Ea Form 2016 Malaysia

Once you click on e form you ll see a list of income tax forms.

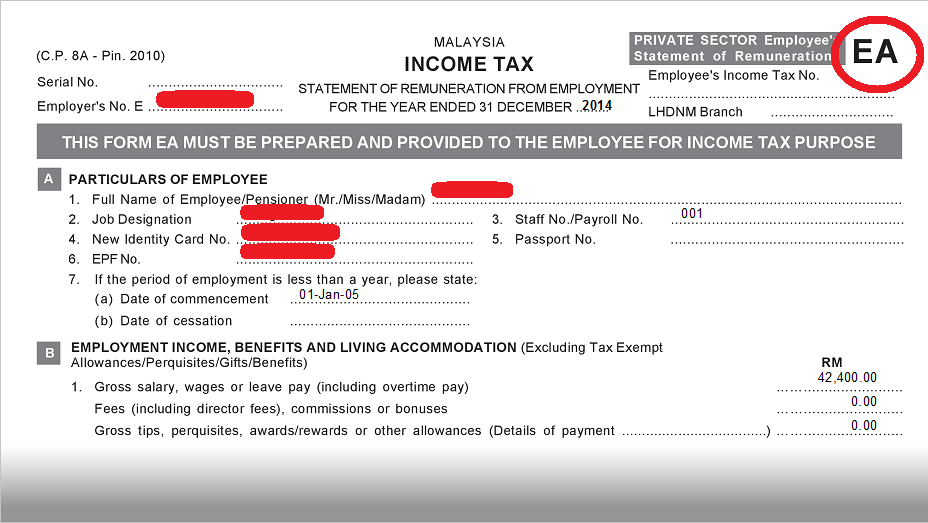

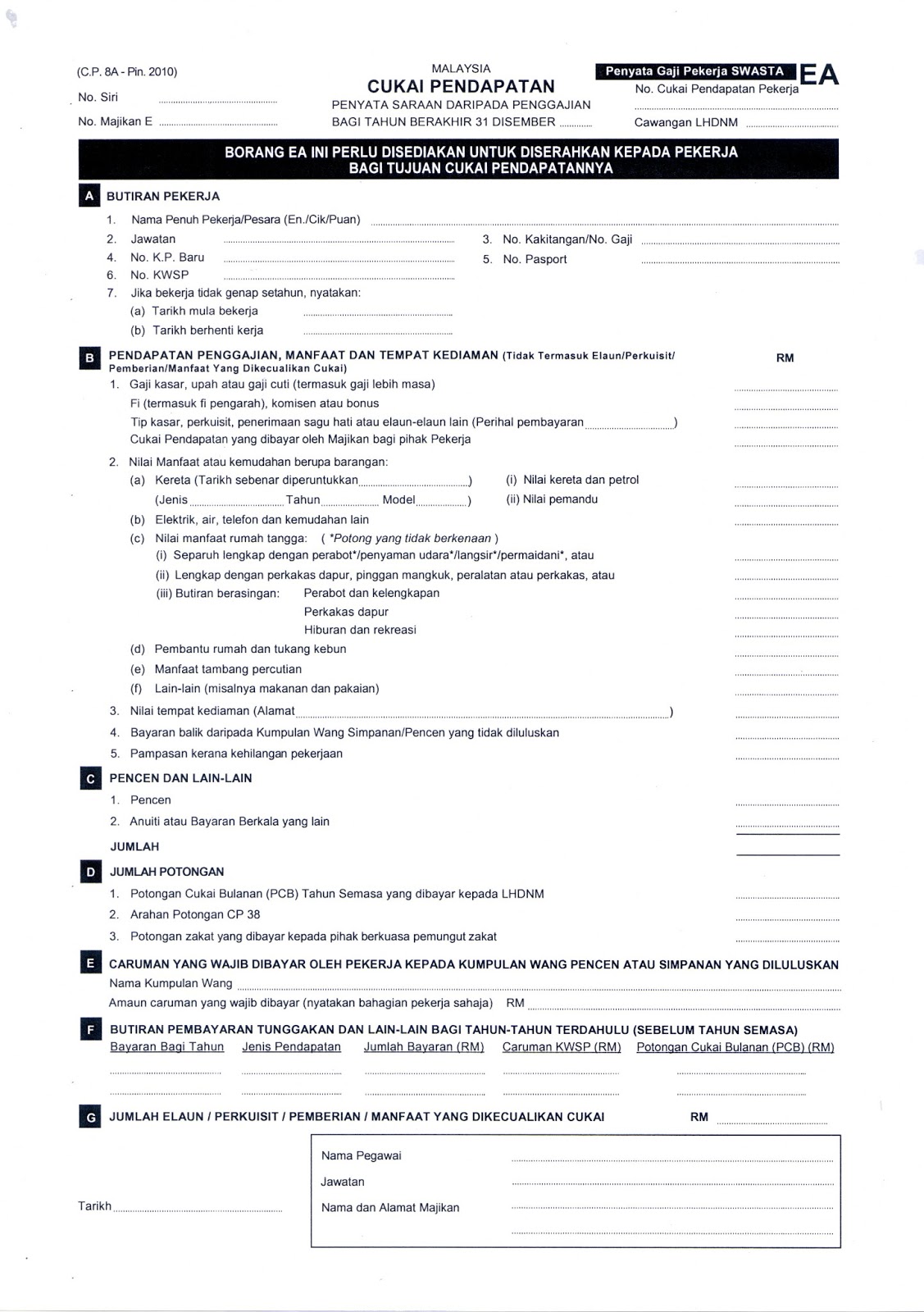

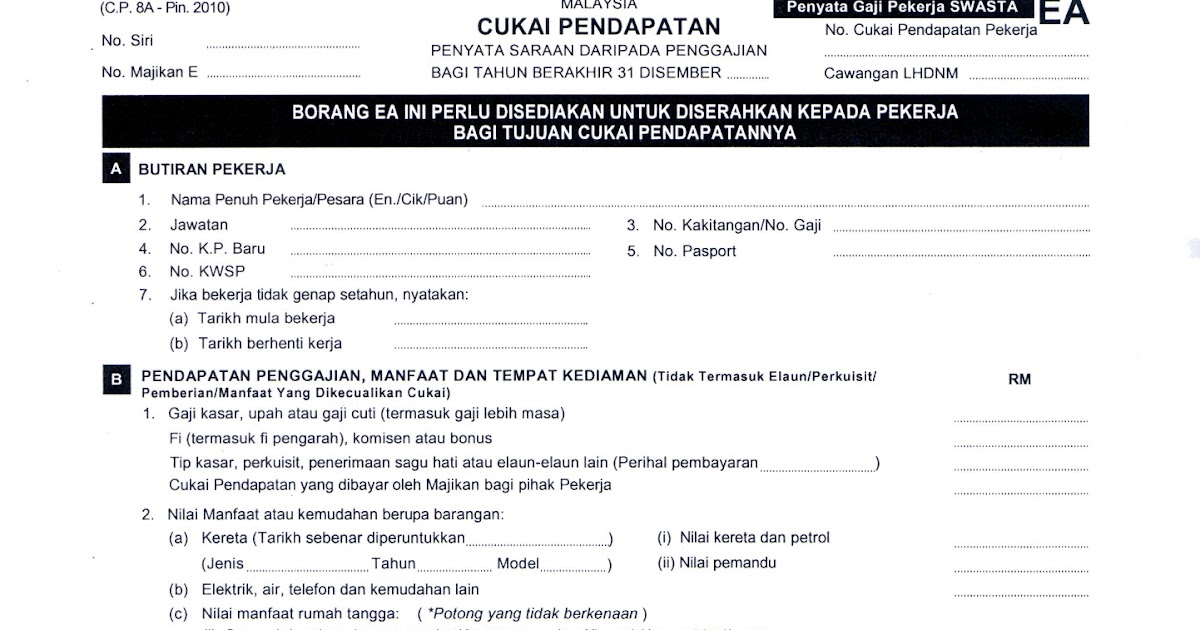

Ea form 2016 malaysia. The ea form has to be prepared by employers in malaysia and given to the employees for income tax purposes. Now s the time to make sure all your details are correct. The board of valuers appraisers and estate agents malaysia was set up in 1981 under the purview of the ministry of finance malaysia. Mulai tahun taksiran 2019 perkongsian liabiliti terhad badan amanah dan koperasi hendaklah mengemukakan anggaran cukai secara elektronik kepada lembaga hasil dalam negeri malaysia.

Tax payer deceased person s estate list under administrator e filing should be attach with form cp55e if there is more than one deceased person s estate to be registered. In the ea form 2016 many fields that were not used regularly have been. Do keep in mind that you re filing for 2016 income tax in 2017. It is the statement of remuneration from employment private sector.

The latest version of the ea form 2020 is. 4 check those details. List of tax exempt allowances perquisites gifts benefits which are required to declare. The sun malaysia 2016 02 29 sunbiz em ploy ers are re spon si ble for pre par ing the state ment of re mu ner a tion from em ploy ment form ea which should be fur nished to each of their em ploy ees by to day.

For everyone who has no idea what ea forms are let us break it down for you. There have been many changes made to both the ea form 2016 and c p 8d forms. 1 to 8 are required to declare in part f of form ea. According to the inland revenue board of malaysia an ea form is a yearly remuneration statement that includes your salary for the past year.

Only tax exempt allowances perquisites gifts benefits listed above no. 2017 download links can be found at the end of this article. Mulai tahun taksiran 2018 syarikat hendaklah mengemukakan anggaran cukai secara elektronik kepada lembaga hasil dalam negeri malaysia. This form ea must be prepared and provided to the employee for income tax purpose a b c e contributions paid by employee to approved.

For individuals with no business income make sure to choose income tax form be e be and choose the assessment year 2016. You will usually use this form to file personal taxes during tax season. Notes for part f of form ea.