E Filing Lhdn 2017 Due Date

Note that individual and business e file returns have different filing season start and stop dates as indicated above.

E filing lhdn 2017 due date. By filing your tax return on time along with certain benefits such as carry forward of losses you will not have to pay a late filing penalty. If you already have the pin from lhdn or an account for e filing you can proceed to lhdn s official website. Prosedur ini tidak terpakai kepada pembayar cukai yang membuat e filing melalui ejen cukai. Once the irs shuts down the mef system in november for individual returns 2015 tax returns can no longer be transmitted.

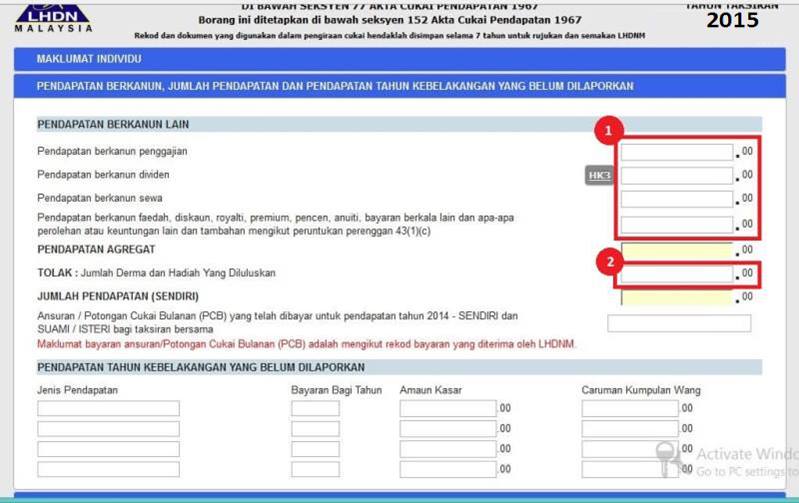

Year of assessment 2017. Frasa keselamatan mulai 27 februari 2017 lhdnm akan meningkatkan keselamatan laman sesawang ezhasil dengan memperkenalkan frasa keselamatan. The deadline to file your income tax return itr for fy 2017 18 is now august 31 2018. Now the cbdt has extended the due date for itr filing for the individuals to 5th august 2017 but for the companies due date is still the same i e.

The original due date for filing of income tax return for the fy 2016 17 or ay 2017 18 is 31st july 2017 for individuals and 30th september 2017 for companies. The filing deadline to submit 2016 tax returns is tuesday april 18 2017 rather than the traditional april 15 date. In 2017 april 15 falls on a saturday and this would usually move the filing deadline to the following monday april 17. Calculations rm rate tax rm 0 5 000.

On the first 5 000 next 15 000. Employers are encouraged to furnish the particulars online using edata praisi which can be accessed via the lhdnm official portal before or on 22 february 2017 the format for information layout for prefill can be obtained from the lhdnm official portal. On the first 2 500. Method of submission grace period for submission of form e e filing 1 month from stipulated filing due date of 31 march 2018 postal delivery 3 working days from the stipulated filing due date.

In lieu with the movement control order period from 18 to 31 march 2020 due to covid 19 pandemic. If a return is submitted after its applicable due date it will be considered late.