Current Account Vs Savings Account

A convenient mode of payment which can.

Current account vs savings account. Unlike savings accounts current accounts offer the added benefit of an overdraft facility 2 which can come useful for emergencies when your funds are limited. Both the accounts are equipped with different features and are designed for diverse purposes. Set up automatic payments like direct debits and standing orders. There are generally no limits on deposits or withdrawals.

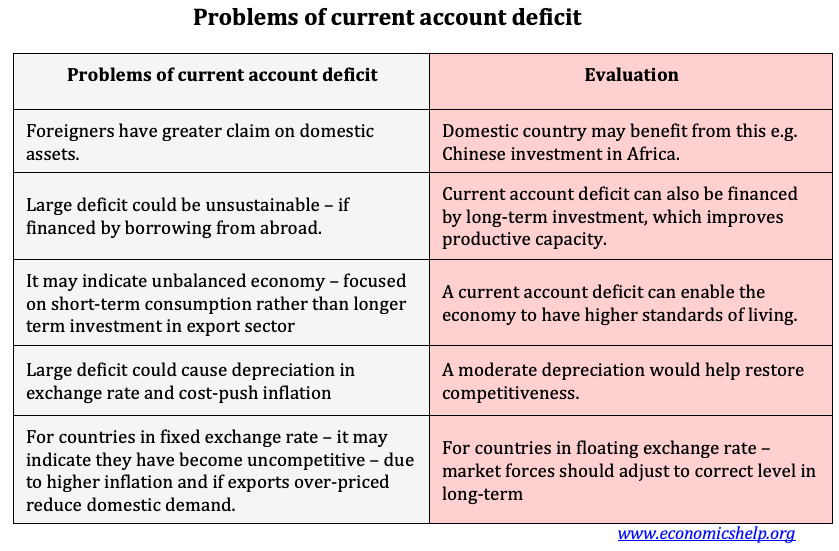

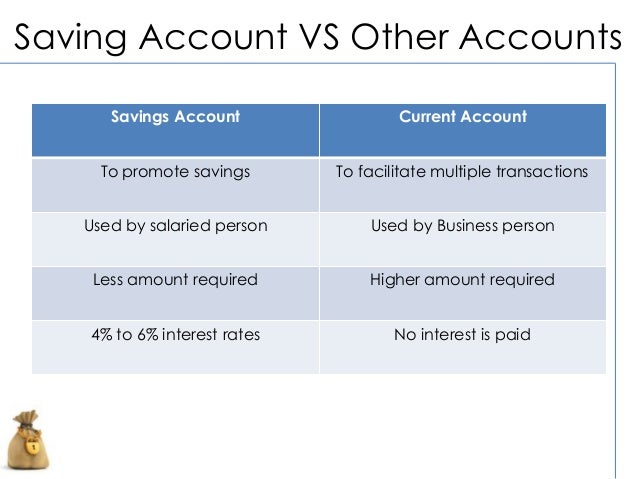

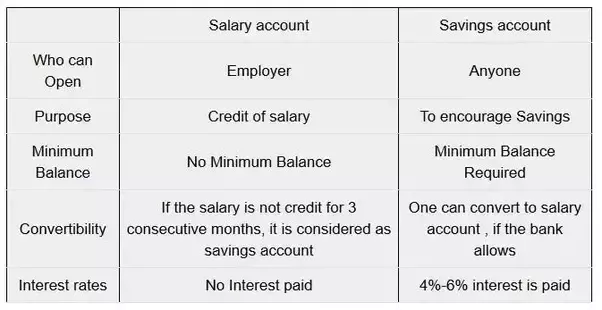

Savings account intended to an individual needs whereas the current account caters to the needs of firms and companies to carry out persistent banking transactions. Savings accounts cater to individuals who want to save whereas current accounts are made for regular transactions of firms and companies. Current accounts are often regarded as non interest bearing accounts. When it comes to operating bank accounts most small business owners don t know the key benefits and differences between a current account and a savings account.

Most current accounts also allow you to. Current accounts also offer overdraft facilities online payment facilities and automatic bill payment facilities that are not provided to savings account holders. Savings account as noted above the current account portion of the casa does not earn any interest. Borrow money using an overdraft.

Savings accounts pay a higher rate of interest while current accounts usually do not pay interest. Savings account vs current account. A current accounts and savings accounts are the two most common types of bank accounts offered by banks in nigeria but what exactly is the difference between the two and which type of account is right for a small business owner. Savings accounts are a safe home for extra cash and pay interest on your balance.

Current accounts are good for. For example the ocbc and uob current accounts charge a minimum balance fee of 7 50 if you can t maintain at least 3 000 daily in the account. Suitability a savings account is most suitable for people who are salaried employees or have a monthly income whereas current accounts work best for traders and entrepreneurs who need to access their accounts frequently. Current accounts are generally best for managing day to day transactions.

Savings accounts accrue higher interests than current accounts. A savings account is a deposit account which allows limited transactions while a current account is meant for daily transactions. Savings account and current accounts are designed for different purposes and have different features.