Definition Of Conventional Banking

Conventional loans are given as per guidelines issued by government sponsored entities.

Definition of conventional banking. Conventional financing is a home financing scheme offered by financial institutions or banks which are not guaranteed by government agencies. The conventional banking stream covers the structures functions processes products and services of the actual conventional banking sector. This ensures that such loans can be sold in the secondary market. Commercial banks make money by providing and earning interest from loans such as mortgages auto loans business loans and personal loans.

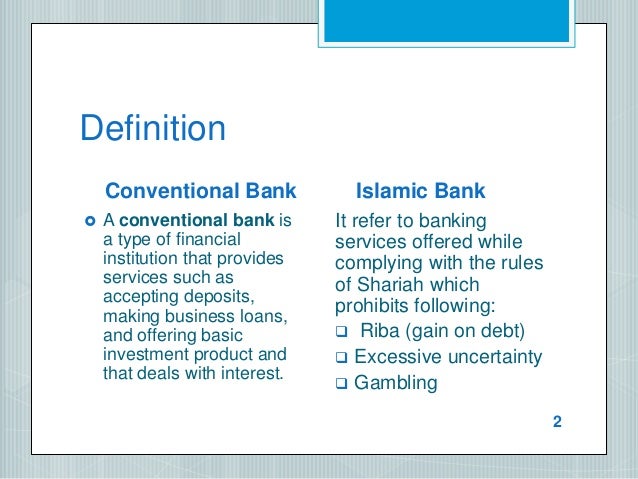

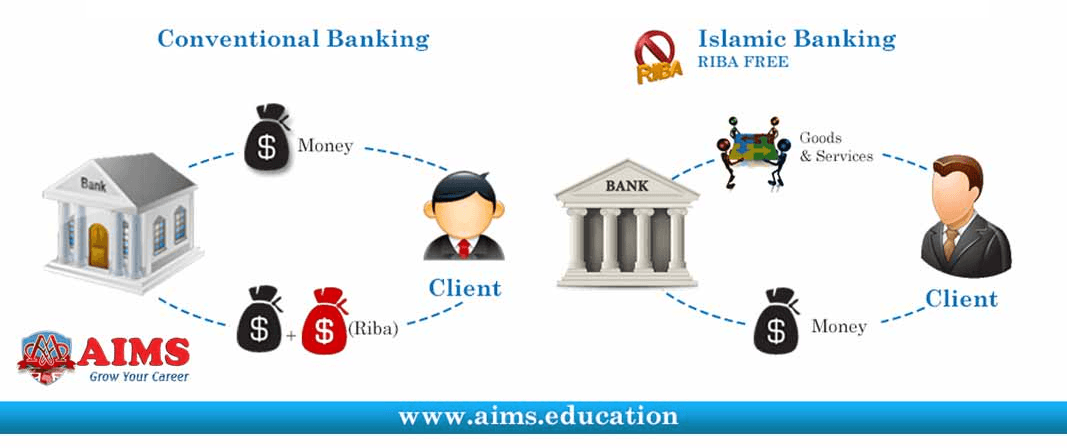

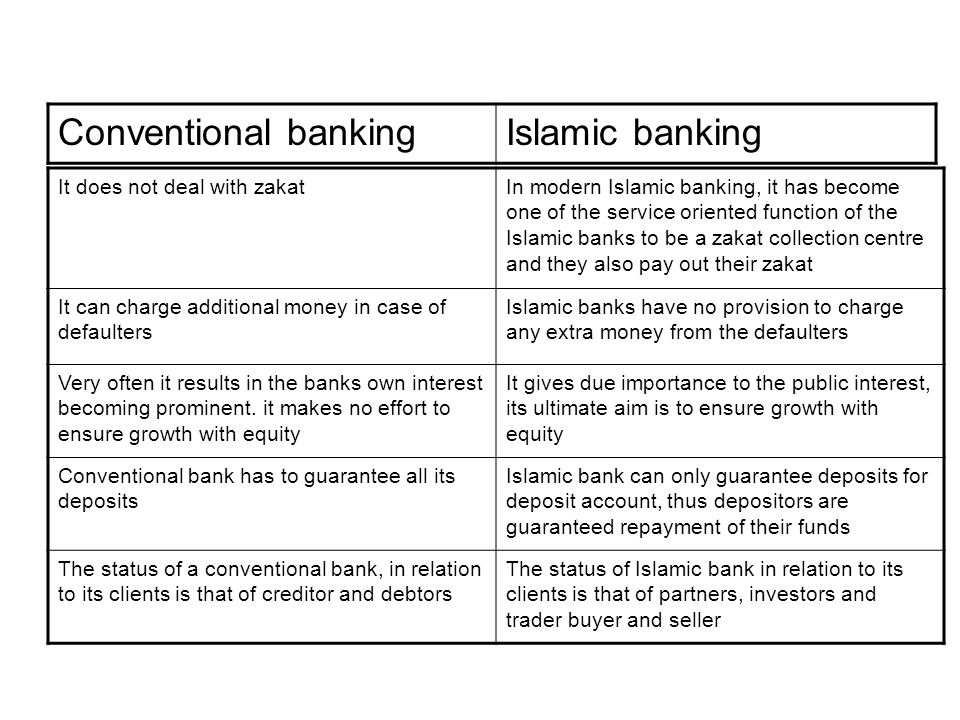

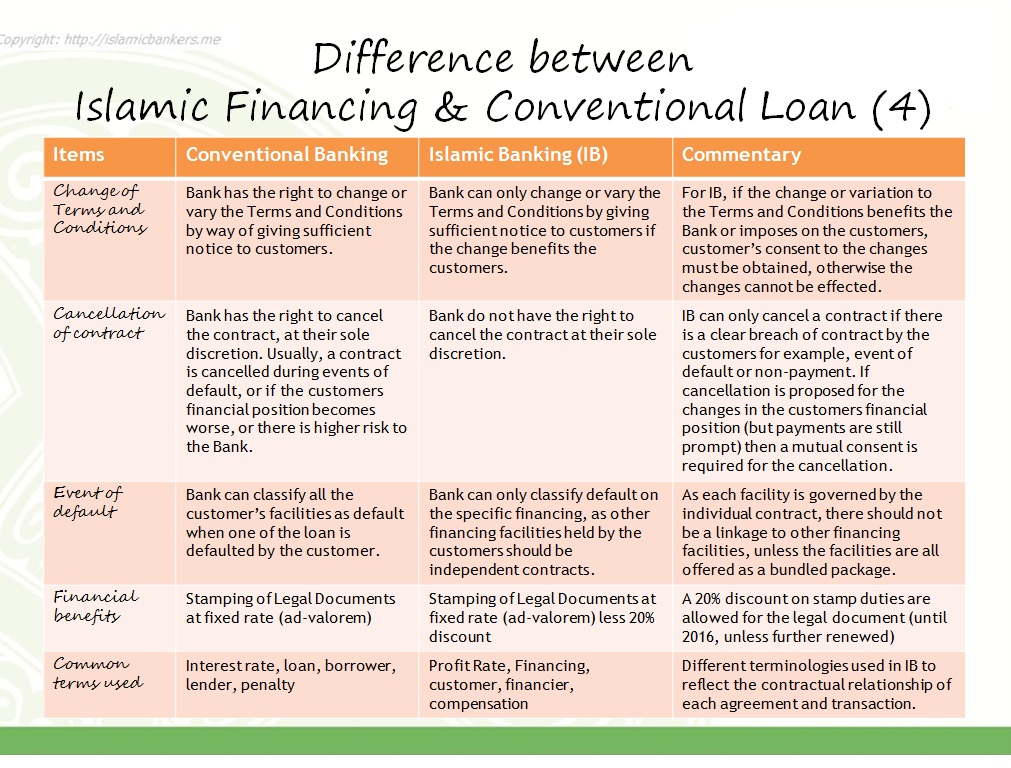

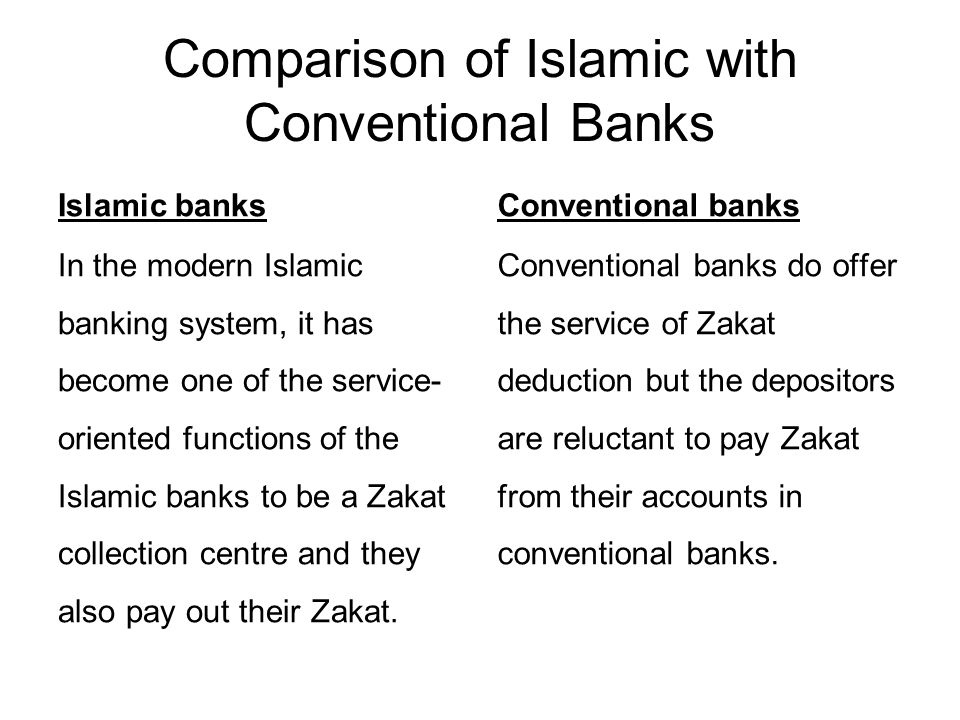

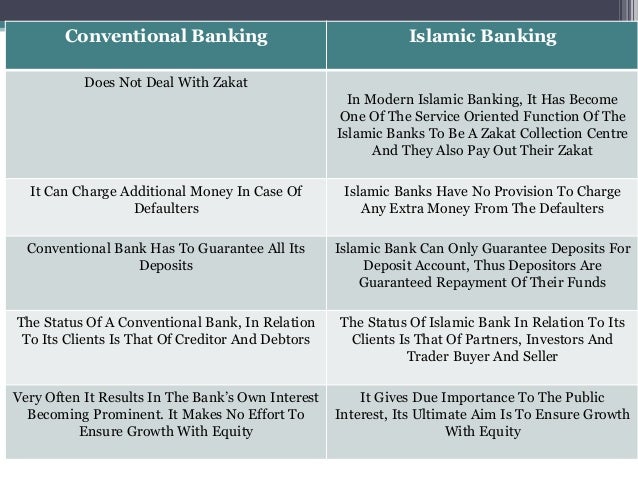

