Company Tax Computation Format Malaysia

Income attributable to a labuan business.

Company tax computation format malaysia. Chargeable income myr cit rate for year of assessment 2019 2020. Some of the major tax incentives available in malaysia are the pioneer status ps investment tax allowance ita and reinvestment allowance ra. Companies limited liability partnerships trust bodies and cooperative societies which are dormant and or have not commenced business are required to register and furnish form e with effect from year of assessment 2014. 2018 2019 malaysian tax booklet 7 scope of taxation income tax in malaysia is imposed on income accruing in or derived from malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope.

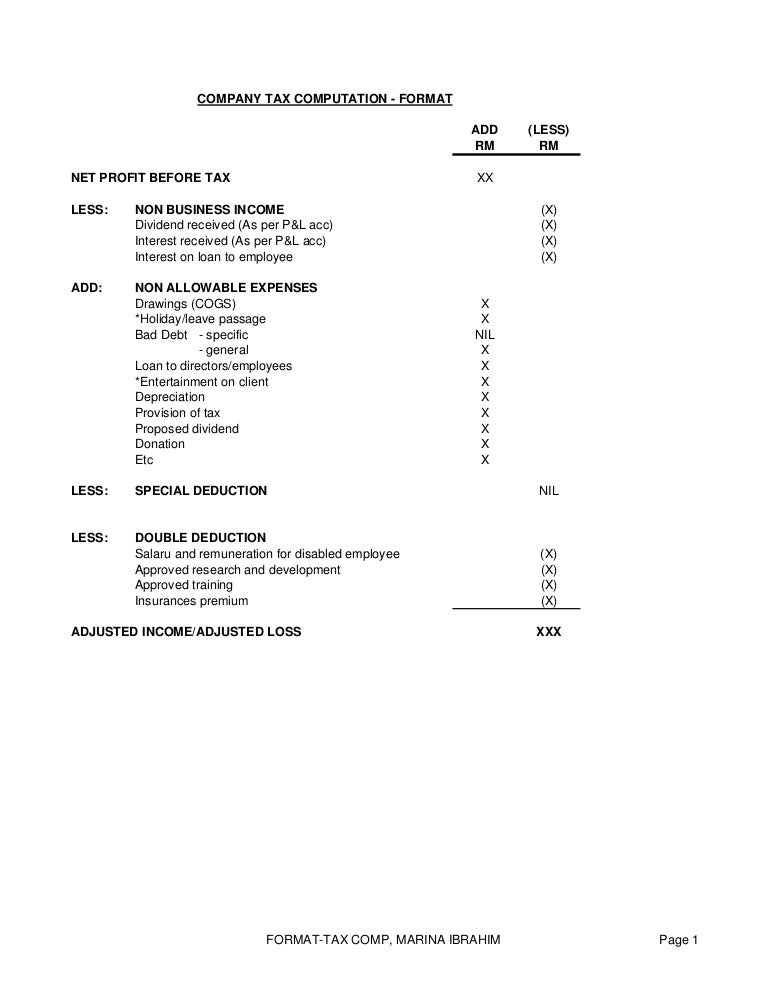

With paid up capital of 2 5 million malaysian ringgit myr or less and gross income from business of not more than myr 50 million. Lee arrived in malaysia on 1 june 2010 and has been. Non business income x dividend received as per p l acc x interest received as per p l acc x interest on loan to employee x add. Melayu malay 简体中文 chinese simplified malaysia corporate income tax rate.

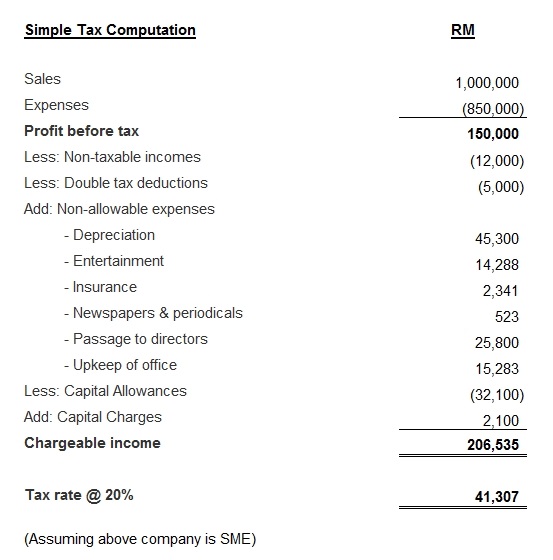

A malaysian company can claim a deduction for royalties management service fees and interest charges paid to foreign affiliates provided that these are made at arm s length and the relevant whts where applicable have been deducted and remitted to the malaysian tax authorities. Lessor company name computation of chargeable incom for ya xxxx rm leasing business. A true b false c true only for companies d true only for individuals and non corporates 6 lee is a canadian employed by a malaysian company. Malaysia adopts a territorial system of income taxation a company whether resident or not is assessable on income accrued in or derived from malaysia.

Company tax computation format. Company tax computation format add less rm rm net profit before tax xx less. Resident company other than company described below 24. This page is also available in.

View tax computation format from accounting bkat3023 at northern university of malaysia. Non allowable expenses drawings cogs x holiday leave passage x bad debt specific nil. 5 under the self assessment system an assessment is deemed to have been made by the director general of inland revenue on the date the tax return is submitted the above statement is. Where a company commenced operations.

You may refer to the following templates for guidance on how to prepare your tax computation for specific industries. They need to apply for registration of a tax file.