Current Account Vs Saving Account

Most current accounts also allow you to.

Current account vs saving account. A savings account is a deposit account which allows limited transactions while a current account is meant for daily transactions. Unlike savings accounts current accounts offer the added benefit of an overdraft facility 2 which can come useful for emergencies when your funds are limited. Current accounts are good for. If you open a savings account your banker might put a restriction in the number of transactions you can carry out in a month.

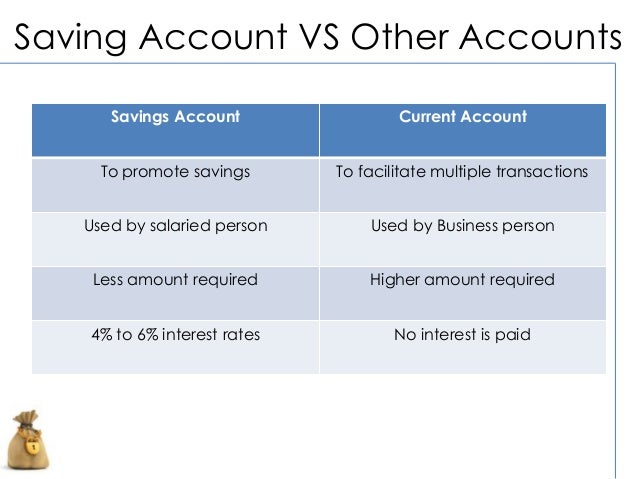

Current accounts are used as a means to deposit checks and for bill payment purposes. Savings account aims at encouraging savings of the general public whereas current account supports frequent and regular transactions of the account holder. Savings account as noted above the current account portion of the casa does not earn any interest. Current accounts are designed to meet the financial transactions of business entities.

Savings accounts accrue higher interests than current accounts. For example the ocbc and uob current accounts charge a minimum balance fee of 7 50 if you can t maintain at least 3 000 daily in the account. Current accounts are often regarded as non interest bearing accounts. Savings accounts are suitable for regular income earners like salaried individuals in meeting their short term financial goals.

Savings accounts cater to individuals who want to save whereas current accounts are made for regular transactions of firms and companies. Borrow money using an overdraft. The difference between savings account and current account is in the interest rates offered for savings accounts. On the other hand current accounts allow seamless transactions for a business.

Savings accounts are a safe home for extra cash and pay interest on your balance. Savings accounts encourage and promote savings among individuals. There are generally no limits on deposits or withdrawals. A convenient mode of payment which can.

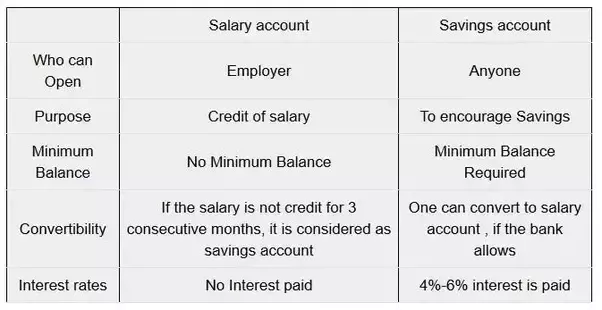

Saving accounts pay a higher rate of interest while current accounts usually do not pay interest. Most basic savings account offer a nominal interest rate usually in the region of 0 2 per annum which is almost insignificant nonetheless it is still better to keep your money here as it is covered by perbadanan insurans deposit malaysiapidm. Savings account and current accounts are designed for different purposes and have different features. Here is a list to help you understand the difference between current account and saving account.

Current accounts also tend to have minimum balance fees. Current accounts are generally best for managing day to day transactions.

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Account_Deficit_Apr_2020-01-ca5e0d6c1ea440d68503f7730d2d5675.jpg)