E Filing Due Date

Tarikh akhir e filling 2020 lhdn perhatian buat pembayar cukai bila tarikh akhir hantar borang cukai efilling 2020 untuk tahun taksiran 2019.

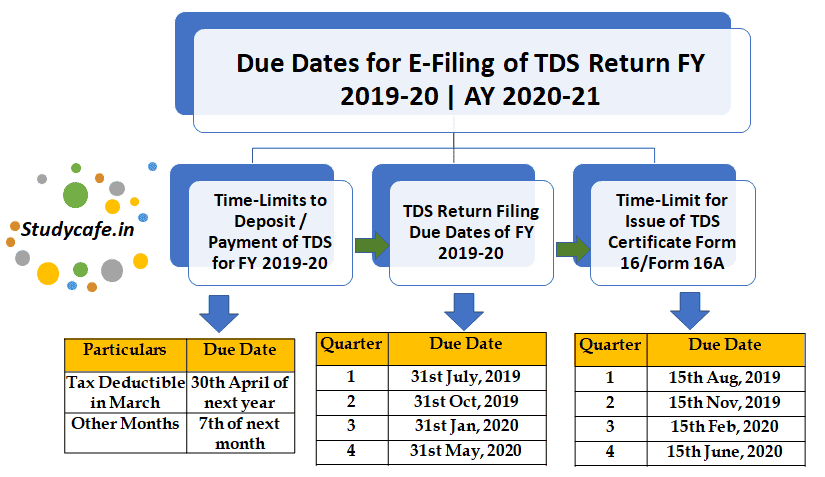

E filing due date. Tds returns are due every quarter. Tds tcs payment deposit due dates for govt non government the due date for depositing tcs is the 7th of next month. Form 24q form 26q form 27q and form 27eq are the same and as follows. Due dates for filing tds returns.

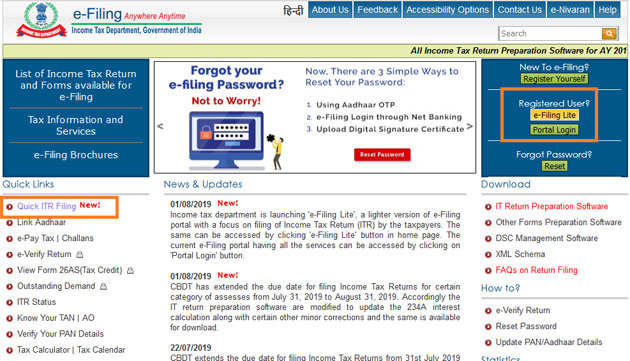

Please refer news and updates for more details. For non government deductors 7th of next month except for the month of march where the due date is 30th of april for government deductors i if paid through challan 7th of next month. Income tax department of india modified file formats in relation to tds and tcs statements. The returns of income which are required to be filed by 31st july 2020 and 31st.

Get to know the tds return due dates and tcs return due dates with last dates for filing for ay 2020 21 fy 2019 20. Due dates extended for filing of income tax returns and tax audit reports for ay 2020 21. However the maximum fees that you will have to pay will be limited to the tds amount. The government had in may extended the date for filing itr for fy2019 20 from july 31 to november 30 to give compliance relief to taxpayers.

The fee will be charged for every day after the due date until the date on which your return is filed. The due dates for all the tds returns i e. Failure to file your tds returns within the due date will mean that you will be subject to a late filing fee of rs 200 per day. If october 15 falls on a weekend or legal holiday you have until midnight the next business day following october 15 to timely file your tax return.

Quarter period last date of filing 1st quarter 1st april to 30th june 31st july 2019 2nd quarter 1st july to 30th september 31st october 2019. Untuk makluman pengemukaan borang nyata cukai pendapatan bncp lembaga hasil dalam negeri malaysia untuk tahun taksiran 2019melalui e filling bagi borang e be b bt p mt dan tf boleh dilakukan pada tarikh yang dinyatakan dibawah. E verify your return using aadhaar otp net banking pre validated bank account and pre validated demat account. E filings return of tds tcs are filed on a quarterly basis and the quarterly statements are accepted in regard to provisions of income tax department.