Donation Tax Deduction Malaysia

The irb in a statement today said the incentives provided under the income tax act 1967 were for the ministry of health s covid 19 fund involving donations of cash and items.

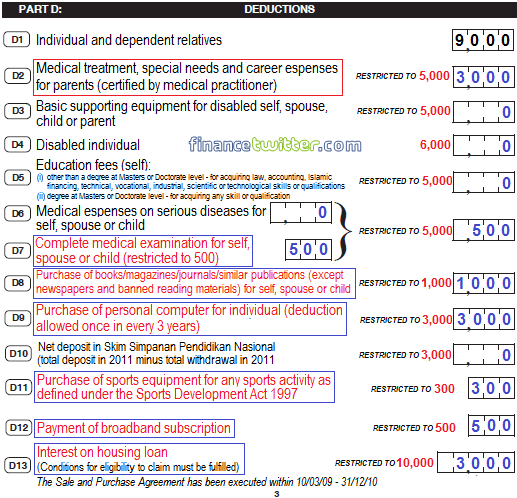

Donation tax deduction malaysia. Tax deductions for donations to covid 19 funds says irb. The donations and contributions made to charity and community projects in relation to covid 19 approved by the mof will be allowed deductions against the gross business income of the donors. Relief tax deduction rebate tax reliefs tax relief which can be claimed by resident individuals in malaysia donations gifts allowable deduction from an aggregate income 1. A general view of the inland revenue board s office in kuala lumpur january 8 2020.