Conventional banking is when there are loans given out to people at a fixed interest rate. Islamic banking and conventional banking major differences now let us review some major differences between islamic banking and conventional banking systems. Act that codifies the law in relation to negotiable instruments including cheques and this act contains a statutory definition of the term banker. Deposit creation financing refer to.

A commercial bank is where most people do their banking. This conclusion is based on the fact that in islam an item is termed as amanah if it bears all the features. The borrower has more time to pay them back but they do end up paying more than originally borrowed. However according to shariah definition deposit has more resemblance to qard loan than amanah.

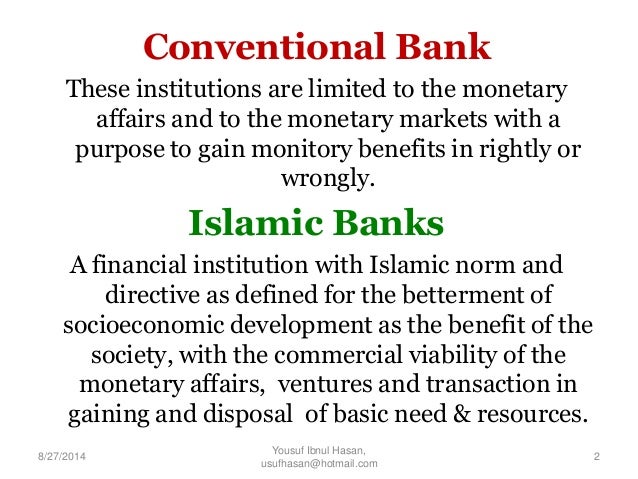

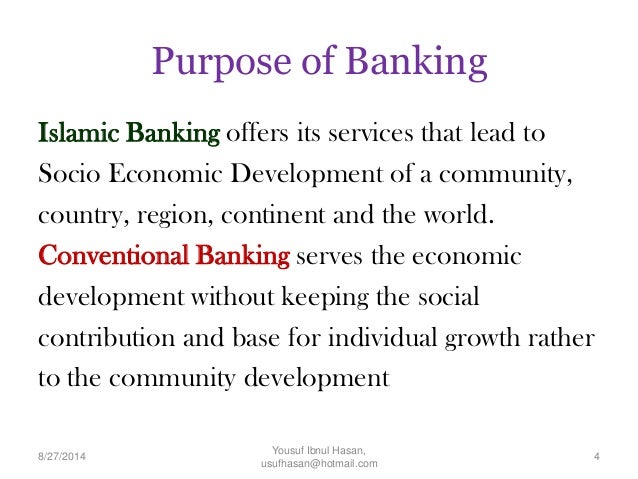

