Difference Between Insurance And Takaful

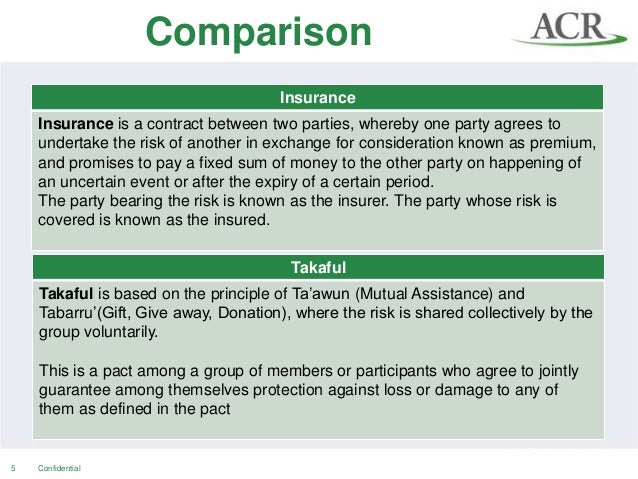

Having said that there are major differences in the workings of the two systems stemming from the fact that takaful adheres strictly to the islamic principles it was developed upon.

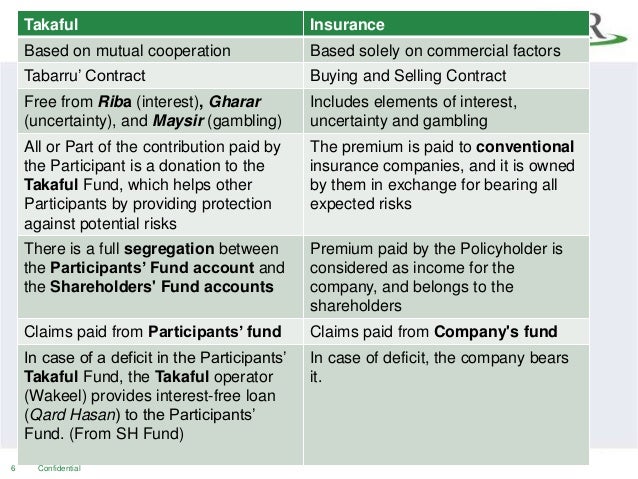

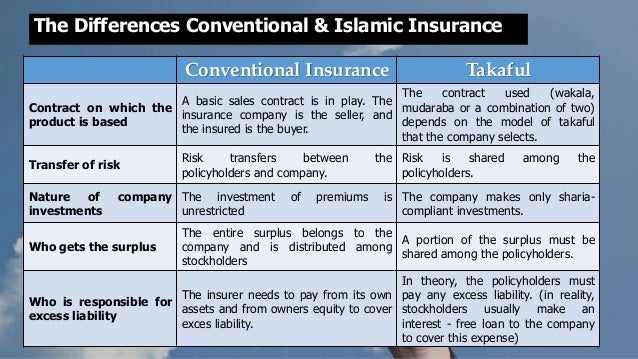

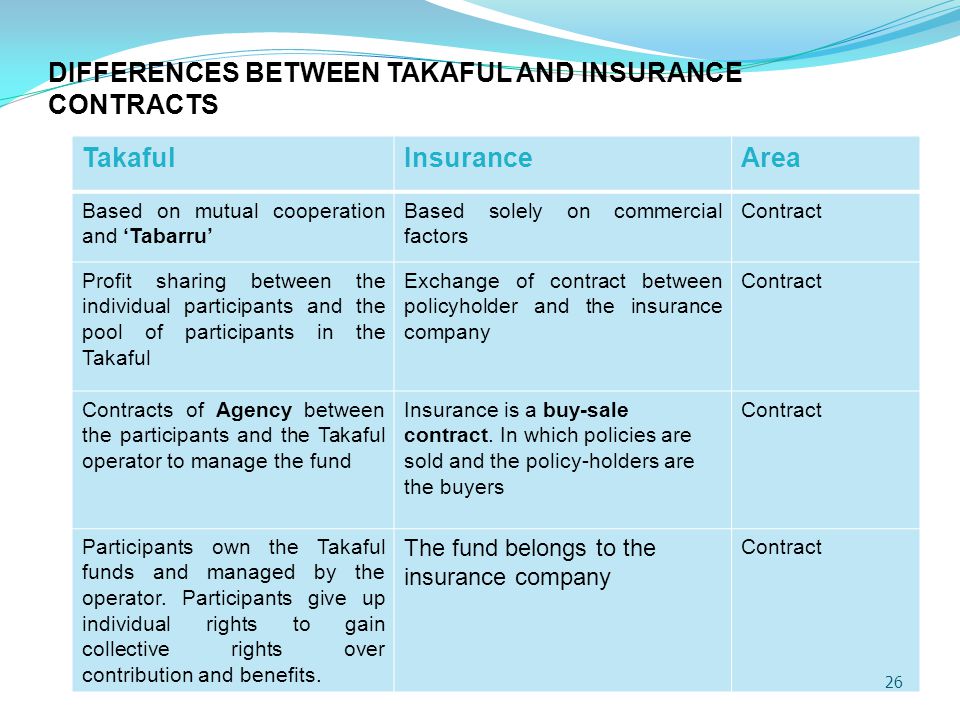

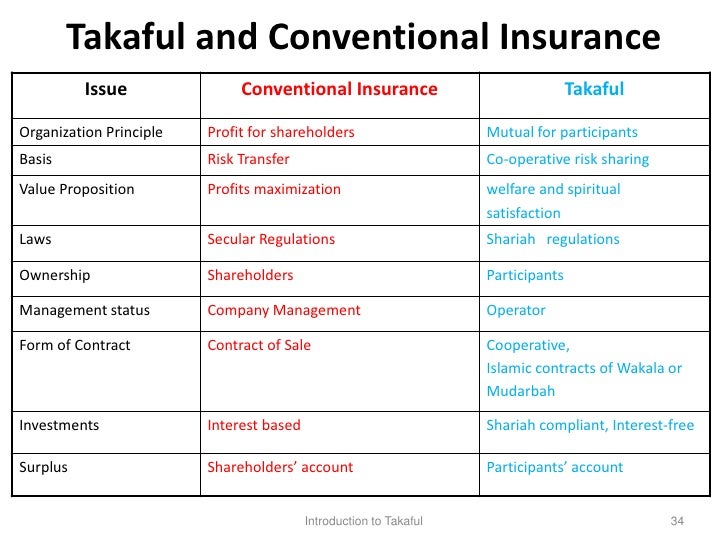

Difference between insurance and takaful. Although both conventional and takaful businesses generate profits for the shareholders in takaful business the expenses paid to the shareholders are explicitly transparent in conventional insurance they are not necessarily so. The following table summarizes the main differences between both systems. Both takaful and conventional insurance policies work on the same basic system which is the pooling of funds to manage the risk of a group of people. Conventional insurance typically charges a fixed commission fee of 2 whereas takaful operators might impose a wakalah charge depending on the product and model.

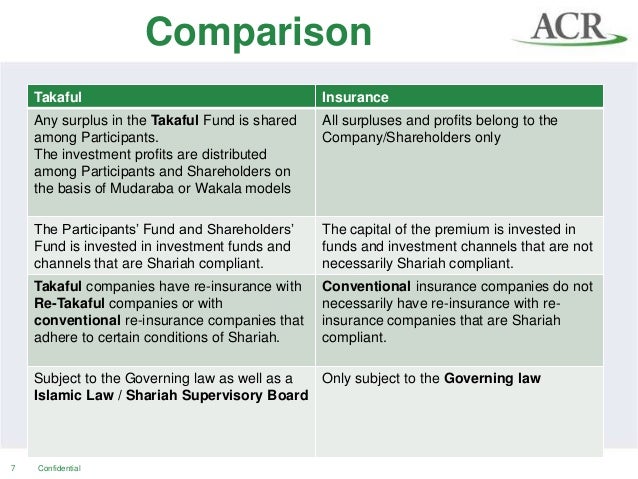

Conventional insurance involves making investments that can incur risk and generate profits that will be retained by the company while under takaful investment profits are distributed among both participants and shareholders on the basis of mudaraba or wakala models. Although both offers the same purpose which is to protect the insurer there are some major differences between both. Always wondered what is the difference between takaful and life insurance. Whereas conventional insurance transfers risk from the customer to the insurer for a price equal to the premium the takaful arrangement socialises risk by sharing it between the participants.

Takaful does not permit uncertainity or gambling when it comes to risk assessment and handling and speculating respectively. The ethic based principle of solidarity mutual help brotherhood and cooperation among the members are the key attributes of takaful. The wakalah charge is similar to a service fee. The term takaful is grounded on the concept of mutual cooperation where both risks and funds are shared between the insured and insurer.

Takaful is a relatively new insurance product that is marketed as an islamic alternative to conventional insurance and is often referred to as islamic insurance. The main different between conventional insurance and takaful is the way in which the risk is handled and assessed along with the management of the takaful fund.