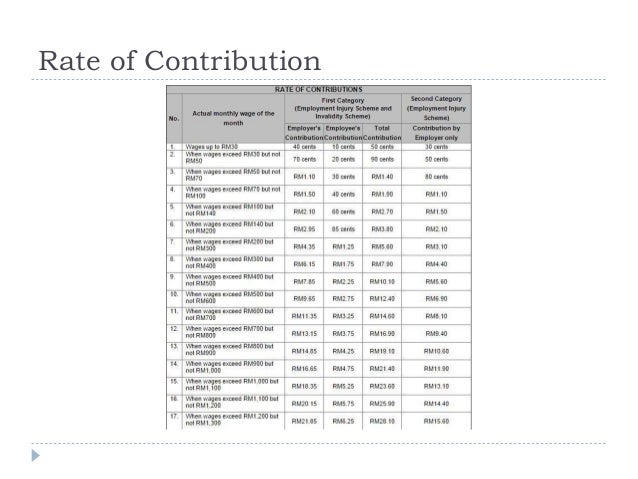

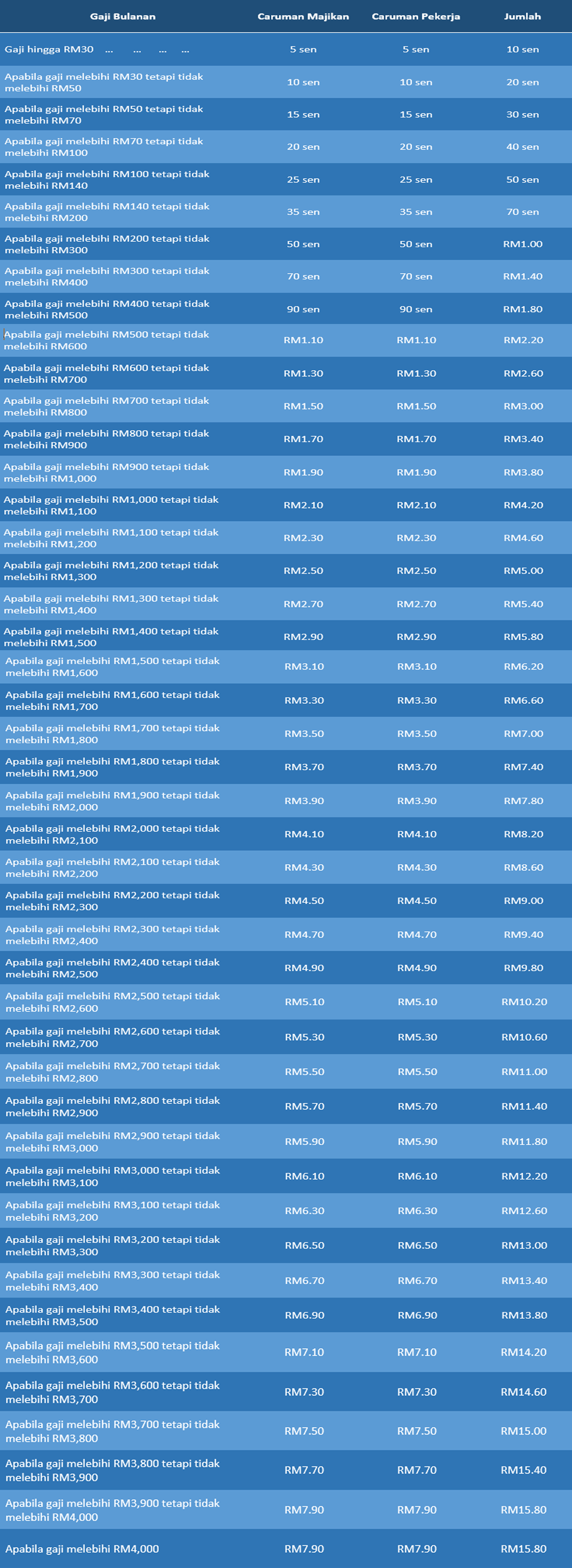

Eis contribution rate malaysia. This means that yusri s eis contribution from his employer is rm7 90 and his own contribution would also be rm7 90. You may refer to the contribution table below for more information. For employees who receive wages salary exceeding rm5 000 the employee s contribution of 11 remains while the employer s contribution is 12. Contribution rates are capped at insured salary of rm4000 00.

For example if an employee s gross monthly wages is rm2 900 but less than rm3 000 then the eis contribution would look like this employee contribution rm5 90 employer contribution rm5 90 total contribution rm11 80 it is noted that the contributions to eis is capped at a monthly salary level of rm4 000. All employees aged 18 to 60 are required to contribute. His eis contribution would be capped at a salary of rm4000. With the eis enforced starting from january 1 2018 employers are not allowed to reduce an employee s salary indirectly or directly owing to contributions made to the scheme.

The minimum employers share of epf statutory contribution rate for employees above age 60 who are liable to contribute will be reduced to four 4 per cent per month while the employees share of contribution rate will be zero per cent. Any employers that do not comply with the scheme or make false claims could lead to a maximum rm10 000 fine or a jail term of up to two years or both upon conviction. Part 2 of 3 have helped to shed some light on what eis is all about. Insured monthly earning contribution payment per month contribution payment per year.

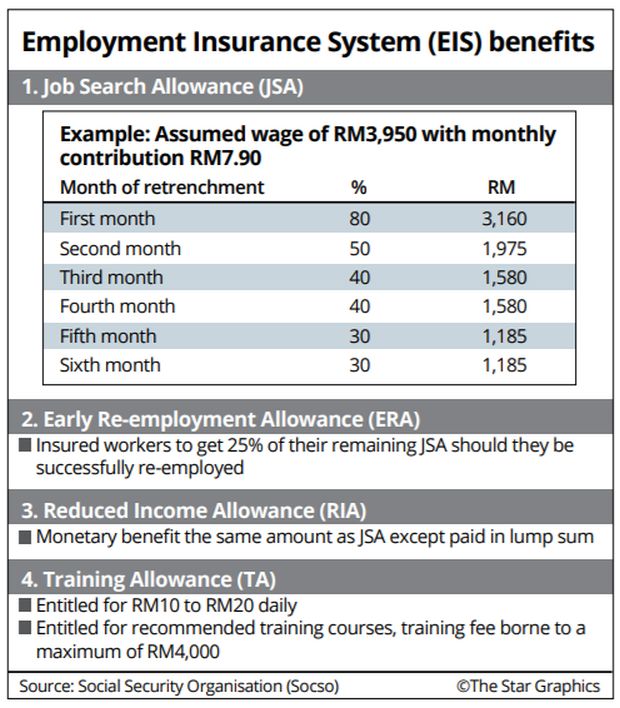

Yusri earns rm7000 per month. How to calculate the eis contribution. Even though eis is not meant to replace your income entirely it sure helps in providing some financial relief. The contribution rate for eis is 0 2 of the employee s salary employer share and 0 2 of the employee s salary employee share.

Inclusion of foreign employees in the eis. However employees aged 57 and above who have no prior contributions before the age of 57 are exempted. This means that employers of foreign workers must make the same 1 25 contribution to the eis that they do for their domestic workers during monthly payroll. In times like these a little goes a long way.