They provide marginal interest rates between loan rates and loans. On the other hand conventional banking is an un ethical banking system based on man made laws. Banker includes a body of persons whether incorporated or not who carry on the business of banking section 2. For a conventional banking the purpose of set up is to collect deposit and to give loans.

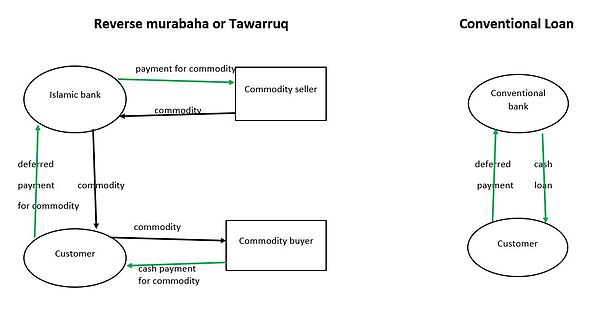

It is profit oriented and its purpose is to make money through interest. Islamic banking on the other hand uses islamic teachings and syariah laws in their banking products which levy profit rates instead of interest rates. The conventional banking which is interest based performs the following major activities. The basic difference between islamic banking and conventional banking is the structure of how the bank is set up.

Conventional banking and mode of financing. Topics that fall within the syllabus scope are.