Cash Back Credit Cards

Discover it cash back.

Cash back credit cards. American express cash magnet card. Winner and best for no annual fee. All eligible dining and entertainment purchases including restaurant takeout and delivery earn 4 cash back while eligible grocery store purchases earn 2 cash back. Compare credit cards from our partners view offers and apply online for the card that is the best fit for you.

The amex cash magnet is a straightforward cash back credit card that is great for beginners or those looking to earn cash back on non bonus spending. Cash back credit cards are a useful tool to get paid back for the things you buy every day. Cash back credit cards don t work that way sadly. Instead you ll get the amount credited back to you on your card.

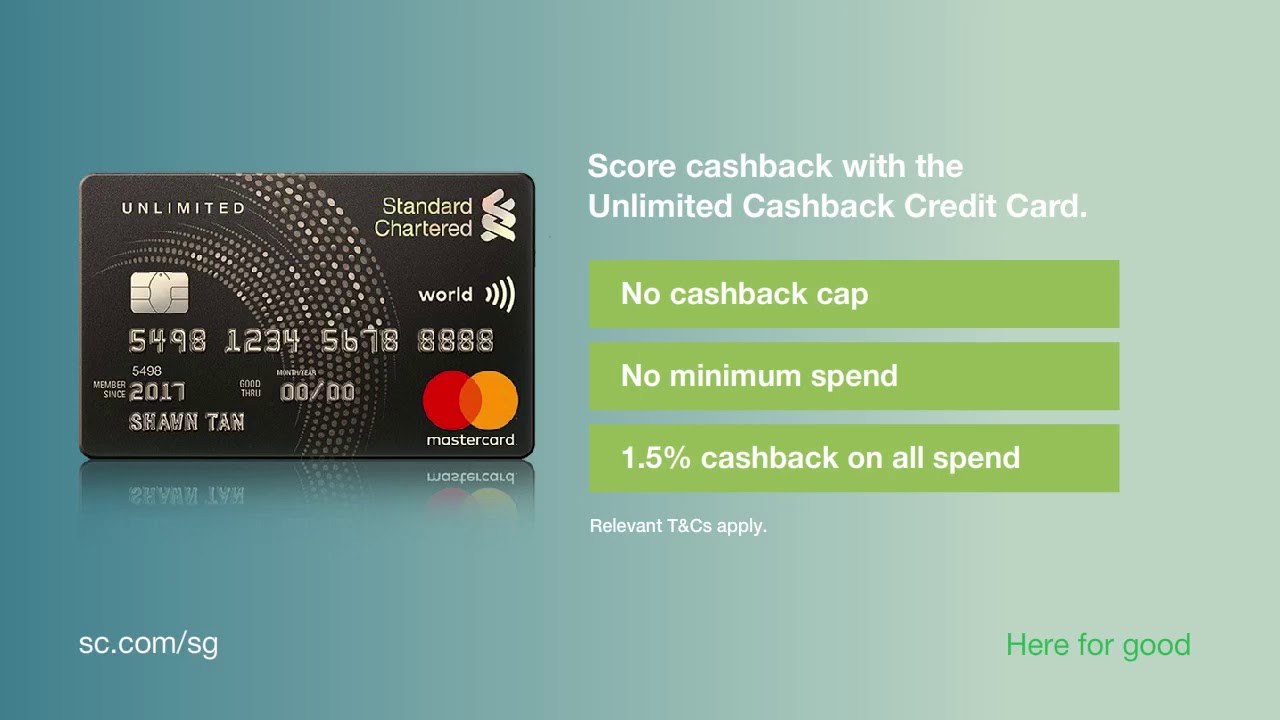

For the simplicity lover some cards offer a flat cash back rate on all purchases usually between 1 and 2 percent. Here are cnbc select s picks for the top cash back credit cards. Why we chose it. The capital one savor rewards credit card is one of the most potent cash back credit cards on the market for folks who live going out and cooking in.

Citi double cash card. Capital one quicksilverone cash rewards credit card. Chase freedom unlimited card. Best for cash back with payment flexibility.

You get 5 cash back on up to 1 500 in spending per quarter in categories that you activate and unlike with some cards the 5 categories include places where a lot of people spend a lot of. Best for flat rate cash back. You could turn 150 cash back into 300. Best no annual fee flat rate cash back card.

Citi double cash card. Other cash back cards offer a higher rewards rate on specific purchase categories like dining or groceries. Best cash back credit cards. Cash back credit cards find cash back credit cards from mastercard.

When your cashback is in your credit card statement will reflect a positive charge. You won t get actual cash that you can see and use right away. Best for fair credit. Another draw to the card is the potential for a low annual fee.