Cimb Preferred Current Account

For complete information please visit the cimb sg website now.

Cimb preferred current account. Make the smart move and earn better returns. Cimb preferred account what is it. A multi tier interest paying current account where the higher the balance maintained the higher the rate offered. Visit our website for more information.

Visit our website for more information and how to apply. Make the smart move and earn better returns. Savings accounts current accounts fixed deposit cards. Clients can also maintain balance in other cimb accounts to meet the minimum aum requirement.

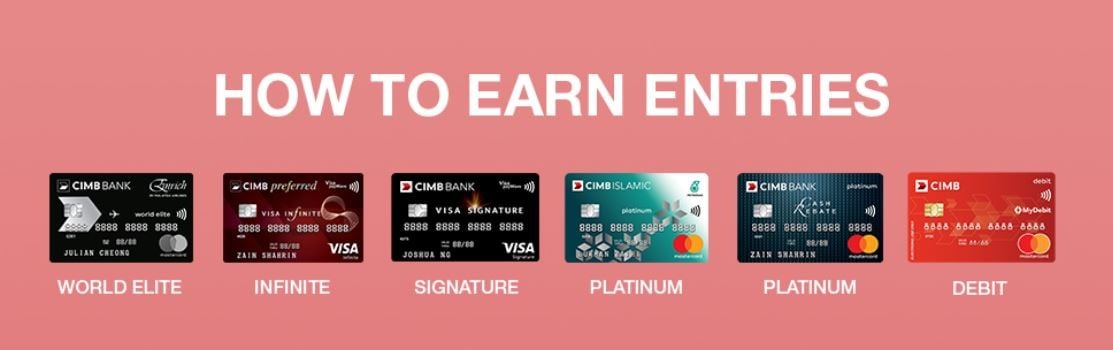

Manage your account and perform online transactions securely and conveniently via bizchannel cimb our online banking service for businesses. Get to know about the cimb preferred account products and respective charges. Open a cimb savings account today. All it takes is a s 10 spend to qualify.

Apply now high cash withdrawal. Get your very own cimb preferred current account today. Clients are required to open this account to be eligible for membership. This solution is a current account that is exclusive to cimb preferred members.

Preferred current account i a current account for cimb preferred members with high returns of up to 2 00 p a. Preferred current account is the main checking account for preferred members to maintain balance. Cimb preferred account being a cimb preferred member entitles you to several benefits including a current account with high interest rates a higher daily atm withdrawal limit. Cimb gbp interest current account products items charges.

Interest is computed daily on your balance exceeding usd1 which allows your money to start earning interest from. Fall below fee if average balance is less than gbp1000. Make cash withdrawals up to usd10 000 per day at overseas branches from your savings and current accounts that are maintained in your home country regional preferred nomination nominate up to 3 of your friends or family members living in other asean country to enjoy the benefits of cimb preferred for 12 months with lower asset under management aum requirement.