Company Income Tax Rate 2018 Malaysia

Melayu malay 简体中文 chinese simplified malaysia corporate income tax rate.

Company income tax rate 2018 malaysia. Definition the malaysian corporate income tax for legal entities incorporated companies other corporate associations of individuals and unincorporated businesses is a specific form of income tax and can be partly compared to the german corporate income tax körperschaftssteuer. Companies incorporated in malaysia with paid up capital of myr 2 5 million or less and that are not part of a group containing a company exceeding this capitalization threshold is 18 on the first myr 500 000 with the balance being taxed at the 24 rate. On the first 2 500. Special tax rates apply for companies resident and incorporated in malaysia with an ordinary paid up share.

Corporate tax rate in malaysia averaged 26 21 percent from 1997 until 2020 reaching an all time high of 30 percent in 1997 and a record low of 24 percent in 2015. 1 corporate income tax 1 1 general information corporate income tax. Rate the standard corporate tax rate is 24 while the rate for resident small and medium sized companies i e. On the first 5 000 next 15 000.

Corporate tax rates for companies resident in malaysia is 24. The current cit rates are provided in the following table. Chargeable income myr cit rate for year of assessment 2019 2020. For both resident and non resident companies corporate income tax cit is imposed on income accruing in or derived from malaysia.

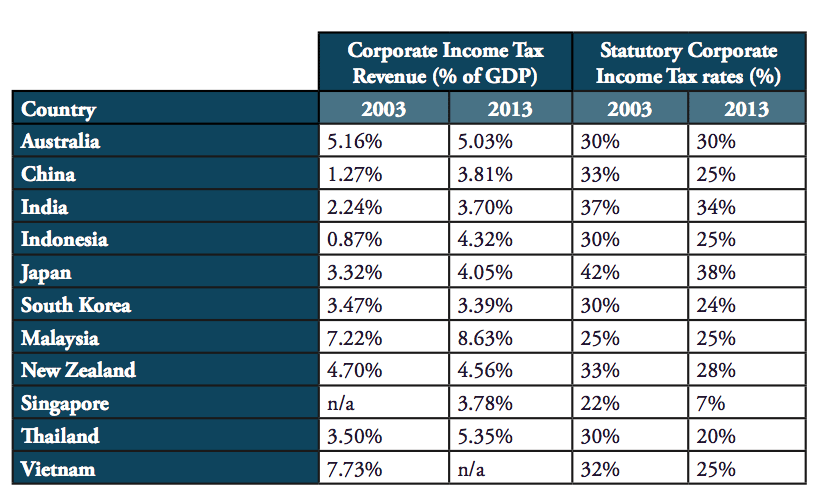

This page provides malaysia corporate tax rate actual values historical data forecast chart statistics economic calendar and news. Malaysia taxation and investment 2018 updated april 2018 1 1 0 investment climate 1 1 business environment malaysia is a federated constitutional monarchy with a bicameral federal parliament consisting of an appointed senate and an elected house of representatives. Resident individuals chargeable income rm ya 2018 2019 tax rm on excess 5 000 0 1 20 000 150 3 35 000 600 8 50 000 1 800 14 70 000 4 600 21 100 000 10 900 24 250 000 46 900 24 5 400 000 83 650 25 600 000 133 650 26 1 000 000 237 650 28 a qualified person defined who is a. Corporate income tax in malaysia as of july 2018 1.

Malaysia adopts a territorial system of income taxation a company whether resident or not is assessable on income accrued in or derived from malaysia. The corporate tax rate in malaysia stands at 24 percent.