Difference Between Gst And Sst

Gst levies a single standard tax rate for all supply of goods and services india.

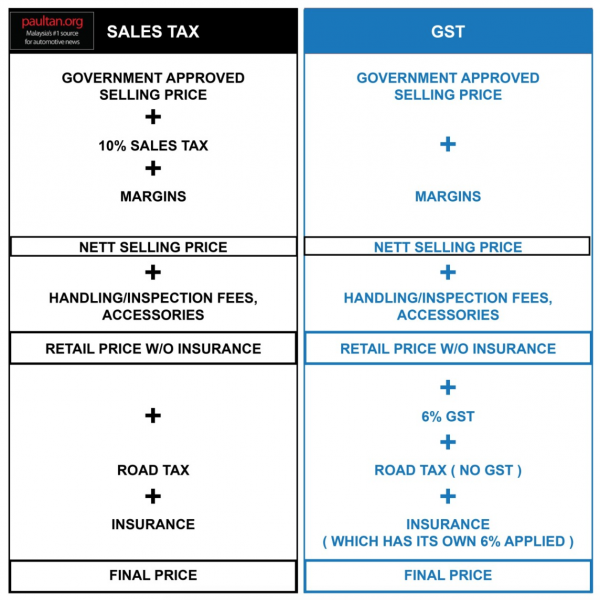

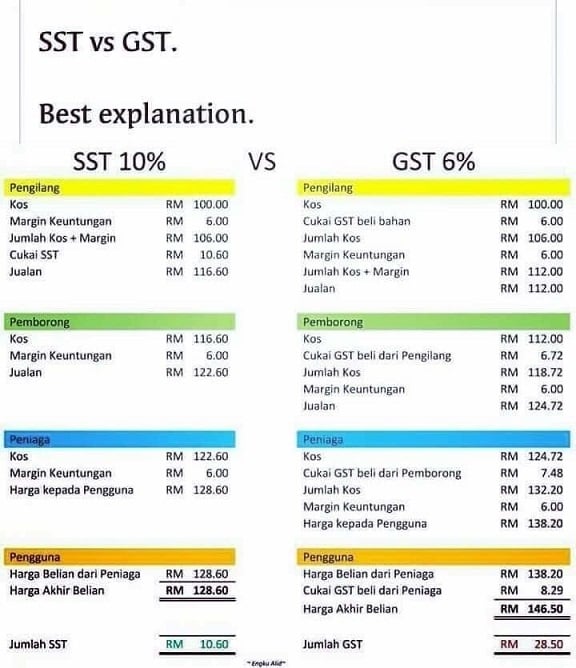

Difference between gst and sst. All gst registered businesses must issue tax invoices for sales made to another gst registered business. However there are some differences between this 2 taxes. Gst vs sales and service tax sst the malaysian government had implemented gst by april 2015 and like it or not individuals or business corporates have to get ready. The example below makes certain assumptions for simplification purposes just to show the differences between sst gst.

