Disposal Of Asset Under The Real Property Gains Tax Act 1976 Yes Or No

This is clearly spelt out under the real property gains tax rpgta 1976 which only imposes tax on chargeable gain accruing on the disposal of any real property not assessed to income tax.

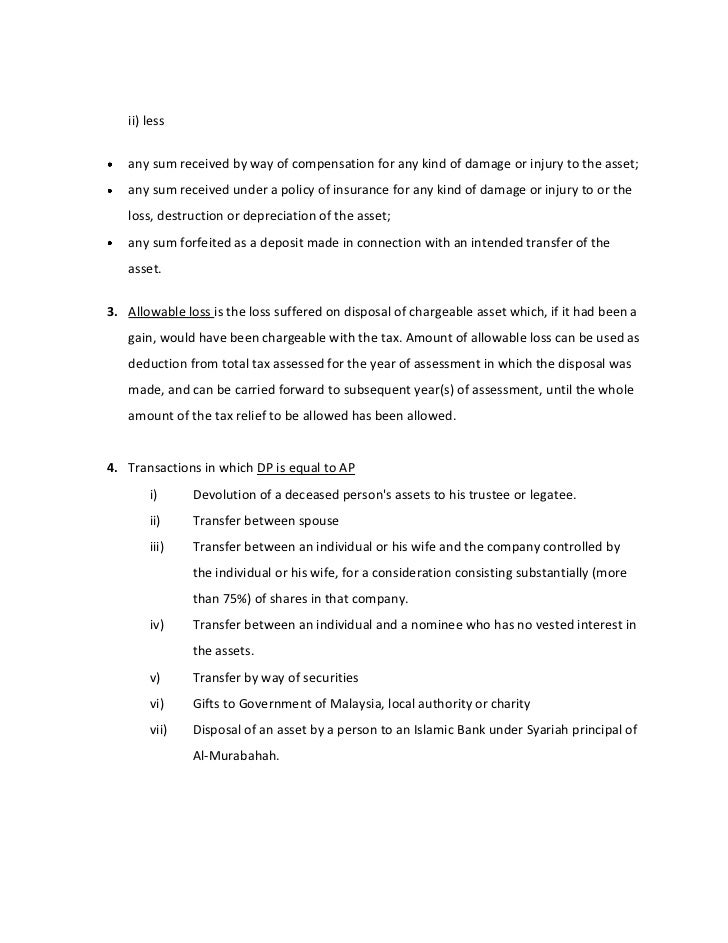

Disposal of asset under the real property gains tax act 1976 yes or no. The act featured progressively stepped tax rates corresponding to the holding period. The tax is levied on the gains made from the difference between the disposal price and acquisition price. It yields a nil tax effect by deeming the disposal price to be the same as the acquisition price of the disposer. Real property gains tax rpgt is a tax levied by the inland revenue board irb on chargeable gains derived from the disposal of real property.

7 november 1975 be it enacted by the seri paduka baginda yang di pertuan agong with the advice and consent of the dewan negara and dewan. Transfer of assets to controlled companies. The disposal price is the amount of money or the value of consideration in monetary terms obtained from the disposal of any asset less. The disposal is a disposal of a chargeable asset under paragraph 34a.

This act may be cited as the real property gains tax act 1976 and shall be deemed to have come into force on 7 november 1975. This tax is provided for in the real property gains tax act 1976 act 169. A chargeable gain is a profit when the disposal price is more than the purchase price of the property. In 1976 the real property gains tax rpgt act was introduced to contain speculative activities in the real property market which had led to spiraling prices.

Pursuant to the amendments it is worth noting that if you are a foreigner wishing to dispose of a property a sum not exceeding 7 must be retained by the purchaser s lawyer for rpgt purposes. Real property means any land situated in malaysia and any interest option or other right in or over such land. But this represents a tax deferral of the rpgt liability not an outright exemption. No gain no loss transactions ngnl this feature is peculiar to rpgt.

Under the real property gains tax act 1976 rpgt act an rpc is a controlled company which the defined value of its real property or shares in another rpc or both is at least 75 of the value of its tangible assets. The disposer and the acquirer are exempted from completing and submitting the relevant disposal and acquisition forms if the disposal of the assets subject to the income tax act 1967. Based on the real property gains tax act 1976 rpgt is a tax on chargeable gains derived from the disposal of property. Act 169 real property gains tax act 1976 an act to provide for the imposition assessment and collection of a tax on gains derived from the disposal of real property and matters incidental thereto.

Further to the above on 1 st january 2018 the finance no 2 act 2017 came into effect with amendments to the real property gains tax act of 1976. Real property companies rpc. Acquisition of shares in an rpc is deemed to be an acquisition of a chargeable asset and any gains arising from disposal of such shares will. It suspends the imposition of rpgt at the time of the transaction.