Deliberations On The Discrepancies Between Islamic And Conventional Deposit Products

The loan contract for bba islamic financing is known as a sale and buy back agreement.

Deliberations on the discrepancies between islamic and conventional deposit products. As part of the malaysian government s efforts to promote islamic financing in general. Extrinsically islamic and conventional deposits are viewed to be similar owing to the fact that both are viewed as banking products. The numerical data is shown in table 1 the difference between the roe is increasing with the passage of time and it was only 1 73 and 23 09 for the conventional banks in the last year but 11 16 and 113 4 for the islamic bank. The purpose of such expositions is to provide novice readers a basic but.

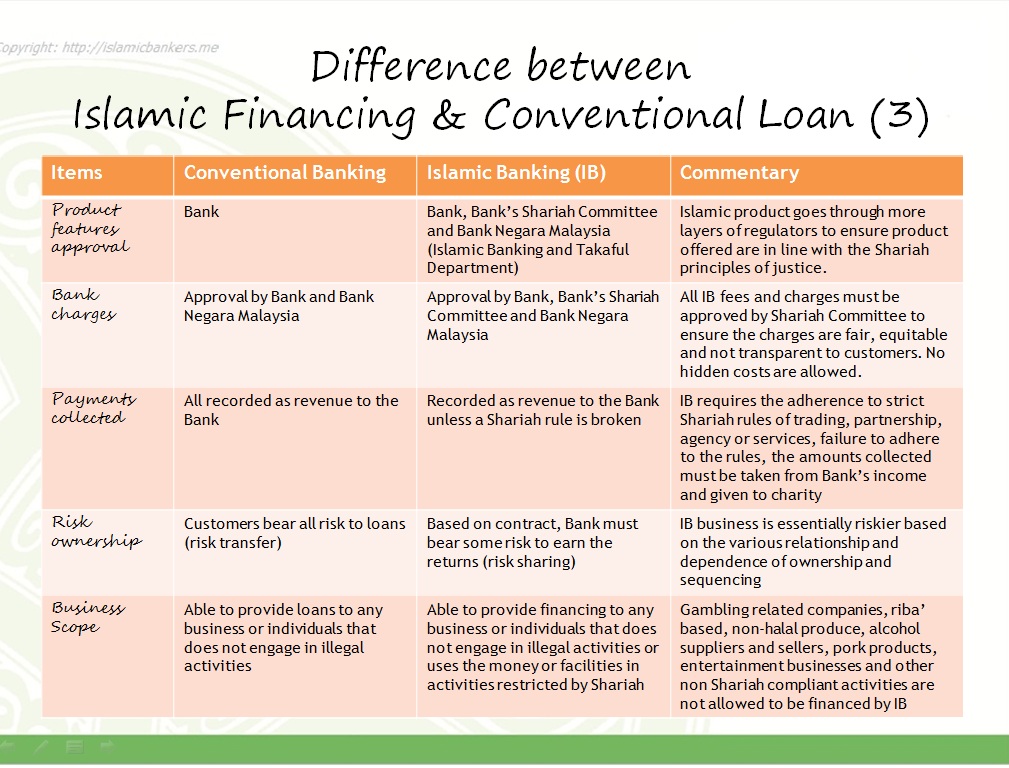

Intrinsically however some appealing discrepancies are emerged to differentiate the two. Income for the depositor for conventional savings account the interest income commonly practiced is between 0 5 to 1 percent based on the policy of the bank. Savings accounts and term deposits whereas current accounts may offer free banking facilities. In the islamic banking sector however there is no creditor debtor relationship between an islamic bank and a customer.

