Company Tax Computation Format Malaysia 2017

For instance a manufacturing company with a pioneer status tax incentive pays an effective tax at the rate of 7 2 as only 30 of its profits are subject to tax.

Company tax computation format malaysia 2017. Headquarters of inland revenue board of malaysia menara hasil persiaran rimba permai cyber 8 63000 cyberjaya selangor. Financial year 2017 2018 or ay 2018 19. Business tax is imposed upon the company s gross sales or receipts. Husband and wife have to fill separate income tax return forms.

To submit the income tax return form by the due date. Computation of business permit fees. 1 jul 2017 30 jun 2018 12 months 2020. Ca final advanced auditing and professional ethics question paper new course nov 2020.

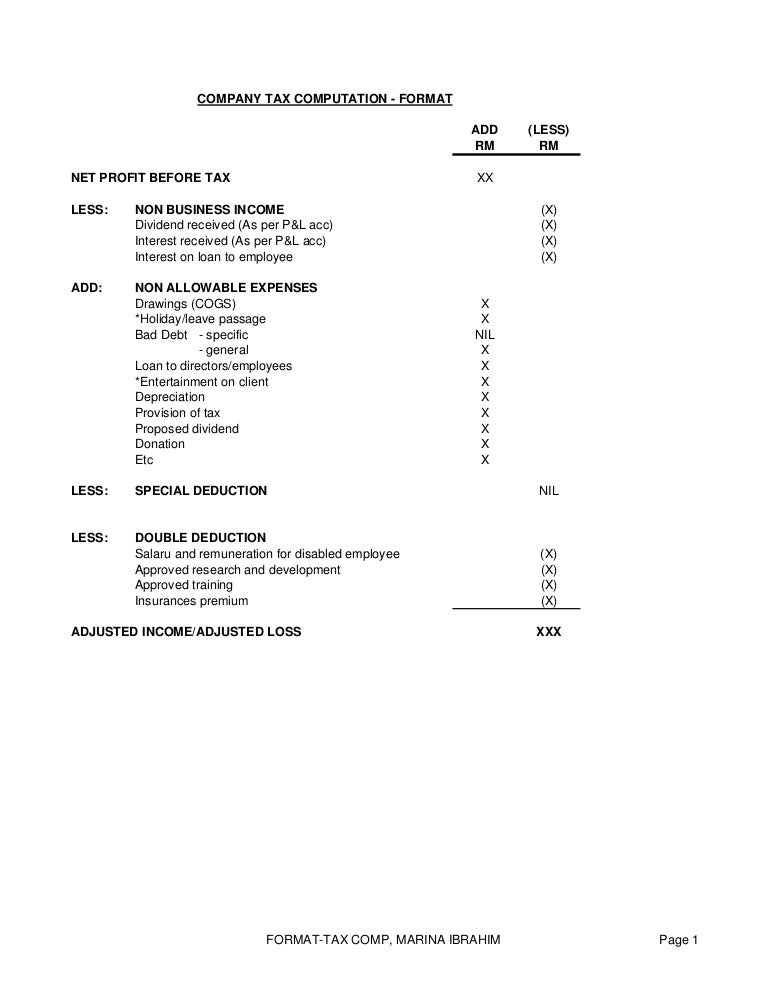

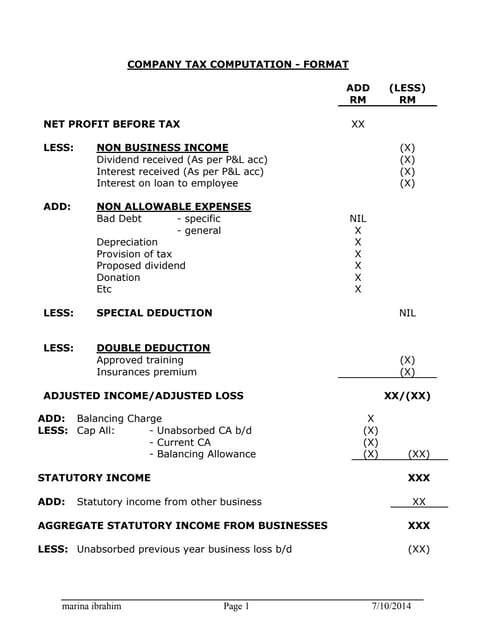

It is prepared taking into account different cases of expense disallowed learn more particulars amount profit as per tally xx add. Non business income x dividend received as per p l acc x interest received as per p l acc x interest on loan to employee x add. Objective the objective of this public ruling pr is to explain the tax treatment in. Income tax computation format for companies.

Scmpe ldr questions nov 2020. Computation of income tax format in excel for fy 2017 18. Non allowable expenses drawings cogs x holiday leave passage x bad debt specific nil general x loan to directors employees x. Inland revenue board of malaysia disposal of plant or machinery part i other than controlled sales public ruling no.

All supporting documents like business records cp30 and receipts need not be submitted with form p. To check and sign duly completed income tax return form. Some of the major tax incentives available in malaysia are the pioneer status ps investment tax allowance ita and reinvestment allowance ra. 7 2017 date of publication.

Business permit renewal 2017. Last updated at may 29 2018 by teachoo. Income attributable to a labuan. Rates vary depending on the nature of the business under section 143 of the local government code of the philippines.

Pwc 2016 2017 malaysian tax booklet income tax scope of taxation income tax in malaysia is imposed on income accruing in or derived from malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope. Company tax computation format add less rm rm net profit before tax xx less. Basic format of tax computation for an investment holding company pdf 497kb basic format of tax computation for a shipping company xls 105kb basic format of tax computation for a development and expansion incentive dei. 150 last update.

Company tax computation format 1.