Car Loan Settlement Process Malaysia

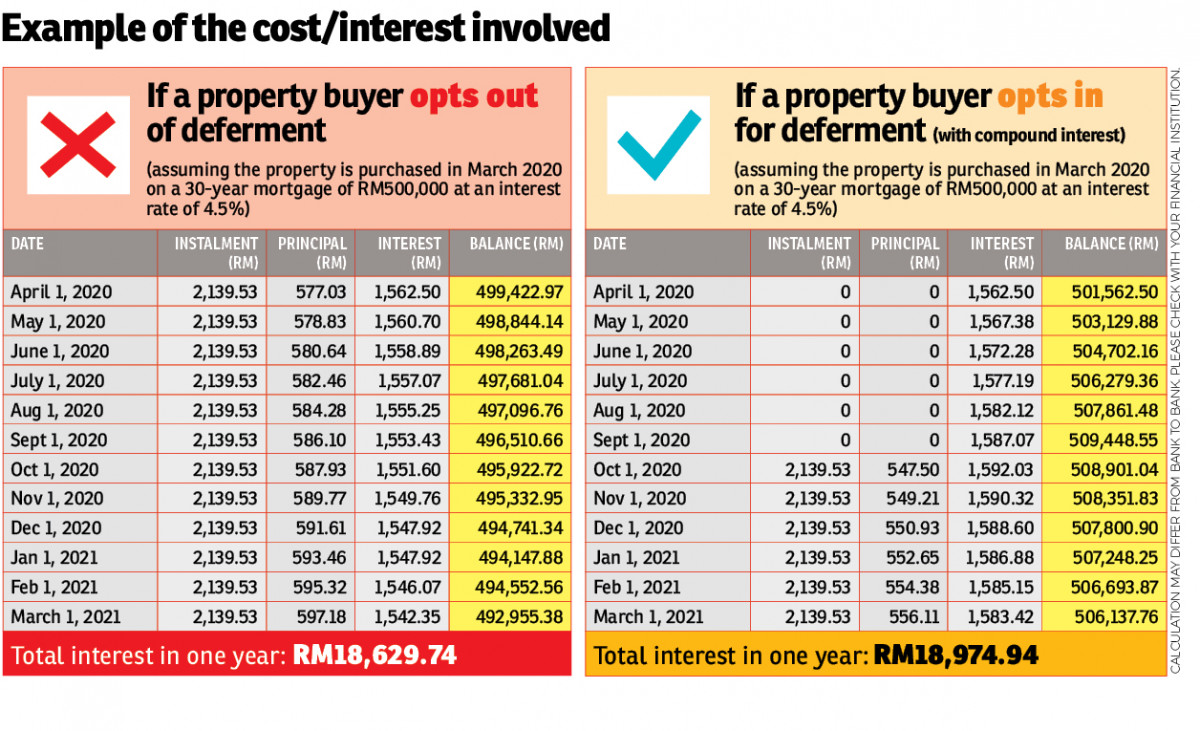

When a personal car vehicle loan is settled early a rebate is usually given.

Car loan settlement process malaysia. Procedure to appy loan to buy a car in malaysia is a bit complicated. 16 personal loans in malaysia and their early settlement requirements 1. Find out the settlement amount here. In malaysia you may take out a car loan for a minimum of 1 year to a maximum of 9 years.

