Car Loan Approval Criteria Malaysia

Estimate monthly car loan repayment amount.

Car loan approval criteria malaysia. Use our car loan calculator to find finance that matches your budget. Depending on your loan amount and interest rate employed your monthly repayments will be bigger for shorter tenured loans. Generate principal interest and balance loan repayment chart over loan period. Once the application and documents are submitted it is up to the bank to decide on the approval of your car loan.

Enter car loan period in years. Below is a summarised diagram of a typical car loan application process in malaysia. Basically if you are a malaysian citizen or permanent resident between the age of 18 and 60 years old with a fixed income or a guarantor if you don t have a fixed income then you will have no problem applying for the loan. We ve got flexi loans graduate loans low interest rate loans and the best used car loans on the market.

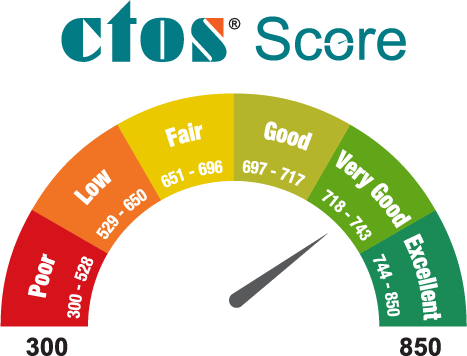

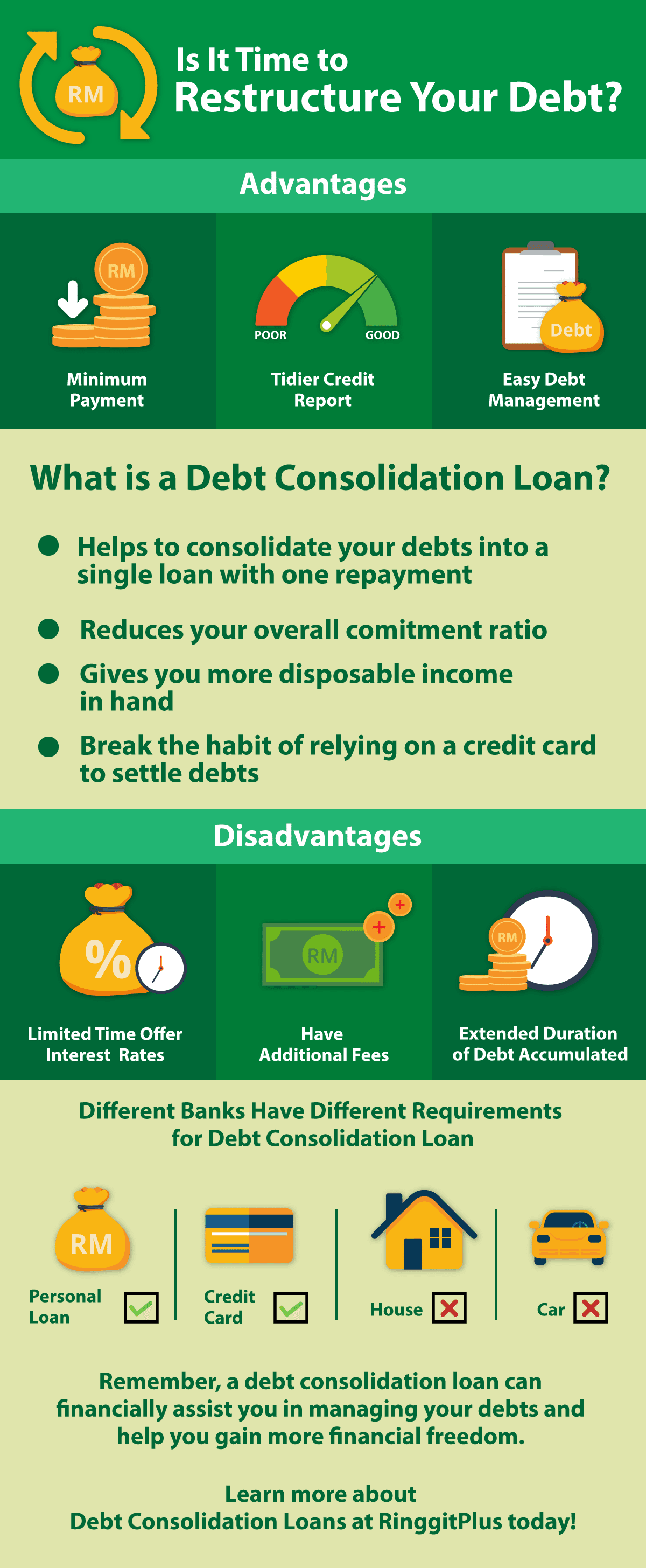

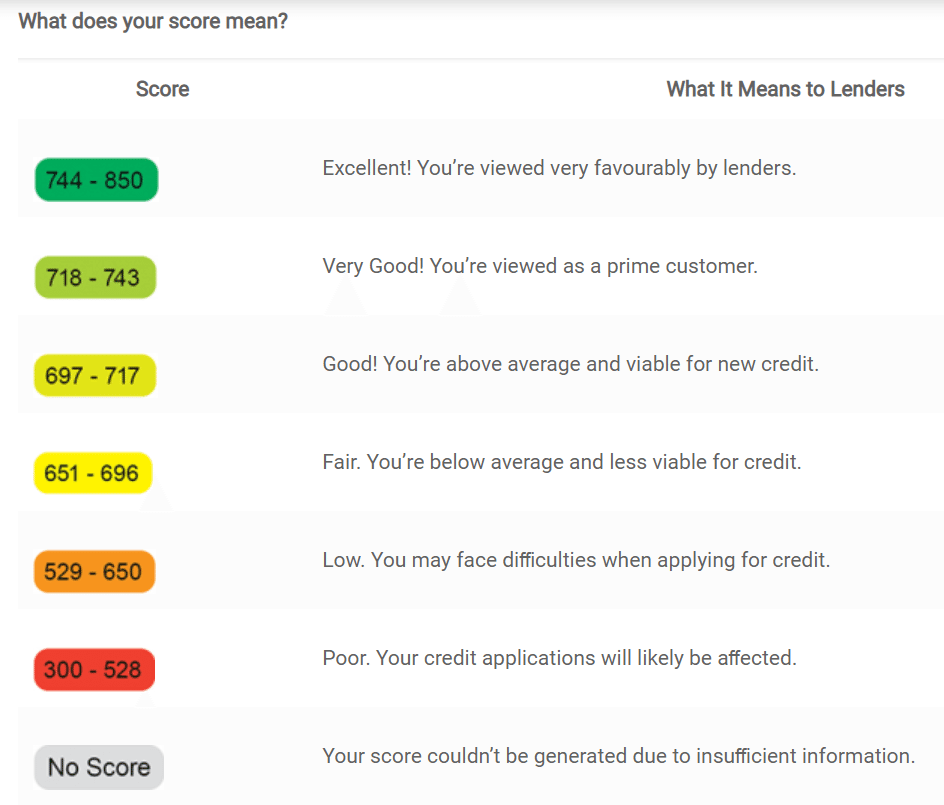

In malaysia you may take out a car loan for a minimum of 1 year to a maximum of 9 years. Update 22 9 2014 car loans are not actually loans in a sense. Whether your loan is approved or not may be determined by a number of factors such as your income level and the information contained in your latest myctos score report including ccris details and ctos score. For car financing ambank hire purchase is the no 1 car financier in malaysia with fast loan approval.

Depending on the type of loan undertaken you may save money with early settlement. You may still be eligible for a car loan even if you already have another loan. The eligibility requirements for most car loans in malaysia are quite standard. In malaysia car loan interest rates differ based on several criteria which notably include the make and model of the car the age of the car new or second hand the financial standing of the borrower the loan amount the repayment period as well as the entity providing the loan.

They are actually reffered to as hire purchase. It consist of 3 000 appointed car dealers with complete auto solutions. Simply because your car is not viewed as collateral by banks thus technically ownership of the vehicle belongs to the bank. To ensure you qualify for a car loan you have to be sure that you provide all the necessary documents for your application.

The final decision on loan approval depends on the bank or. Generate principal interest and balance loan repayment table by year. Ambank offers a 90 car financing for up to 9 years with easy repayment via internet banking or electronic banking nationwide.