Direct Tax In Malaysia

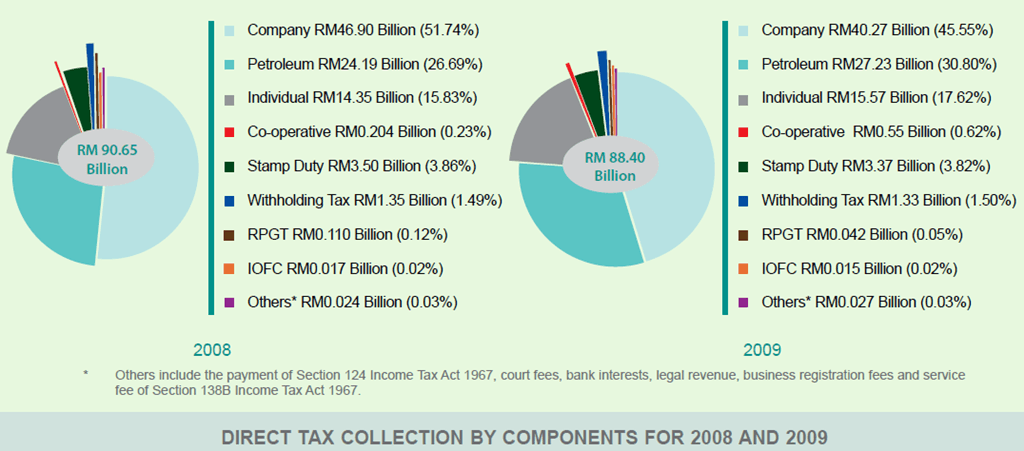

Malaysia s direct tax collection target of rm143 9 billion in 2021 is expected to be achievable according to the inland revenue board irb speaking during a panel discussion at deloitte tax max 46th series webinar today irb chief executive officer ceo datuk seri sabin samitah noted that direct taxes will account for 40 9 or rm143 9 billion of budget 2021 and also.

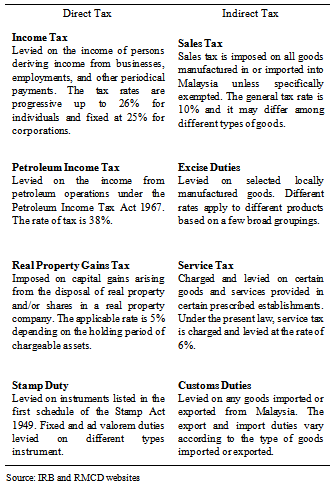

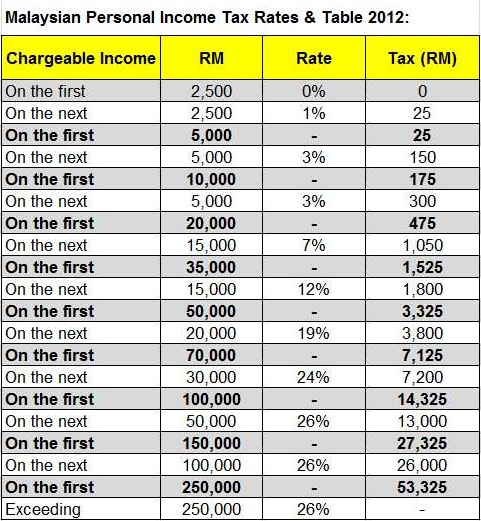

Direct tax in malaysia. The indirect tax landscape in malaysia is evolving at a fast pace. What supplies are liable to the standard rate. Direct taxes and indirect taxes a comparison between entities in malaysia and labuan the comprehensive range of tax benefits available in labuan ibfc makes it a very attractive jurisdiction for a variety of business and financial activities. If you are working in malaysia for more than 182 days a year the government considers you to be a tax resident and you will pay progressive tax rates and be eligible for tax deductions.

Price control and anti profiteering pcap conduct training for businesses on the pcap regulations and the impact it may have in determining pricing policy. Assist in applying for indirect tax exemption including making presentation to customs malaysian investment development authority mida and or mof. 10 for sales tax and 6 for service tax. Sales tax and service tax were implemented in malaysia on 1 september 2018 replacing goods and services tax gst.

In addition taxes like estate duties annual wealth taxes accumulated earnings tax or federal taxes are not levied in malaysia. Service tax is levied on prescribed taxable services while many goods are exempt from sales tax. Since the repeal of the goods and services tax gst and the implementation of sales and service tax sst indirect tax risk has never been higher. Kuala lumpur nov 23.

Noting that the government collected rm145 08 billion from direct taxes last year guan eng said that the sum was almost 6 or rm8 billion more than the amount collected in 2018.