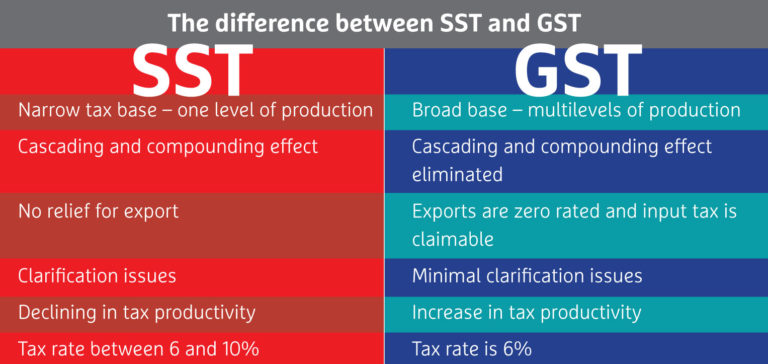

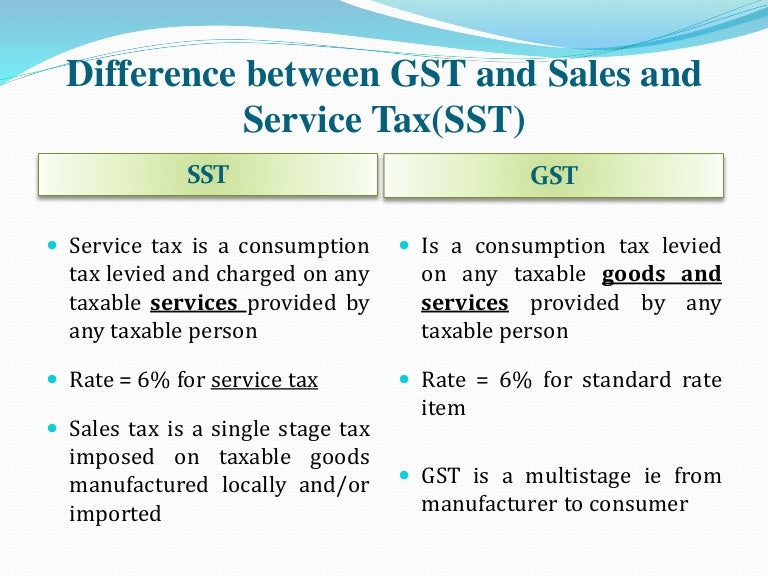

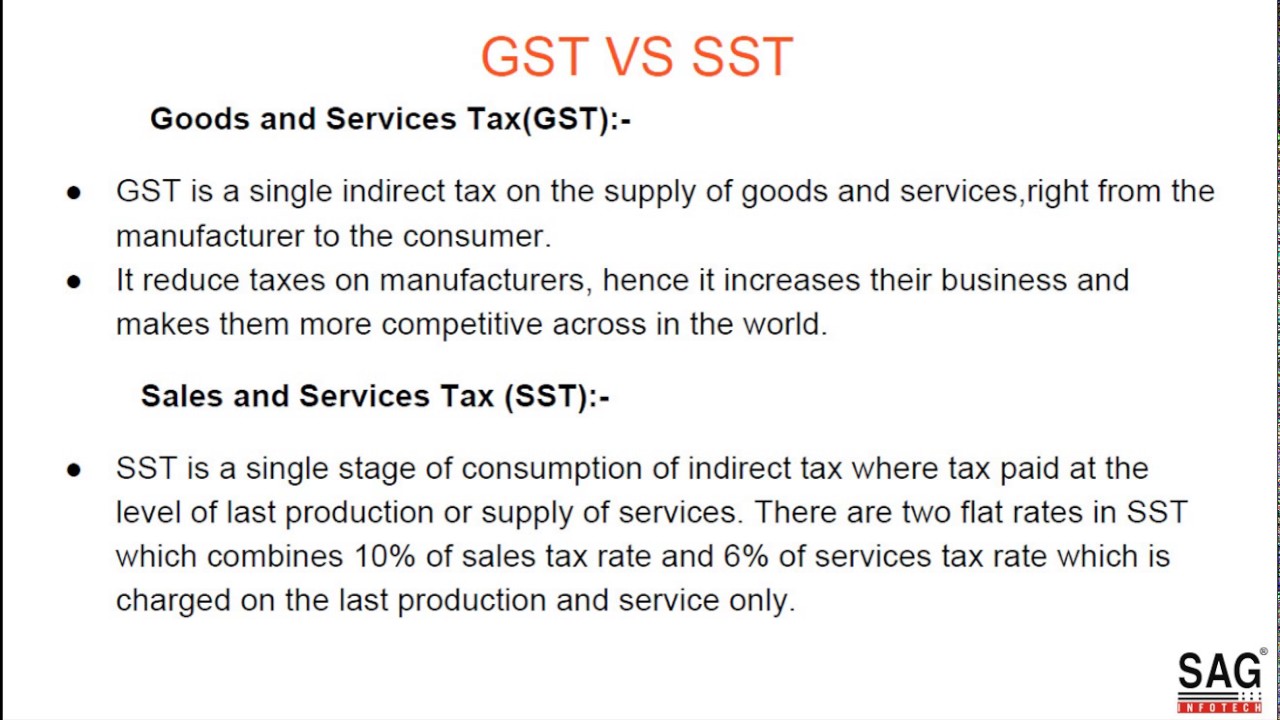

Gst is a multi stage 6 goods and services tax that is charged and collected at every stage of the supply chain. So depending on the sst coverage consumers could be paying the same or slightly more for certain items. The difference between gst and sst is that gst is a unified and indirect tax that is levied on the supply of goods and services. Exempted supplies zero rated gst relief of gst.

The differences gst vs sst 1. If the value of your supply does not exceed 1 000 you can issue a simplified tax invoice with fewer details. This is to enable your customer to claim the gst incurred based on your tax invoice. This is the real question.

Sst is a business cost. Is gst better than sst. Sst only goods services that fall under the sst list are to be taxed. Gst all goods and services are subject to gst except.

The sst was initially replaced by the gst but it is making a comeback on 1st september 2018. Gst vs sst 1. Here are some major differences between the gst and the sst that you should know as a business owner. Difference between gst and sst sales service tax updated on may 18 2018 posted by ca hitesh sukhnani posted in gst articles service tax taxes in india biggest indirect tax regime of india the goods and services tax gst is on its way to be adapted worldwide.

Pakatan harapan had consistently said that gst had burdened the rakyat. The differences between sst gst. Sst is a service tax levied on any taxable service carried out by a taxable individual and a sales tax levied either at the manufacturer level or consumer level once only. Under the gst regime input tax is available as a credit or deduction against output tax based on tax invoice received from gst registrant suppliers.

The above two differences are about the basic differences between gst and sst which is also the fundamental reason why people of our country opposed the implementation of gst in the first place. It is charged once at the manufacturer and or consumer level only and the tax can range between 5 10.