Difference Between Conventional And Islamic Banking

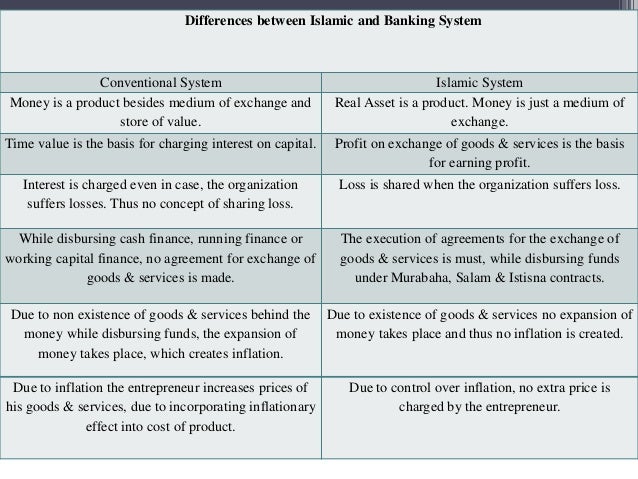

Money is a product besides medium of exchange and store of value.

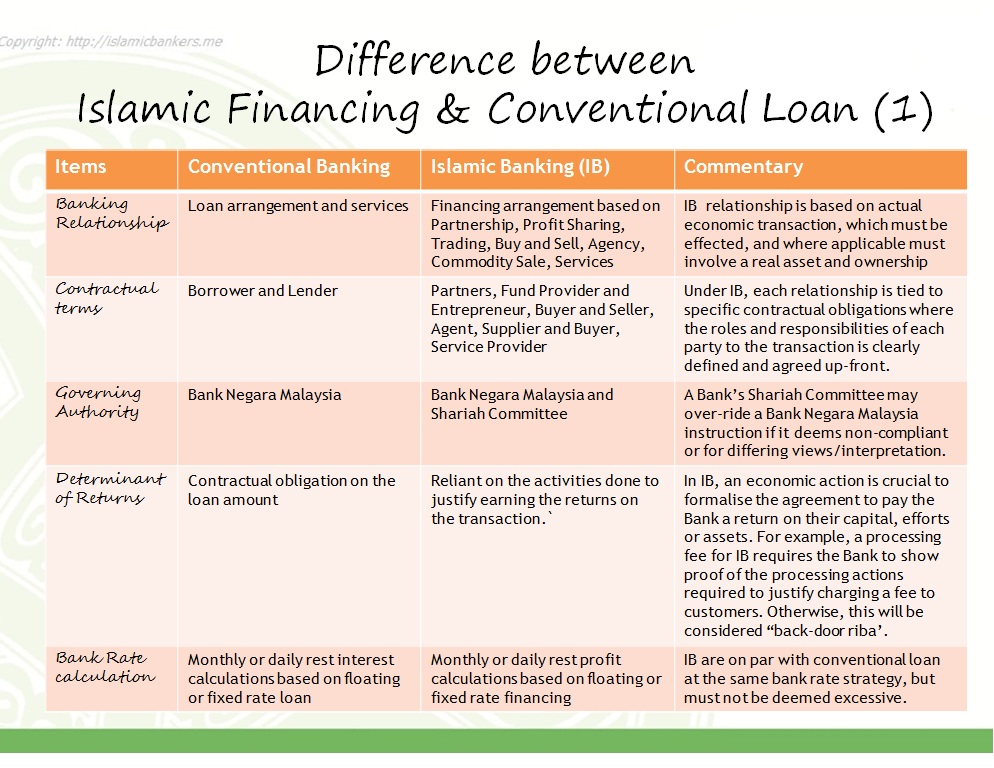

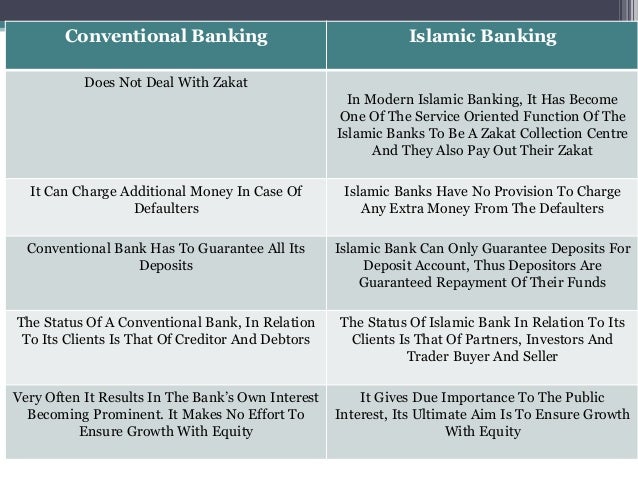

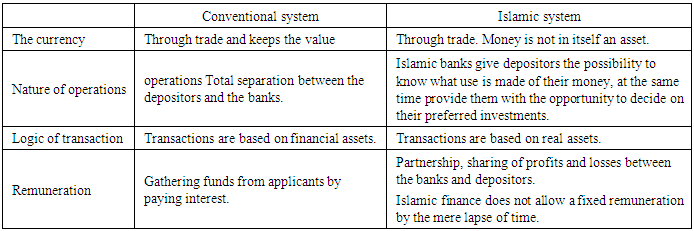

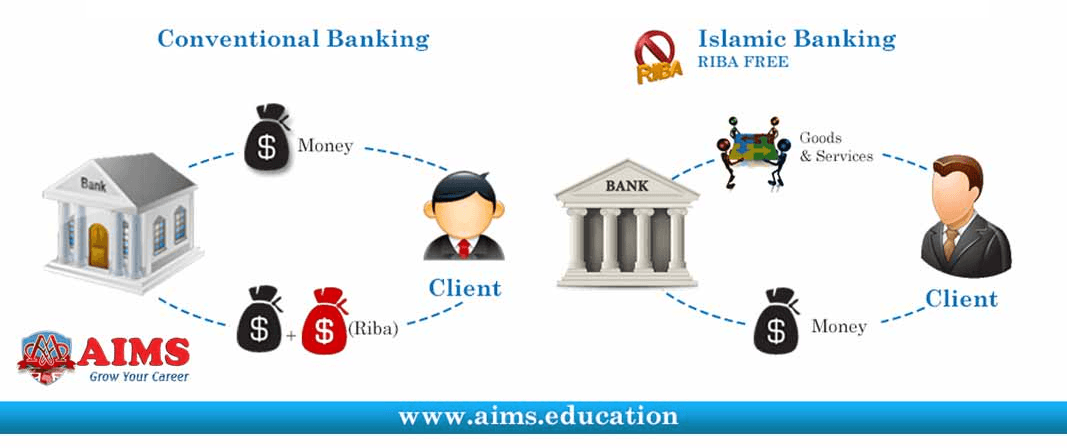

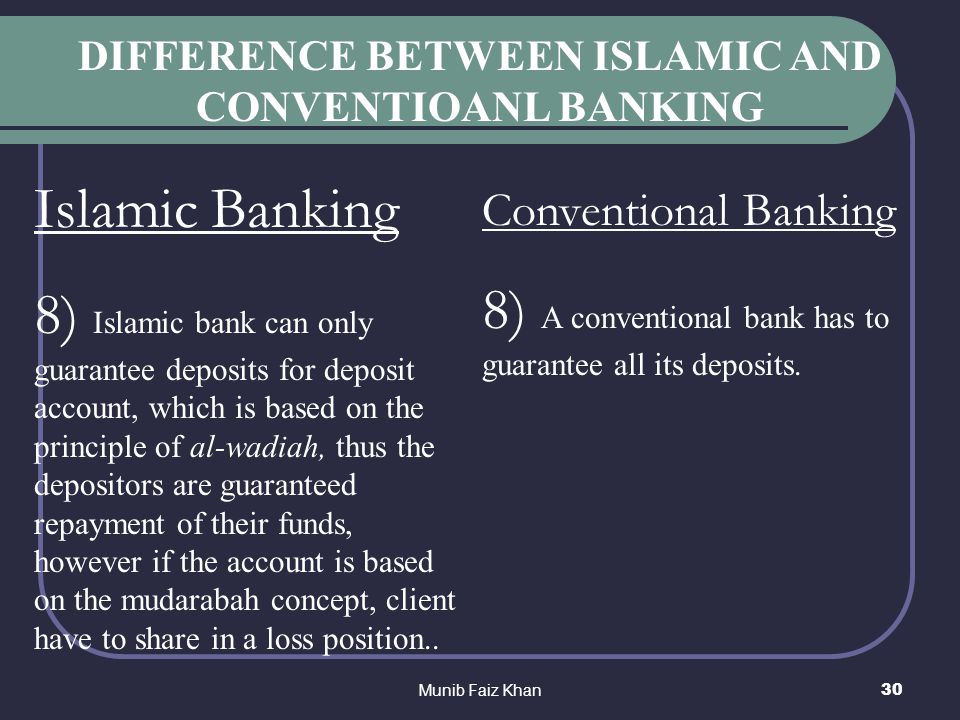

Difference between conventional and islamic banking. Time value is the basis for charging interest on capital. Real asset is a product money is just a medium of exchange. The conventional bank offer greater emphasis on credit worthiness of the customers. The status of a conventional bank in relation to its clients is that of creditor and debtors.

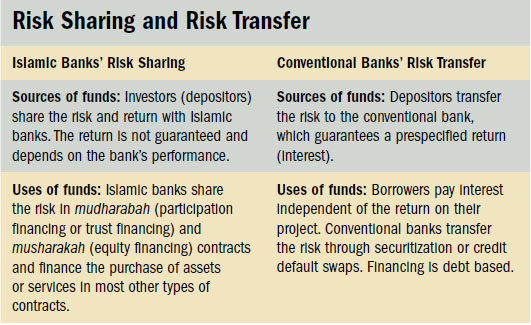

For example you cannot take a loan for a wine shop. Conventional banks aim to maximize returns and minimize risk. Islamic banking is an ethical banking system and its practices are based on islamic shariah laws. The bank s interest comes before the client s as opposed to the islamic banking system.

The islamic bank gives greater emphasis on the viability of the projects. It is asset based financing in which trade of elements prohibited by islam are not allowed. Profit on exchange of goods services is the basis for earning. Major differences between islamic and conventional banking.