Difference Between Takaful And Conventional Insurance

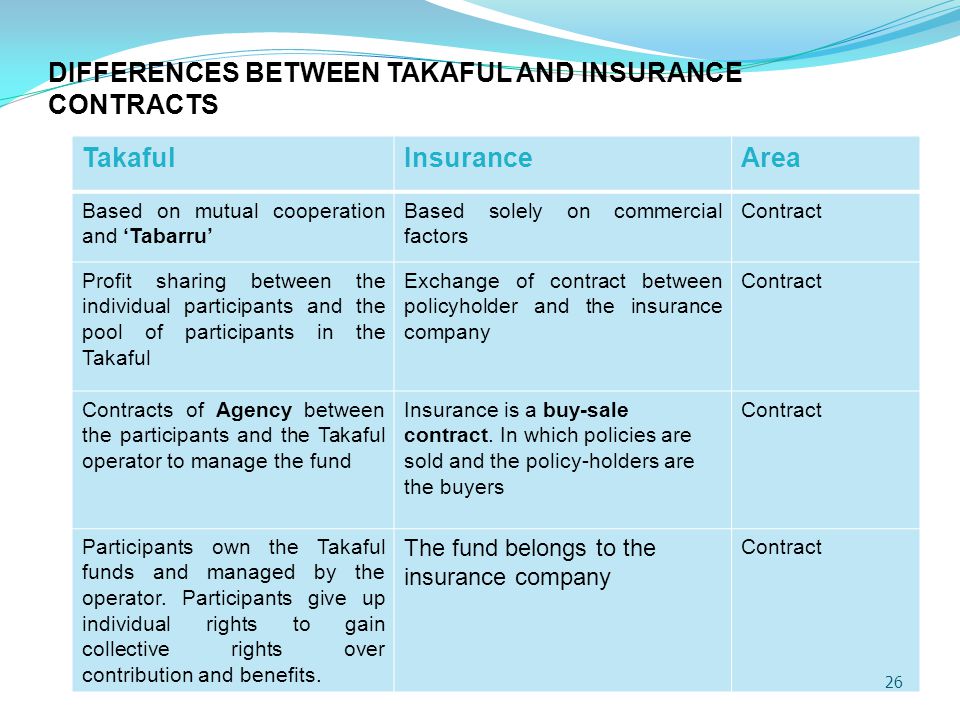

Ahmad ali khan 2003 it is a business institutions operated upon the principles of contract which is exchange.

