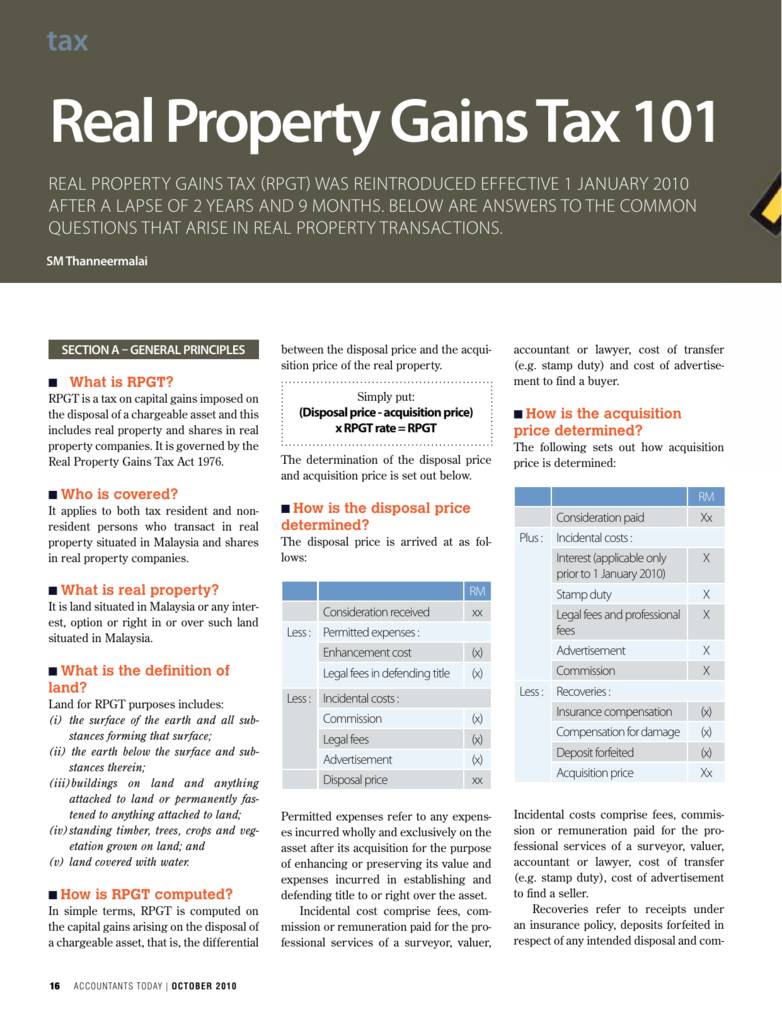

Disposal Of Asset Under The Real Property Gains Tax Act 1976

What most people don t know is that rpgt is also applicable in the procurement and disposal of shares in companies where 75 of their tangible assets are in properties a k a.

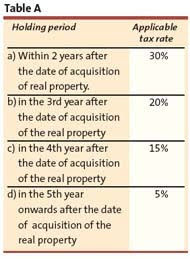

Disposal of asset under the real property gains tax act 1976. Acquisition of shares in an rpc is deemed to be an acquisition of a chargeable asset and any gains arising from disposal of such shares will. Real property gains tax exemption order 2011 5 2 2 where the disposal of a chargeable asset is made in the sixth year after the date of acquisition of such chargeable asset or any year thereafter the minister exempts any person from the application of schedule 5 of the act on the payment of tax on the. Under the real property gains tax act 1976 rpgt act an rpc is a controlled company which the defined value of its real property or shares in another rpc or both is at least 75 of the value of its tangible assets. Act 169 real property gains tax act 1976 an act to provide for the imposition assessment and collection of a tax on gains derived from the disposal of real property and matters incidental thereto.

7 november 1975 be it enacted by the seri paduka baginda yang di pertuan agong with the advice and consent of the dewan negara and dewan. Real property companies rpc.