Company Tax Computation Format Malaysia 2018

Abc bhd computation of tax payable for ya 2018 business 1 net profit before tax as per sopl less.

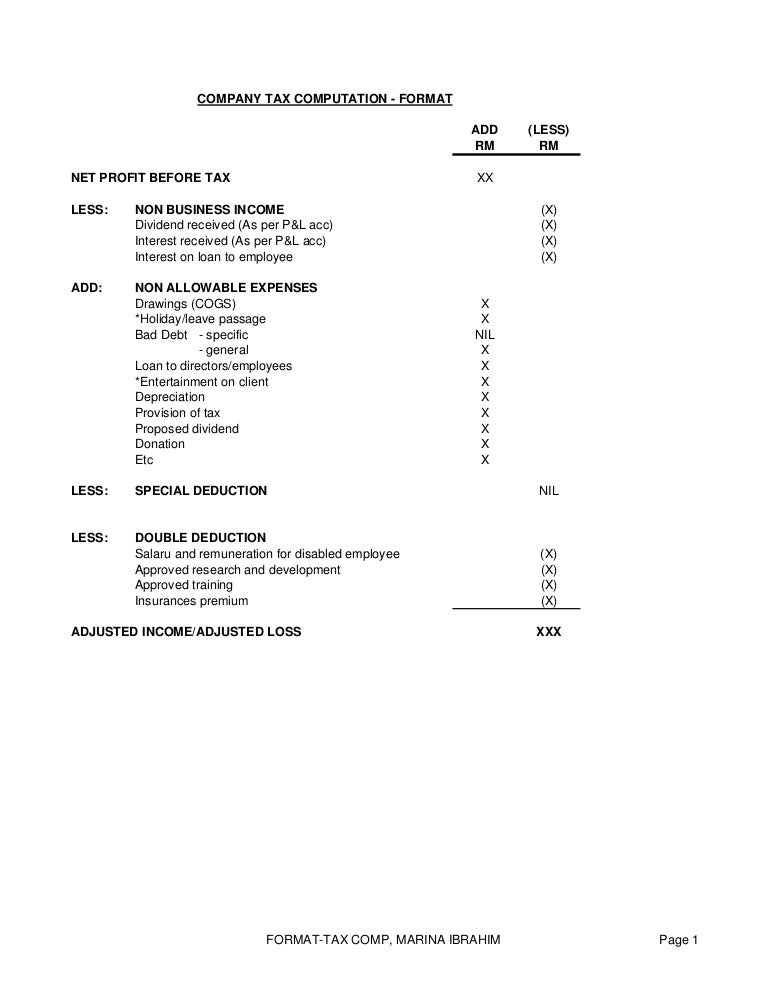

Company tax computation format malaysia 2018. Non business income x dividend received as per p l acc x interest received as per p l acc x interest on loan to employee x add. Part iii computation of income tax and tax payable public ruling no. Objective the objective of this public ruling pr is to explain the computation of income tax and the tax payable by an individual who is resident in malaysia. 6 2018 inland revenue board of malaysia date of publication.

Computation format for individual tax liability for the year of assessment 20xx docx. Gross income less. Acctg tax667 spring 2018. Company tax computation format 1.

View corporate tax format 2018 docx from tax 517 at universiti teknologi mara. Non allowable expenses drawings cogs x holiday leave passage x bad debt specific nil general x loan to directors employees x. Financial year end changes from 30 jun to 31 dec with effect from 2018 the company can prepare one set of tax computation for ya 2020 based on the accounts from 1 jul 2018 to 31 dec 2019. Income attributable to a labuan business.

2018 2019 malaysian tax booklet 7 scope of taxation income tax in malaysia is imposed on income accruing in or derived from malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope. 2018 or ay 2018 19 cash payments 10000 are disallowed under section 40 a. It is prepared taking into account different cases of expense disallowed learn more particulars amount. Basic format of tax computation for an investment holding company pdf 497kb.

Lessor company name computation of chargeable incom for ya xxxx rm leasing business. Some of the major tax incentives available in malaysia are the pioneer status ps investment tax allowance ita and reinvestment allowance ra. Company tax computation format add less rm rm net profit before tax xx less. 13 september 2018 page 1 of 14 1.

Malaysia taxation and investment 2018 updated april 2018 1 1 0 investment climate 1 1 business environment malaysia is a federated constitutional monarchy with a bicameral federal parliament consisting of an appointed senate and an elected house of representatives. For instance a manufacturing company with a pioneer status tax incentive pays an effective tax at the rate of 7 2 as only 30 of its profits are subject to tax. It also incorporates the 2018 malaysian budget proposals announced on 27 october 2017. 2017 2018 malaysian tax booklet this publication is a quick reference guide outlining malaysian tax information which is based on taxation laws and current practice.

Income tax computation format for companies.