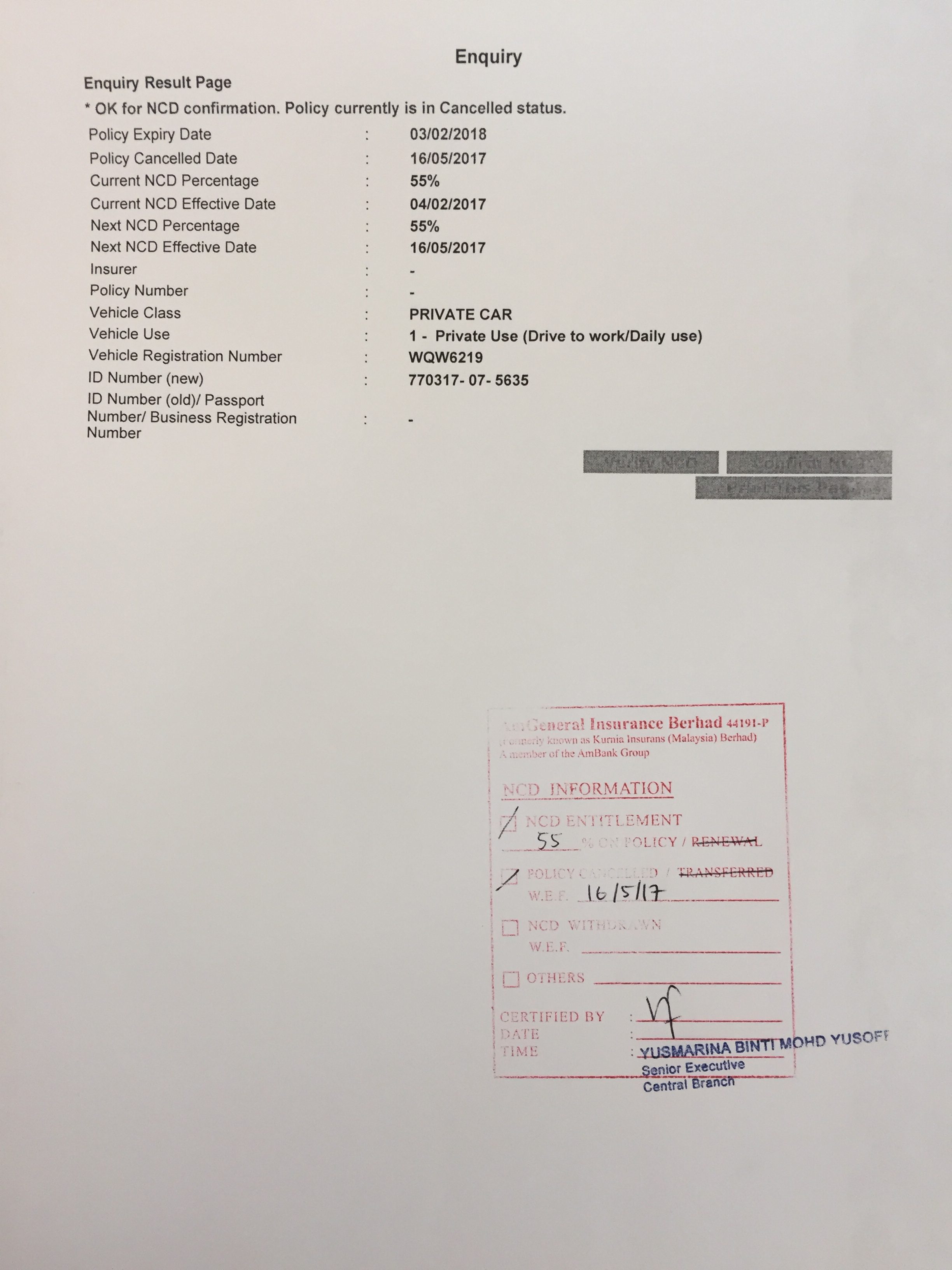

To ensure you qualify for a car loan you have to be sure that you provide all the necessary documents for your application. Depending on the type of loan undertaken you may save money with early settlement. You must have driving license pay slip and guarantor to get better interest rate for car loan in malaysia. Contrary to popular belief the rebate amount does not differ from bank to bank but is calculated based on a standard formula known as the rule of 78 using loanstreet s personal loan settlement calculator you can now know your settlement and rebate amount more importantly it tells you the effective interest.

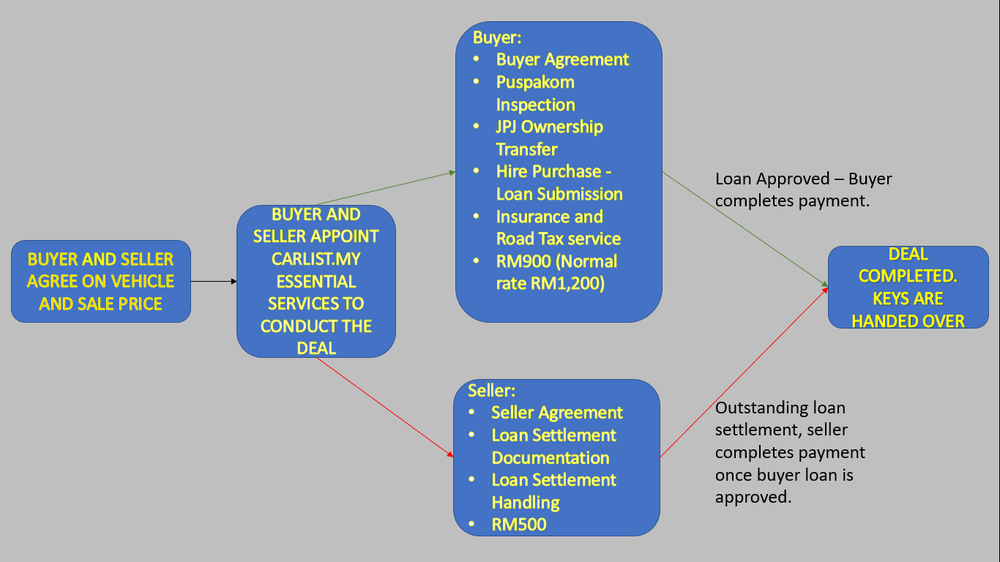

I have check my car full loan settlement rm93k and roughly my car market price with all the additional modification about rm125k. Calculate the balance to pay for your hire purchase car loan personal loan. After you complete the installation of the car loan you will be contacted by the bank to collect the settlement release letter to show that you have completed all your payments also to collect the vehicle registration card if you have never collect before. To make it easier for you refer to your car seller about the loan approval for hire purchace agreement and car registration.

Highly recommended for users with multiple loans and new car buyers. Determine how much you should pay and ways to save more on your monthly repayments. Depending on your loan amount and interest rate employed your monthly repayments will be bigger for shorter tenured loans. My concern is i m still owning the bank but if say i manage to market sell the car i would have extra of 30k in hands prior to the loan settlement.

Once the application and documents are submitted it is up to the bank to decide on the approval of your car loan. Settlement release letter. You can check the latest plate number.