Credit Card Balance Transfer

Most balance transfer credit cards have a balance transfer fee often 3 or 5 whichever is greater.

Credit card balance transfer. Coronavirus financial worries have caused lenders to tighten acceptance criteria. The new bank card issuer makes this arrangement attractive to consumers by offering incentives. This process is encouraged by most credit card issuers as a means to attract customers. If you have a high balance on a store credit card with a 21 percent apr you may be able to transfer that debt to a credit card with a lower rate during the introductory period saving money on interest and possibly helping pay debt faster.

Fee harvesting cards charge fees for. So if your second credit card has a limit of rs 50 000 and your pending dues from previous credit card are rs 75 000 then only rs 50 000 can be transferred to the new credit card under the balance transfer scheme. A balance transfer credit card can save you 1 000s by slashing the interest you pay. Credit cards targeted at consumers with poor credit scores that carry numerous fees making the cost of credit extraordinarily expensive.

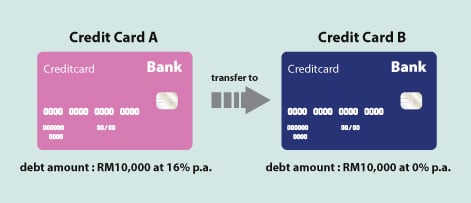

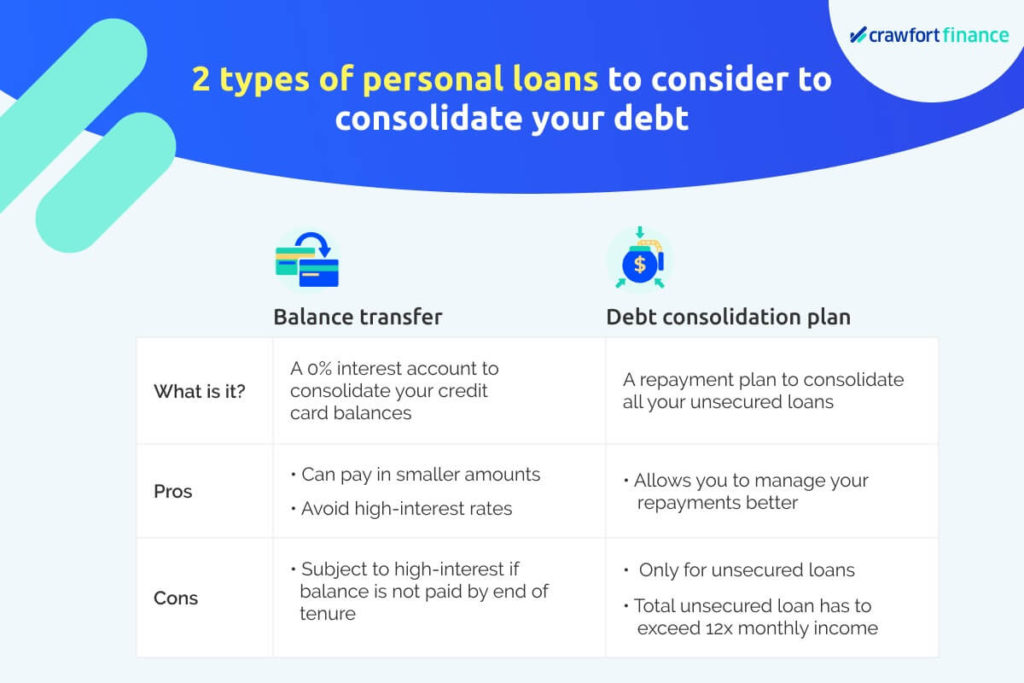

A credit card balance transfer is the transfer of the outstanding debt the balance in a credit card account to an account held at another credit card company. A balance transfer card can be a powerful tool in your debt busting arsenal. Even when a card has a shorter offer period it can be worth your while if there is no balance transfer fee. By taking advantage of a 0 apr offer on a credit card you can save money by having all of your payments go towards.

Our guide has full info and best buys though act now as one of the top deals has just been pulled so more could follow. Many balance transfer cards have no annual fee and they sometimes offer welcome and ongoing rewards. A credit card balance transfer gives you a way to move the money you already owe to a new credit card that offers a low or 0 introductory interest rate for a set period of time.