Corporate Tax Rate 2018 Malaysia

Jadual average lending rate bank negara malaysia seksyen 140b sekatan ke atas kebolehpotongan faedah seksyen 140c akta cukai pendapatan 1967 edisi bahasa inggeris sahaja study group on asian tax administration and research sgatar.

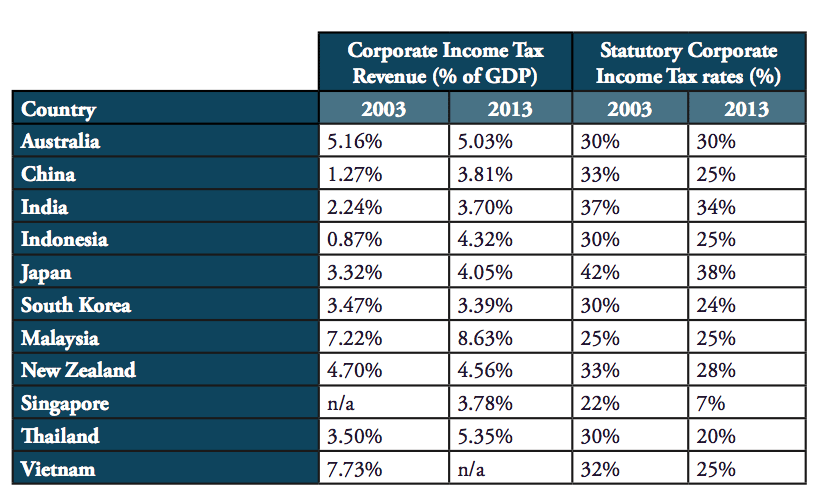

Corporate tax rate 2018 malaysia. Malaysia personal income tax guide 2017 taxplanning budget 2018 wish list lhdn income tax reliefs smeinfo understanding tax. The current cit rates are provided in the following table. Rate the standard corporate tax rate is 24 while the rate for resident small and medium sized companies i e. Chargeable income myr cit rate for year of assessment 2019 2020.

This page displays a table with actual values consensus figures forecasts statistics and historical data charts for list of countries by corporate tax rate. Corporate companies are taxed at the rate of 24. Companies incorporated in malaysia with paid up capital of myr 2 5 million or less and that are not part of a group containing a company exceeding this capitalization threshold is 18 on the first myr 500 000 with the balance being taxed at the 24 rate. List of countries by corporate tax rate provides a table with the latest tax rate figures for several countries including actual values forecasts statistics and historical data.

24 tax on royalties. Malaysia personal income tax guide 2017 taxplanning budget 2018 wish list the edge markets. For existing companies including existing companies with approved operational. 10 tax on rental of moveable goods.

Tax rates for non resident company branch if the recipient is resident in a country which has entered a double tax agreement with malaysia the tax rates for specific sources of income may be reduced. Malaysia corporate tax rate 2018 table. Semua harga di atas akan dikenakan cukai perkhidmatan malaysia pada 6 bermula 1 september 2018. Service tax is a consumption tax levied and charged on any taxable services provided in malaysia by a registered person in carrying on one s business.

The standard corporate tax rate of 24 for a period of five years with a possible extension for another five years. The rate of service tax is 6. All prices in malaysian ringgit rm myr all price above will subject to malaysia service tax at 6 commencing 1 september 2018.