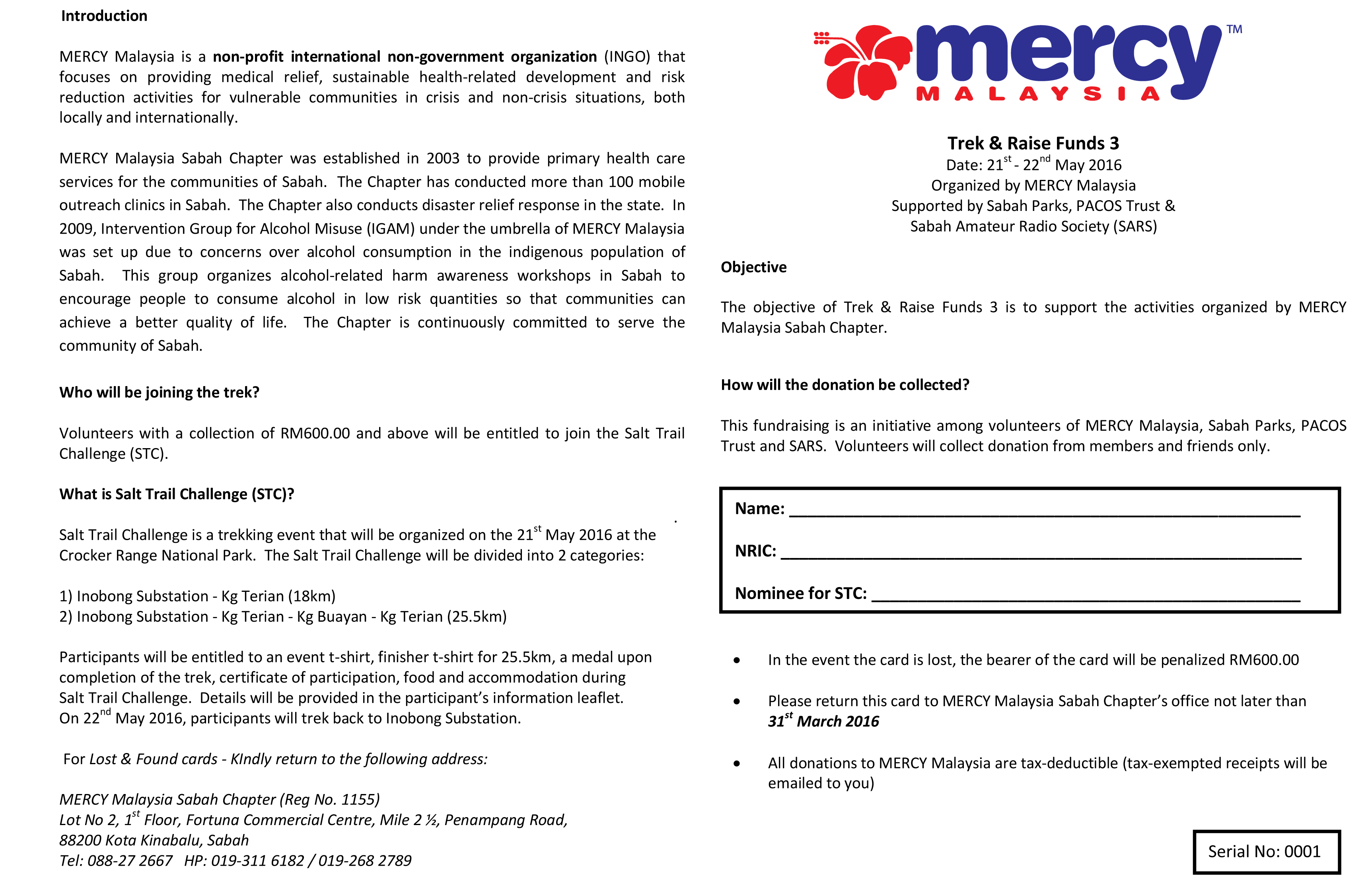

Tax deduction donation contribution. Non business expenses for example domestic or household expenses and taxes are not deductible. For more details on the guidelines and tax deductions on contributions and donations made in relation to covid 19 please refer to our tax whiz which can be accessed via the above link. The deduction is limited to 10 of the aggregate income of that company for a year of assessment.

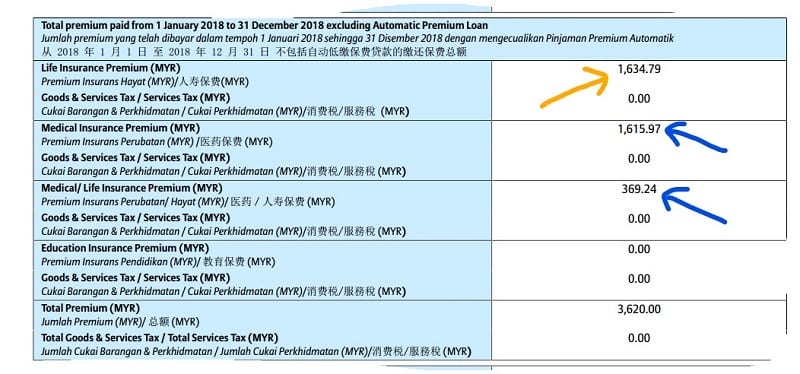

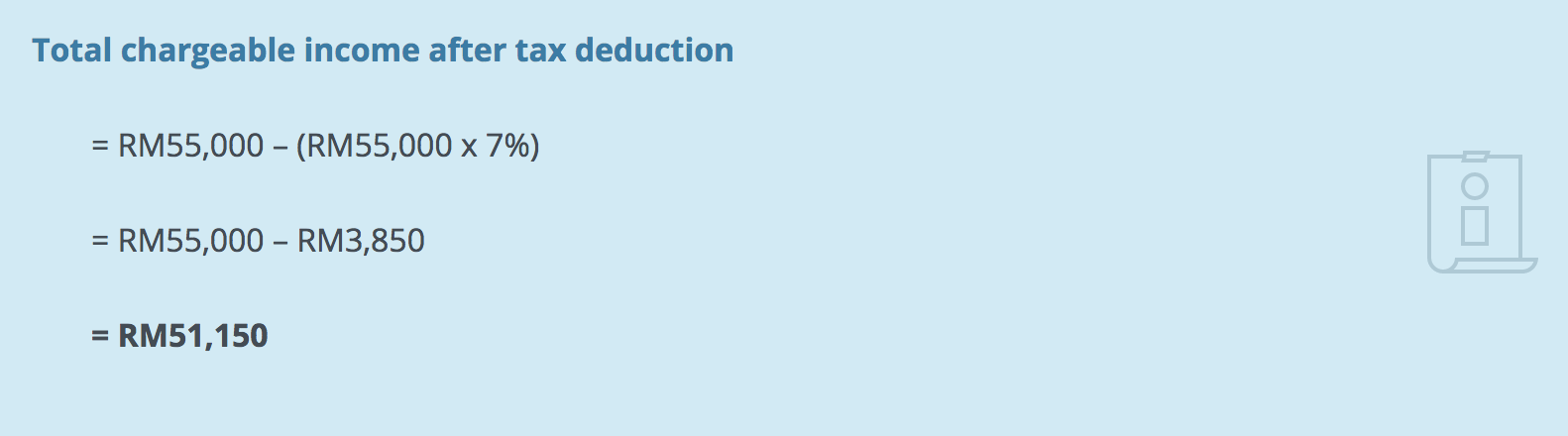

Donations to approved institutions or organisations are deductible subject to limits. Donations are only tax deductible if they are made to a government approved charitable organisation or directly to the government. Updates and amendments 15 director general s public ruling section 138a of the income tax act 1967 ita provides that the director general. Since this donation is limited to 7 of his aggregate income he can claim rm4 200 7 x rm60 000 in tax deductions.

Records of entertainment expense 14 12. Thus his chargeable income after taking the tax deduction for his donation into account is rm60 000 rm4 200 rm55 800 thus lowering the amount of tax he has to pay. Donations and gifts allowable deduction from aggregate income gift of money to approved institutions or organisations. Promotion expense is part of entertainment expense 9 10.

And you must keep the receipt of the donation. A deduction is allowed for cash donations to approved institutions defined made in the basis period for a year of assessment. Steps to determine allowable entertainment expense 13 11.

.jpg)