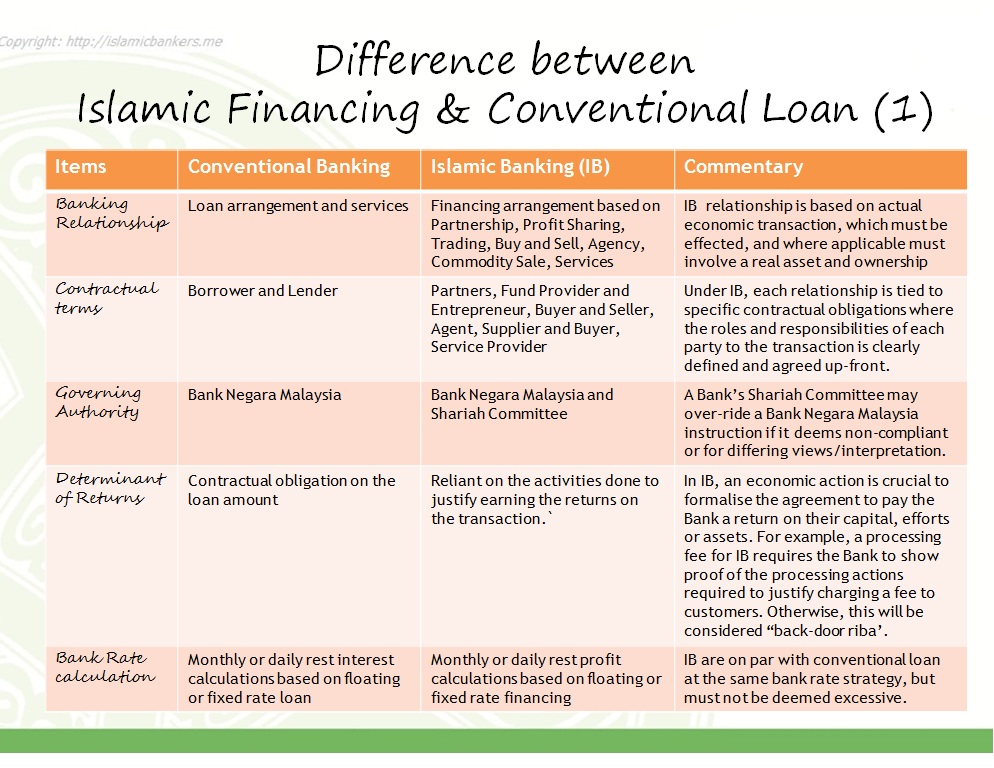

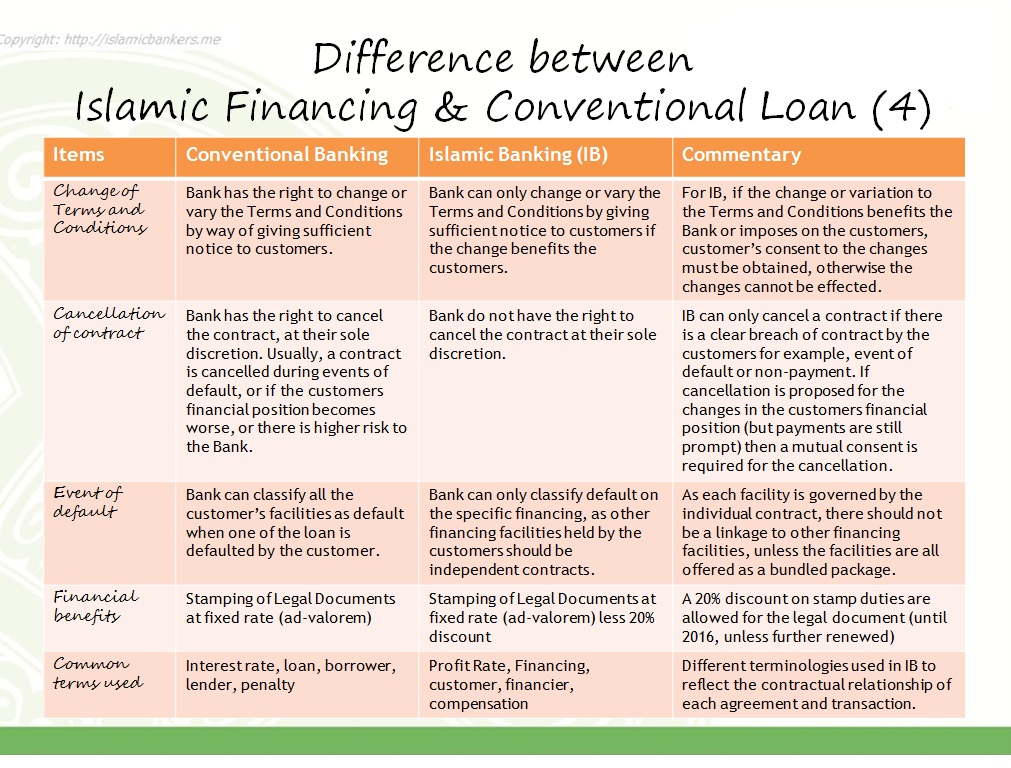

Under conventional system reward is fixed and predetermined while under islamic deposits are accepted through musharaka and mudaraba appendix b where reward is variable. In order to bring to light the discrepancies between islamic and conventional deposit facilities the following elucidation are provided. Qard current accounts. This article expounds two key differences but are not limited to the following.

Return on equity is the second measure of profitability which is higher for islamic bank for the year 2015. Islamic banks conventional banks 1 the relation between the bank and its depositors is that of mudarib and rabb ul maal in case of savings account and term deposits the relation between bank and depositors that borrower and lenders 2 the bank invests the funds it receives at the depositors own risk in case of savings account and term. Islamic banks offers deposit products based on the following structures. Benefits of islamic financing over conventional financing.

Deliberations on the discrepancies between islamic and conventional deposit products. In addition to this conventional bank invests the deposits in non shariah compliant avenues and subsequently earns non shariah compliant returns. Under conventional banking return is higher on long term deposits and lower for short term deposits. On the same note some discrepancies between deposit facilities offered by islamic and conventional banks are exposed.

In addition to this conventional bank invests the deposits in non shariah compliant avenues and subsequently earns non shariah compliant returns.