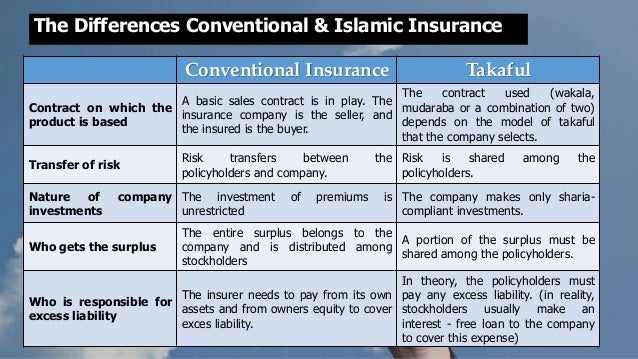

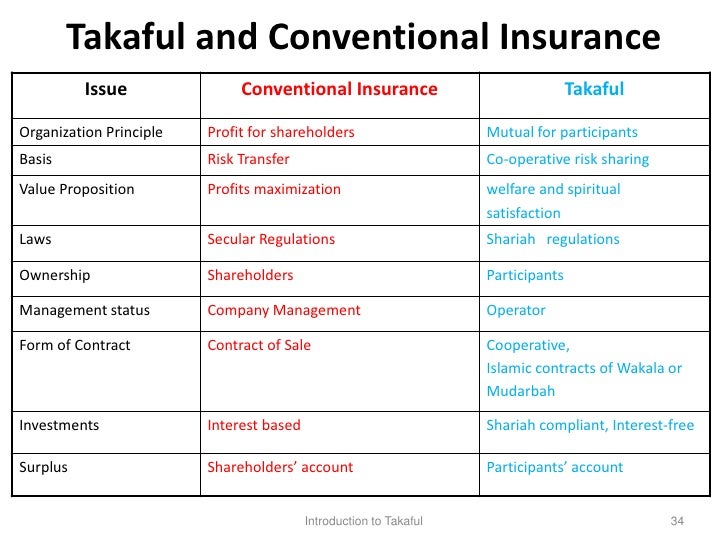

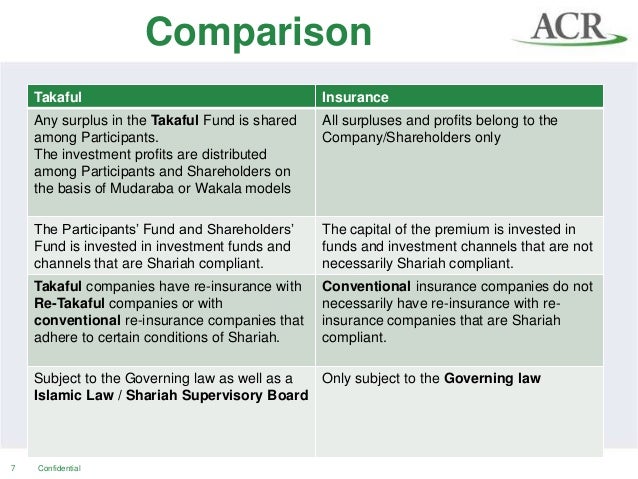

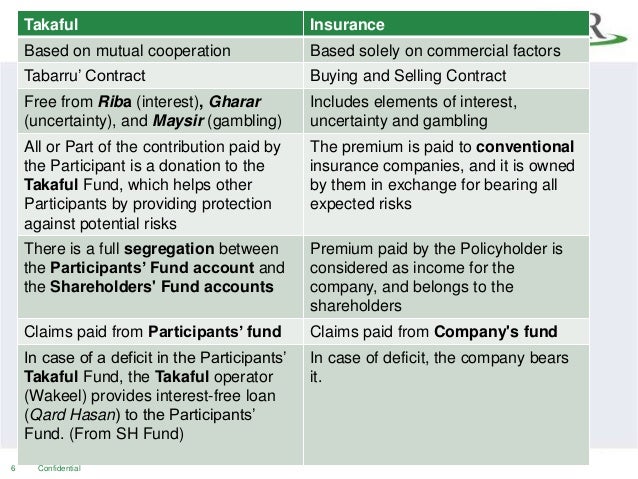

Difference between takaful and conventional insurance. Although both offers the same purpose which is to protect the insurer there are some major differences between both. Ammb holdings s islamic banking income down by 2 7 for half year ended the 30th september 2020. Under takaful capital is only invested in funds that are fully shariah compliant. Conventional insurance including mutual insurers may involve ribaand some other elements which may not be justified by shari a principles.

Difference between conventional insurance and takaful. Having said that there are major differences in the workings of the two systems stemming from the fact that takaful adheres strictly to the islamic principles it was developed upon. Conventional insurance typically charges a fixed commission fee of 2 whereas takaful operators might impose a wakalah charge depending on the product and model. We at takaful emarat provide products based on the concept of takaful which differs from the conventional insurance in the following aspects.

The main different between conventional insurance and takaful is the way in which the risk is handled and assessed along with the management of the takaful fund. Shari a takafulpractices are free from the elements of ribaand other prohibited elements and is evolved around the elements of mudaraba tabarruand other shari a justified elements. It is a co operative institution according to the principles of contract which is mutual co operation ta awun. 4 funds are only invested in non interest bearing i e.

Both takaful and conventional insurance policies work on the same basic system which is the pooling of funds to manage the risk of a group of people. The wakalah charge is similar to a service fee. 2 3 difference between takaful and conventional insurance takaful conventional insurance. Hence it obviates the element of maisir while at the same time without losing the benefit of takaful in the same way as conventional insurance.

Takaful is a relatively new insurance product that is marketed as an islamic alternative to conventional insurance and is often referred to as islamic insurance. Malaysia building society swings back to black in the third quarter with rm258 24 million us 63 32 million net profit. This is because when you purchase conventional insurance the amount of coverage you re entitled to isn t left to chance. This means that from the customer s point of view takaful is an inferior insurance product compared to conventional insurance.