Difference Between Sst And Gst

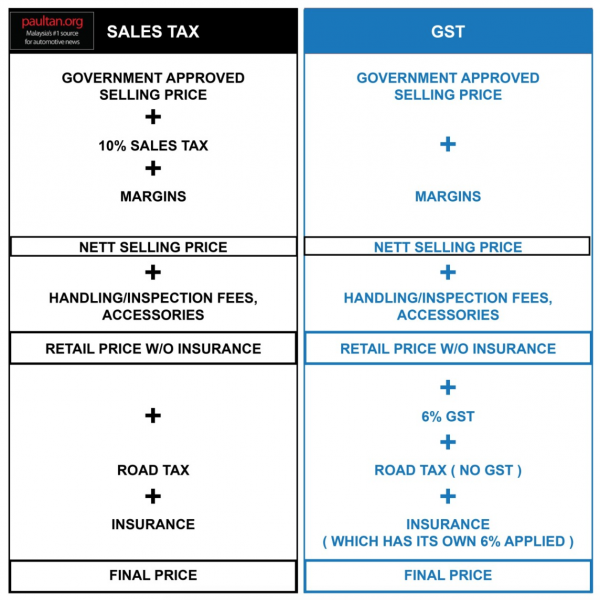

The sales tax is only levied on the level of the producer or manufacturer while the service tax is imposed on all customers who use tax services.

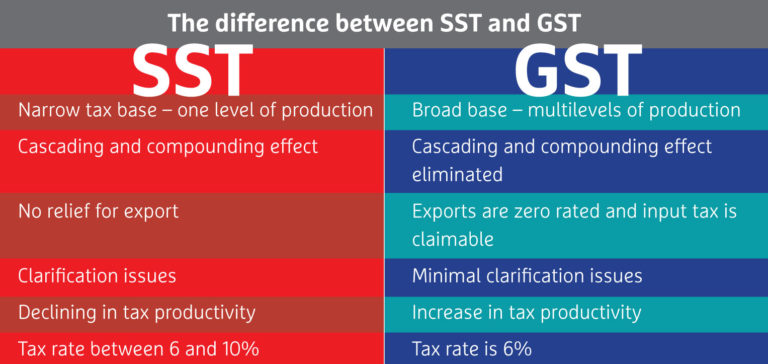

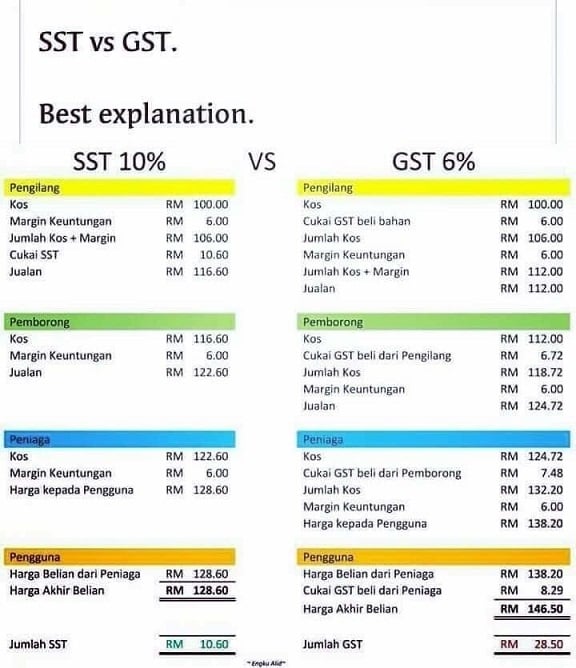

Difference between sst and gst. Goods and services tax gst gst covers everyone retailers and trades. Sst rates are less transparent than the gst which had a standard 6 rate the sst rates vary from 6 or 10. The difference between gst and sst is that gst is a unified and indirect tax that is levied on the supply of goods and services. The sst rates are less transparent than the standard 6 gst the sst rates vary between 6 and 10.

Gst levies a single standard tax rate for all. The sales tax is only imposed on the manufacturer level the service tax is imposed on consumers that are using tax services. Sst refers to sales and service tax.