Donation Exemption For Income Tax Malaysia

This relief is applicable for year assessment 2013 and 2015 only.

Donation exemption for income tax malaysia. Ibu pejabat lembaga hasil dalam negeri malaysia menara hasil persiaran rimba permai cyber 8 63000 cyberjaya selangor. Special relief of rm2 000 will be given to tax payers earning on income of up to rm8 000 per month aggregate income of up to rm96 000 annually. For example if an individual makes a donation in 2018 tax deduction will be allowed in his tax assessment for the year of assessment ya 2019. Since this donation is limited to 7 of his aggregate income he can claim rm4 200 7 x rm60 000 in tax deductions.

Tax exemption receipt shall only be issued to the person company that makes payment name appearing on the cheque or direct bank in for the donation. The irb in a statement today said the incentives provided under the income tax act 1967 were for the ministry of health s covid 19 fund involving donations of cash and items. For income tax 2019 if your chargeable income is rm55 000 and you ve donated rm2 500 to an approved charitable organisation you are allowed to deduct 7 of your aggregate income to reduce your chargeable income. And you must keep the receipt of the donation.

The incentives are also for cash donations to the covid 19 fund under the national disaster management prime minister s department and contributions to any organisation approved under subsection 44 6 of the act. Thus his chargeable income after taking the tax deduction for his donation into account is rm60 000 rm4 200 rm55 800 thus lowering the amount of tax he has to pay. Income tax offices. You do not need to declare the donation amount in your income tax return.

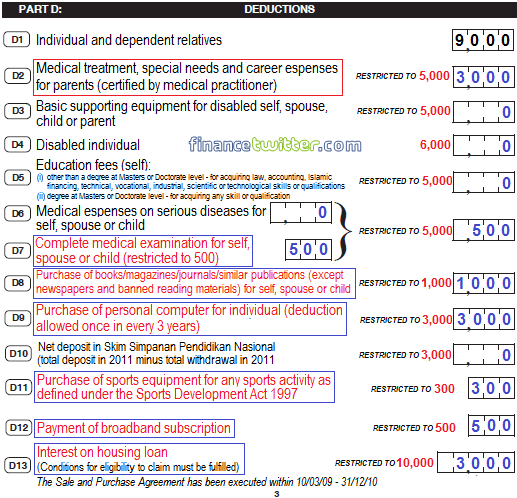

Allowable deduction from aggregate income. Tax deduction is given for donations made in the preceding year. Tax payment faqs. Yes wwf malaysia is an ngo under sub section 44 6 of income tax act 1967 and all cash donations to wwf malaysia are tax deductible applicable only to donations made within malaysia.

Donations are only tax deductible if they are made to a government approved charitable organisation or directly to the government. It s worth noting however that a sizable percentage of your income must go into the donation before you can qualify for the tax deduction. Income tax about income about tax. Tax exemption guidelines under subsection 44 6 income tax act 1967.

Tax exemption receipt cannot be issued in another person s or company s name. In malaysia for example the amount of aggregate income eligible for tax deductions is limited to 7 if you have made a monetary donation to approved institutions organizations sports bodies or projects and national interests vetted by the ministry.